Deloitte: EV Inertia Returns As Hybrid Popularity Grows

-

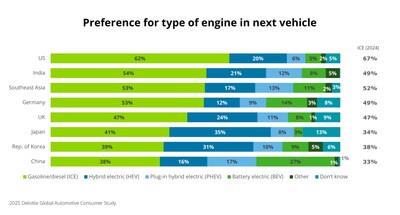

In the U.S.,

intent to purchase a hybrid vehicle (HEV/PHEV) is up 5 percentage points year-over-year to 26% as surveyed consumers seek a "best of both worlds" solution to fuel costs. Internal combustion engine (ICE) and EV intent declined five and 1 percentage points year-over-year (to 62% and 5%), respectively. Demand for public charging infrastructure may be exaggerated , as 79% of U.S. EV intenders surveyed plan to charge their vehicle at home. Over half (54%) of U.S. consumers surveyed plan to switch brands for their next vehicle

(up from 51% last year), as product quality ranks highest in determining the next vehicle brand choice. As driverless technology gains traction, more than half (52%) of U.S. consumers surveyed are concerned about fully autonomous robotaxi services operating where they live. More than

4 in 10 U.S. consumers surveyed aged 18-34 would be willing to give up vehicle ownership in favor of a fully available mobility-as-a-service (MaaS) solution .

Why this matters

The automotive industry continues to contend with evolving mobility, shifting consumer preferences and variable ownership experiences. For 15 years, Deloitte has explored automotive consumer trends impacting the dynamic and evolving global mobility ecosystem. This year's report, "2025 Global Automotive Consumer Study ," examines the consumer trends and issues shaping the global automotive sector, including electrification, future vehicle intentions, brand loyalty, connectivity features and mobility-as-a-service offerings.

Hybrid vehicles gain momentum

While consumers appeared to be navigating more toward ICE powertrains last year, interest is beginning to normalize in some markets. At the same time, hybrid powertrains continue to build traction as a "best of both worlds" solution for reducing fuel costs and emissions. In addition, reliance on public charging infrastructure may be somewhat overstated given the reality of charging intentions coupled with average driving distances and increasing EV range.

-

Among surveyed consumers in the U.S., intent to purchase hybrid electric vehicles (HEV/PHEV) is up 5 percentage points year-over-year to 26%, and interest in ICE vehicles is down 5 percentage points from 2024 to 62%.

Interest in all-battery electric vehicles remains nominal among U.S. consumers surveyed and relatively flat at 5%, underscoring the headwinds automakers face in ramping up BEV production.

Lowering fuel costs remains the top reason among U.S. consumers surveyed to purchase an EV (56%), followed by environmental considerations (44%) and driving experience (36%). However, available battery driving range remains a top concern (49%) for U.S. consumers surveyed, followed by the time required to charge (46%) and the lingering cost premium associated with BEVs (44%).

One-third (35%) of U.S. consumers surveyed said they drive 60 miles or more from their home only once or twice a month with a further 23% saying they never drive that far away, raising an important question regarding the amount of investment being earmarked to build out EV charging infrastructure.

The push to create public charging infrastructure may be overstated as most U.S. EV intenders surveyed (79%) plan to charge their vehicle at home. However, more focus on making it easy and affordable for people to install a home charger may be required as 58% of those surveyed said they currently do not have access to a dedicated EV charger.

Charging wait times may be a softening barrier for U.S. consumers surveyed as three-quarters (77%) are willing to wait up to 40 minutes to charge their vehicle to 80% from zero. U.S. consumers surveyed prefer a dedicated EV charging station (44%) to a traditional gas station with EV chargers (15%).

Vehicle brand loyalty wanes

A significant number of global consumers surveyed intend to switch to a different brand the next time they are in the market for a vehicle. Despite evolving preferences, key factors like price, performance and quality remain the primary drivers of purchase decisions.

-

Almost half (47%) of U.S. consumers and a majority (55%) of respondents in China and Japan owned the same brand of vehicle prior to their current car. However, in the U.S., only 5% say they are first time owners, compared to nearly one-third (31%) who say the same in China, signaling the need to build strong relationships to ensure forward brand loyalty.

A majority of consumers surveyed in most global markets plan to switch brands for their next vehicle, with the highest intent among consumers in China (76%) and India (72%). In contrast, 54% of U.S. consumers surveyed plan to switch brands, up 3 percentage points from 2024.

Brand affinity for domestic brands ranks highest among surveyed consumers in Japan (76%), whereas almost half (47%) of U.S. consumers surveyed indicate no preference as long as the vehicle meets their needs.

When determining the brand of choice for their next vehicle, U.S. consumers surveyed prioritize product quality (58%), followed by price (53%) and vehicle performance (51%).

Regardless of vehicle brand, U.S. consumers maintain the need to interact with the vehicle in person (86%) and conduct a test drive to ensure it is the right fit (86%).

Key quote

"As the global automotive sector continues to navigate shifting consumer preferences, powertrain intent and brand affinity are two decisive battlegrounds for industry stakeholders across the value chain. Interest in full hybrids and range extender technologies reflects a growing desire for pragmatic, cost-effective solutions that lower emissions without requiring a robust charging infrastructure. Simultaneously, brand loyalty is being tested, with rising defection rates across several markets signaling the importance of cultivating strong relationships, particularly in emerging markets with a high proportion of first-time buyers."

-

Jody Stidham , managing director, global automotive, Deloitte Consulting LLP

Consumers want new technology on their terms

As autonomous vehicle technology extends into potential commercial applications, consumer safety concerns mount as opposed to dealing with safety-related AI features in isolation. As automakers continue looking for ways to monetize vehicle cabins and infotainment screens, transitioning consumers away from longstanding smartphone integration may be difficult in some markets. Further, mobility-as-a-service (MaaS) is emerging as an alternative to traditional vehicle ownership for younger, cost-conscious consumers surveyed.

-

When it comes to autonomous applications, surveyed consumers express concerns over fully driverless robotaxi services operating in India (63%), the U.K. (52%) and the U.S. (52%).

How new technology is deployed makes a difference, as the majority of consumers surveyed in India (82%) and China (77%) see the addition of AI in vehicle systems as beneficial. Conversely, that sentiment is less prevalent in the U.S. (45%) and the U.K. (43%).

As some automakers seek to introduce their own connected service ecosystems, surveyed consumers in some global markets still believe their next vehicle should retain the ability to connect with their smartphone, particularly in the U.S. (63%) and India (87%).

About one-half of those surveyed in the U.S. (49%) and India (51%) indicate they drive their vehicle every day, twice that of consumers in South Korea (25%) and Japan (23%), reflecting the quality and/or availability of mass transit in those markets.

Despite the travel volumes observed among those surveyed in India and the U.S., many younger consumers aged 18-34 are interested in giving up vehicle ownership in favor of a mobility-as-a-service solution (U.S. 44%; India 70%).

Key quote

"The U.S. automotive industry is navigating a period of profound transformation, shaped by evolving mobility trends, shifting consumer preferences and diverse ownership models. Considering last year's slowdown on EV intent, the rise in hybrid adoption may serve as a practical bridge between legacy and alternative powertrains for U.S. consumers as infrastructure and cost realities persist in the near term. Autonomous vehicle technology is also regaining attention, but safety concerns remain a significant hurdle to success."

-

Lisa Walker , vice chair and U.S. automotive sector leader, Deloitte

Deloitte's "2025 Global Automotive Consumer Study ," is based on a survey of more than 31,000 consumers from 30 countries conducted between October and November 2024. For additional details and country-specifics, please visit the interactive dashboard .

About Deloitte

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including nearly 90% of the Fortune 500® and more than 8,500 U.S.-based private companies. At Deloitte, we strive to live our purpose of making an impact that matters by creating trust and confidence in a more equitable society. We leverage our unique blend of business acumen, command of technology, and strategic technology alliances to advise our clients across industries as they build their future . Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Bringing more than 175 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte's approximately 460,000 people worldwide connect for impact at .

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see

to learn more about our global network of member firms.

SOURCE Deloitte

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment