Do you own gold?

(MENAFN- Asia Times) Inflation is headed upwards, but the gold price is falling.

Many investors buy gold in the mistaken belief that it's a hedge against inflation. It isn't. It's an insurance policy against a catastrophic loss of value for the US dollar.

So are inflation-indexed Treasury securities. Investors get a negative yield on Treasury Inflation-Protected Securities, or TIPS, plus the percentage increase in the US Consumer Price Index. If inflation goes up (at least by the CPI gauge) they will be paid more.

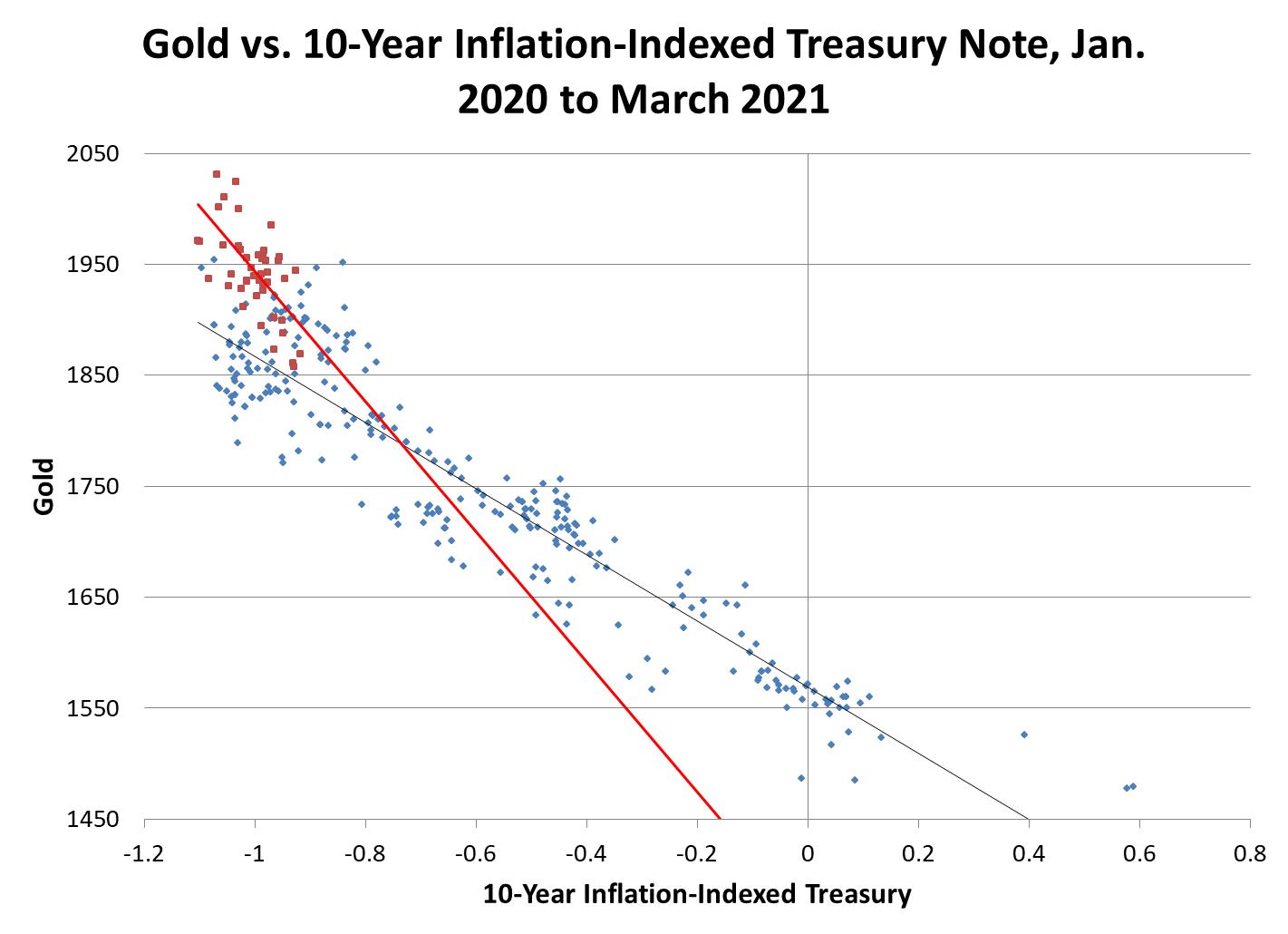

The gold price is falling because the price of TIPS is falling (which means that TIPS yields are going up; bond prices move inversely to yields). That means that investors are less eager to own TIPS as a catastrophe hedge. As we show in the chart, the gold price tracks TIPS yields very closely, at least under normal circumstances.

But circumstances between July and September of 2020 were anything but normal. The economy was in free fall, and 10-year TIPS yields fell to an all-time low of about negative 1 percent. At that point gold gained much faster than the TIPS yield would have indicated.

We see two trend lines on the chart, a 'normal' one that applied for most of the past fifteen months, and a much steeper one that characterized the most panicky days of the Covid-19 pandemic.

The trouble is that buying inflation insurance from the US Treasury is like buying shipwreck insurance from the captain of the Titanic. If the ship goes down, he won't be around to pay you.

The US government sells you inflation insurance in the TIPS market, but the government also gets to say what inflation is. The Consumer Price Index is a very poor measure of inflation.

What happens if the rest of the world decides that it doesn't want to own Treasury notes, because the US is running a budget deficit equivalent to a fifth of its GDP? Interest rates shoot up, the housing market crashes, and the US dollar loses a third of its value – or something like that.

The US government then works the collapse of housing prices into the Consumer Price Index and announces that inflation has fallen! That wouldn't be good for owners of CPI-indexed Treasury securities.

That's why gold soared when the yield on TIPS fell to negative 1 percent. It looked like things were coming unstuck, and investors were less confident about buying catastrophe insurance from the US Treasury.

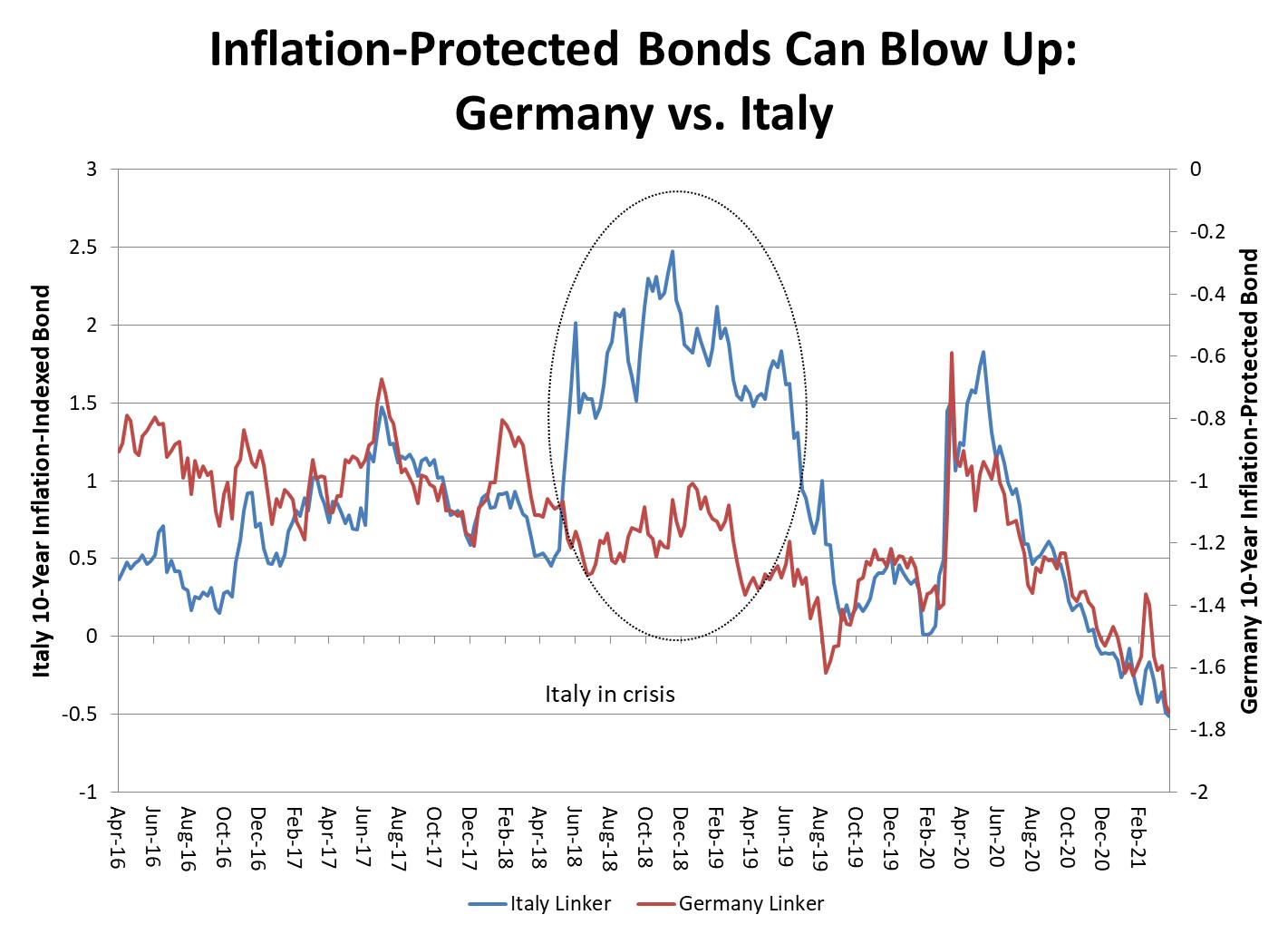

Something like this happened to the Italian equivalent of TIPS during Italy's 2018 financial crisis:

The yield on Italian inflation-indexed bonds tracked the yield on German inflation-indexed bonds until April 2018, when Italian yields jumped (that is, bond prices collapsed) and German yields fell.

Investors figured out that Italy could choose to pay off its inflation-linked bonds not in Euros but in a newly-created national currency like the old Italian lira, and leave them holding the bag.

When things look really grim, as they did last summer, gold jumps. It's like a lifeboat: useless under normal circumstances, but if the ship hits an iceberg, it's too late to get one.

All is normal for the time being in US financial markets, despite unprecedented levels of federal spending and borrowing. What can't go on forever won't – as the late Herb Stein said.

You don't check the price of your insurance policy every day. Gold is an insurance policy. You should own some, just in case.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Brazil Edtech Market Size, Share, Trends, And Forecast 2025-2033

- Vietnam Vegan Food Market Size, Share, Trends And Report 2025-2033

- Cryptogames Introduces Platform Enhancements Including Affiliate Program Changes

- Accounting And Bookkeeping Service Business Plan 2025: How To Start, Operate, And Grow

- USDT0 And Xaut0 Are Now Live On Polygon

- Global Open Banking Market 20252033: Services, Deployment & Distribution Trends

Comments

No comment