(MENAFN- ING) Taiwan's economic structure

Taiwan is a small open economy. The size of the economy was US$739bn in 2022 in nominal terms.

It has been the smallest electronic manufacturing economy in the region when compared to Japan and Korea. All three electronic manufacturers in the Asia region suffered a slowdown during Covid-19. Taiwan's real GDP growth was just 2.45% in 2022 after growth of 6.53% in 2021. Inflation in 2022 was moderate at 2.95%. But GDP growth contracted to

0.41% year-on-year in the fourth quarter of

2022.

Taiwan's nominal GDP compared to Japan and Korea

CEIC, ING

The relative performance of Taiwan's economic growth in the region

CEIC, ING

Export demand has fallen, hinting at a recession in the first quarter of 2023

Even though Covid-19 is behind us, 2023 is likely to be a challenging year for Taiwan. Our GDP forecast for Taiwan is growth of

1.5%

for

2023. The economy turned into negative yearly growth in the final quarter of last year, and we forecast GDP growth of -0.5%YoY for

the first quarter of this year. This suggests

the economy entered into a mild recession.

The main reason behind the likely recession is

the weaker

external market for semiconductors. We can see from the chart below that

exports should contribute negatively to GDP growth in 2023. The contraction in export growth has put pressure on employment and wages in the manufacturing sector. This should have started to pass through to

weaker consumption. We also expect

that investment

from the private sector will contract this year as export demand wanes.

Taiwan's GDP growth by expenditure component

CEIC, ING

Semiconductors are the pillar of the economy

Apart from being a small open economy, Taiwan is characterised as centralising in manufacturing semiconductors, so the economy depends heavily on semiconductor exports to generate economic growth.

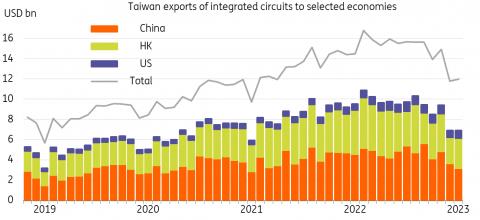

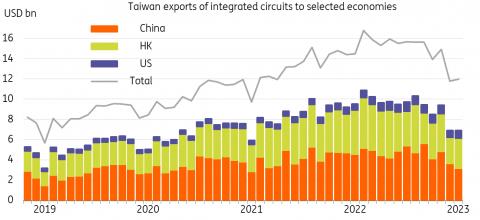

Taiwan's exports of integrated circuits amounted

to $184bn

in 2022, nearly 25% of Taiwan's GDP. According to the Semiconductor Industrial Association, global semiconductor sales reached $574bn in 2022, making

Taiwan's

market share around 32%.

Taiwan exports by items

Taiwan Customs, ING

The information and communication industry's contribution to Taiwan's GDP growth

CEIC, ING

Export outlook is gloomy

The World Semiconductor Trade Statistics forecasts that the

global semiconductor

market will decline by 4.1% in 2023 to $557bn. This will have a negative impact on Taiwan's manufacturing and export activities.

From the chart below, we can see that Mainland China and Hong Kong received 51%

of Taiwan's integrated circuit exports in the 12 months to February, and the US only received around 6.5%. It should not be interpreted that Mainland China is the largest import destination of Taiwan electronic parts –

the high percentage of Taiwan semiconductor chips exported to Mainland China

is because

Taiwanese semiconductor companies have set up factories in Mainland China to process electronic goods, e.g. smartphones, that use Taiwanese

chips. Eventually, some of the final products are shipped from Mainland China to the US and Europe. It is therefore the slowing of American and European economies that will affect Taiwan's exports and therefore economic growth. This is also shown in the bigger export orders from the us relative to orders coming from Mainland China and Hong Kong.

Mainland China's economic recovery in 2023 may support Taiwan's export orders from the second half of the year onwards when the recovery becomes more solid. And this is the reason we are forecasting positive GDP growth for Taiwan in the second half of 2023.

Taiwan exports of integrated circuits to China vs US

CEIC, ING

Taiwan's semiconductor industry is being impacted by the climate

Apart from the weakening external market, Taiwan's semiconductor production is facing challenges from climate change as well.

The semiconductor industry experienced the impact of climate-driven adverse events in 2021 and 2022. Extreme heat and drought conditions have affected Taiwan's manufacturing of semiconductor chips. There was restricted water usage (in 2021 and 2023)

in Taiwan that limited semiconductor chip manufacturing. And there were

electricity stoppages (in 2017 and 2022) that affected production as well.

Both risks are rising as the weather becomes more extreme. Taiwan needs to strengthen its water and electricity infrastructure in order to better protect semiconductor manufacturing, something the industry has complained

about.

Economic relationship with Mainland China There are currently two major events occurring that could change Mainland China and Taiwan's economic relationship:

The launch of CHIP4, an alliance led by the US that involves Japan, South Korea and Taiwan, the main players in the semiconductor industry. This initiative follows the US's CHIPS and Science Act which aims to slow the pace of China's technological advancement. The aim is to

form

a tighter supply chain among the four economies. After the US, Taiwan is the key player in CHIP4, but this might not be such a good thing as Taiwan has already established a supply chain in Mainland China, so getting actively involved in CHIP4 could push Mainland China further into developing its own chips, which could lead to increased

competition in the semiconductor market. Taiwan is going to hold a presidential election in 2024. It is still highly uncertain which party could win the presidency. A president from the

Kuomintang (KMT) party background should bring closer economic ties between Mainland China and Taiwan. The immediate impact should be more cross-border factoring and retail activities, and potentially slower progress with CHIP4.

Fiscal policy

Investment

In

2019, the Taiwan government launched a reshoring initiative which aimed to encourage Taiwanese manufacturers to shift production back to Taiwan from China.

The "return to Taiwan"

policy was originally planned for three

years but was extended to 2024. The impact at first was not significant, but since the

US imposed technology export bans on Mainland China

this policy has become more effective in boosting investments and production in Taiwan. The policy has so far attracted investment

of around TWD2tr (around $68bn)

from 2019 to March 2023.

Overall, investment

in the manufacturing sector increased by 31% and 18% in 2021 and 2022, respectively. The electronics industry contributed around 69% and 72% of these

investments in 2021 and 2022, respectively.

But there have been doubts about the genuine use of investment funds from the "return to Taiwan" policy. Some believe that some of the funds were used to buy land for property developments instead of building factories for production.

Assuming the funds have been used for building factories, this will not be so positive for Taiwan this year

even though it should be positive for longer-term growth. This is because

there will be overcapacity in factories in Taiwan. If the "return to Taiwan" investment funding

was partly used for property developments, then it could be even worse as corporate and household

investment appetite and

repayment ability

should deteriorate with the slowing economic outlook in 2023.

Consumption

Apart from attracting investment, there are also fiscal measures to support consumption. Each eligible resident can get TWD6000 for consumption in 2023 and around seven

million residents are eligible. That should amount to around TWD42bn (around $141m). It is a timely policy to cushion downward

pressure on employment and wages, but the impact on economic growth should be limited.

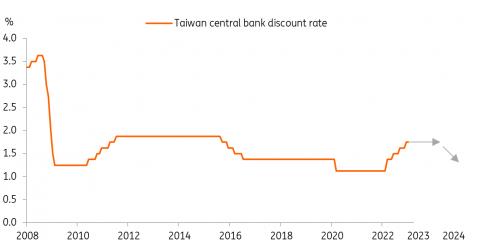

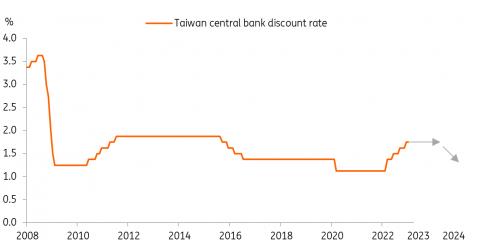

Monetary policy actions in 2023 – a rate cut is more likely than a hike

Taiwan's central bank surprised the market by hiking the policy rate by 12.5bp to 1.875% on 23

March, even though economic data was weak

and Taiwan was not suffering from

sky-high inflation like the US and Europe.

The Taiwan central bank is likely to keep interest rates low in 2023. Another rate hike in the second quarter would be very surprising, even though the central bank likes to keep the interest rate differential with the US stable and the Federal Reserve is expected to hike in the second quarter.

From a macro perspective, the economy would struggle to grow if rates rise. From a financial market perspective, it would be dangerous to raise policy interest rates when financial markets are worrying about global growth prospects.

Instead of looking for a hike, we're focusing on when the central bank could start to cut

interest rates. We believe that the central bank will not cut

hastily. The room for lowering interest rates is limited for Taiwan. As the chart below shows, the floor

of the central bank rate should be at 1%. And the current policy rate is 1.875%. Our forecast for the Fed is to cut by 100bp around the fourth quarter of this year. It's unlikely Taiwan's central bank will follow the size of the Fed's cut, as interest rates would then be lower than the 1% floor. We expect the Taiwan central bank to cut by 25bp

in the fourth quarter.

Taiwan has not suffered from high inflation like the US and Europe has

CEIC, ING

Our base case: Taiwan's central bank will maintain a low interest rate environment

CEIC, ING

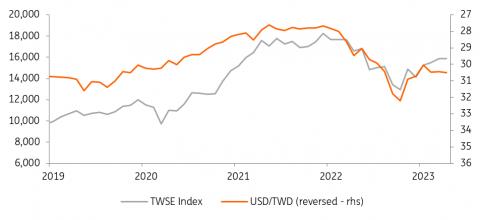

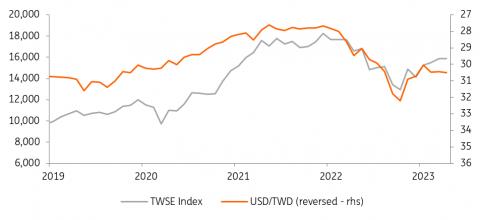

The Taiwan dollar will be more volatile in 2023

USD/TWD is sensitive to cross-border portfolio flows. There is a high correlation between USD/TWD and the Taiwan stock index, TWSE. Usually, capital flows into Taiwan when the market believes that Taiwan semiconductors will benefit from rising global demand. This was the case during the first year of the pandemic when there was high demand for laptops and therefore semiconductor chips as workers around the world needed to work from home.

But this is the not case for the first half of this year. Macro fundamentals in the US economy are weakening and demand from Europe is falling. As a result, we have seen portfolio outflows from the Taiwan stock market, as shown in the chart below.

The interest rate differential

between the Taiwan dollar and the US dollar may play a part but is

not a key driver of portfolio flows for Taiwan as foreign investors are usually more interested in Taiwan's stock market than the bond market.

This will put extra pressure on the Taiwan dollar, at least in the second quarter. Our previous forecast of USD/TWD was 30.00 and 29.50 by the end of the second

and third quarters, respectively. Weakness in the external market has passed onto the domestic economy as we have seen in the CPI and PPI inflation data.

Further deterioration of the global and domestic economy has led to our recent revision of

the USD/TWD forecasts to 31.00 and 30.00 by the end of the second and third quarters, respectively.

We expect the Fed to

cut interest rates aggressively by 100bp around the fourth quarter, and by that time

the dollar should weaken. As the Taiwan central bank does not have much room to cut so deep, and by that time demand for semiconductors from Mainland China's economic recovery should increase, TWD should be supported. As such, our USD/TWD forecast is 29.00 by the end of 2023.

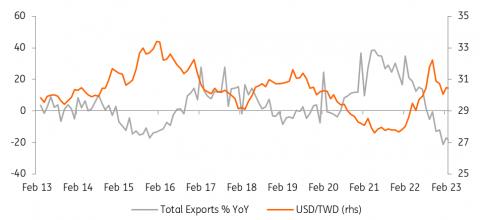

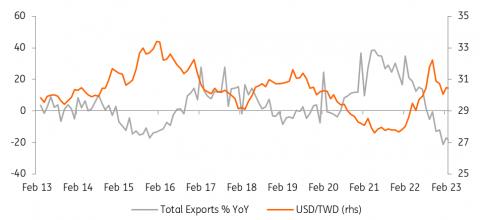

One point we would like to make is that the exchange rate is not a factor in changing

the course of export growth for Taiwan. As shown in the chart, the Taiwan dollar and exports usually strengthen together. That is because of the high correlation between TWD and Taiwan stock market performance.

Relation between TWSE and USD/TWD

CEIC, ING

A weak TWD doesn't help exports

CEIC, ING

Conclusion

The Taiwan economy should have entered into a mild recession due to the falling global demand for semiconductors from the weakening US economy. Mainland China's recovery may only support semiconductor demand in the latter part of this year, which should help Taiwan end its recession in the second half of the year. We expect the Taiwanese economy to grow by 1.5% in 2023.

Previous fiscal policies that boost investment in Taiwan

could magnify

the overcapacity situation

of the manufacturing sector. Property investments will also become quiet as the overall economic environment slows.

Monetary policy should turn from hawkish to dovish and a policy interest rate cut of 25bp by the end of the year

is on the cards. But as Taiwan's central bank is expected to cut

less than the Fed, we expect the Taiwan dollar to strengthen against the US dollar to 29.00 by the end of 2023.

In short, 2023 is going to be a challenging year for the Taiwanese economy.

Comments

No comment