(MENAFN- PR Newswire)

Debt's Annual Holiday Shopping Survey Reveals AI Gifts and BNPL are Pushing Holiday Budgets to the Brink

FORT LAUDERDALE, Fla., Nov. 25, 2024 /PRNewswire/ --

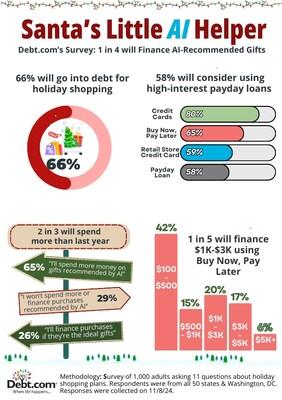

Debt 's annual holiday shopping survey reveals that 66% of Americans plan to take on debt for holiday shopping this year. The survey, which polled 1,000 Americans about their spending habits, shows that rising use of credit cards and Buy Now, Pay Later (BNPL) services is driving the trend.

Key findings include:

Continue Reading

The combination of BNPL & AI-recommended gifts makes it dangerously easy to overspend. A perfect storm for holiday debt.

Post thi

Debt's Annual Holiday Shopping Survey Reveals AI Gifts and BNPL are Pushing Holiday Budgets to the Brink

26% expect to take on $100 to $300 of holiday debt

13% estimate $300 to $500 of debt

17% plan to accrue $500 to $700 of debt

19% foresee $700 to $900 of debt

15% anticipate $900 to $1,000 of debt

10% believe they will take on more than $1,000 of holiday debt

"Americans are feeling squeezed this holiday season, and it's not just inflation," said Howard Dvorkin , CPA, chairman of Debt. "The combination of convenience tools like BNPL and the allure of AI-recommended gifts can make it dangerously easy to overspend. This creates a perfect storm for debt that consumers will still be paying off long after the holiday lights come down."

Americans Turn to BNPL and Credit Cards, Taking on $900+ in Holiday Debt

The study also found that two out of three respondents plan to use both credit cards and BNPL to finance their holiday purchases. Alarmingly, one in four said they expect to take on at least $900 in debt to cover holiday expenses. Many will rely on AI to recommend ideal gifts for their loved ones.

When it comes to AI's influence on spending:

65% said they would spend more on AI-recommended gifts

26% admitted they would finance AI-recommended purchases

29% said they would not increase spending or finance purchases recommended by AI

"AI and BNPL are reshaping how Americans shop, for better or worse," said Dvorkin. "AI-driven recommendations are incredibly persuasive, and BNPL options make financing large purchases deceptively simple. While these tools can be helpful, they also demand greater discipline from consumers."

According to the survey, 88% of respondents plan to use credit cards for their holiday shopping, with 69% using both credit cards and BNPL. Among BNPL users, clothing is the most popular item to finance (62%), followed by electronics (46%) and jewelry (45%). Encouragingly, 70% said they would create a BNPL budget to avoid overspending.

Generational Breakdown

Millennials (77%) lead the way in combining credit cards and BNPL to finance holiday shopping, followed by Gen X (73%) and Gen Z (67%). Millennials and Gen X also show a higher likelihood of spending more when AI suggests the "perfect" gift, with 71% in both groups indicating they would spend or finance more.

Budgeting for BNPL breakdown by Generations:

76% of Millennials

74% of Gen X

67% of Gen Z

57% of Baby Boomers

"Holiday shopping debt is nothing new, but the intersection of AI technology and BNPL financing is a unique challenge this year," Dvorkin said. "Consumers need to remember that debt has a ripple effect. While AI and BNPL offer convenience, it's critical to shop within your means and plan for the financial consequences of overspending."

About Debt

Debt is a consumer website that provides resources for managing credit card debt, student loan debt, tax debt, credit repair, bankruptcy, and more. Debt partners with vetted and certified providers, offering expert advice and solutions for consumers "when life happens."

SOURCE Debt

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

MENAFN25112024003732001241ID1108922070

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.