Tokyo Inflation Slows, But Don't Be Tricked By The Headline

Date

12/5/2023 4:14:55 AM

(MENAFN- ING) Headline inflation decelerated to the 2% range as goods prices declined quite sharply in Japan. But price pressures from services remained quite resilient, keeping the core inflation excluding fresh food and energy well above 3%

| 2.6% YoY | Tokyo's consumer inflation

(vs 3.2% in October, 3.0% market consensus) |

| Lower than expected |

Tokyo inflation decelerated to the 2% level in November

The headline inflation rate moved down faster than expected to 2.6% year-on-year in November (vs 3.2% in October, 3.0% market consensus), the slowest since August 2022. This was mainly due to declines in supply side-driven prices such as fresh food, utilities, and transportation.

Core inflation also missed the market consensus but still remained relatively stickier than the headline. Core inflation excluding fresh food rose 2.3% YoY in November (vs 2.7% in October, 2.4% market consensus), and core-core inflation excluding fresh food and energy rose 3.6% YoY in November (vs 3.8% in October, 3.7% market consensus).

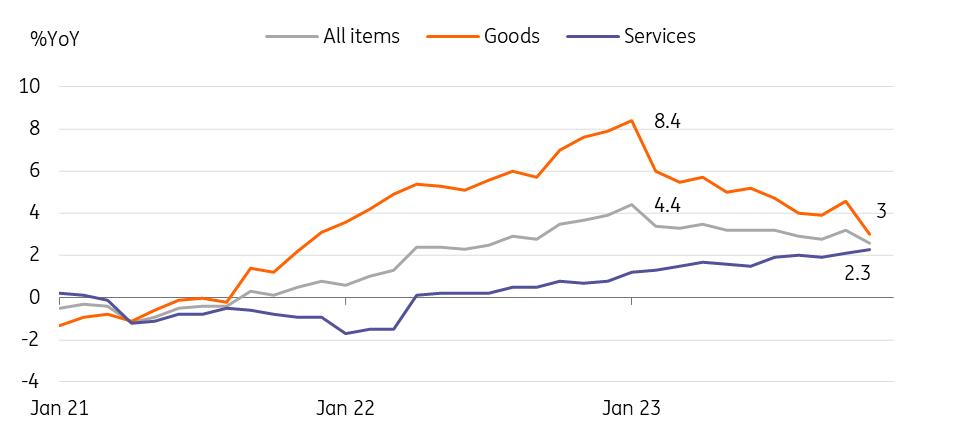

In a monthly comparison, goods prices fell -0.6% MoM sa in November (vs 1.6% in October), but services prices rose 0.2% (vs 0.4% in October).

We believe that fresh food prices and gasoline prices are expected to drop over the coming months, reflecting the better harvest and the recent drop in global oil prices. The government also extended its subsidy program until next April (the beginning of the new fiscal year) and utility prices will therefore likely remain subdued for at least four to five months. However, we believe that processed food prices and other service prices tend to stay on the rise, reflecting the recovery of service activity.

Service prices are still on the rise

Statistics of Japan Bank of Japan

It is true that cost-push inflation tends to be short-lived and could be transitory, but we clearly see quite resilient upward pressures in service prices. The Bank of Japan will likely take a wait-and-see approach as headline inflation is expected to trend down. We believe that the Bank of Japan will likely pay more attention to core-core inflation than headline inflation, which more closely represents the demand side inflationary pressures. Also, next year's wage negotiations should be key for the BoJ's possible policy shift.

MENAFN05122023000222011065ID1107537049

Author:

Min Joo Kang

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.