(MENAFN- Asia Times)

I've been talking about

vibes

a lot over the past week, so let's talk about something a little more substantive. trump and his movement basically have two main policy ideas: 1.) immigration restriction, and 2.) more tariffs. Let's think about the second of these.

Tariffs aren't just a Trump idea anymore – they're now an important part of the Democratic policy toolkit. Biden's tariffs on Chinese products, announced back in May, went well beyond anything Trump did in his first term.

I doubt a Harris administration would reverse this approach – some Democrats want to protect American jobs while others want to preserve American manufacturing capacity against the possibility of a war with China. So whoever wins in November, we're probably going to see tariffs continue to be a key policy tool in the US.

Back in February, I wrote a post about why tariffs often aren't as effective at reducing trade deficits as their proponents hope, link here .

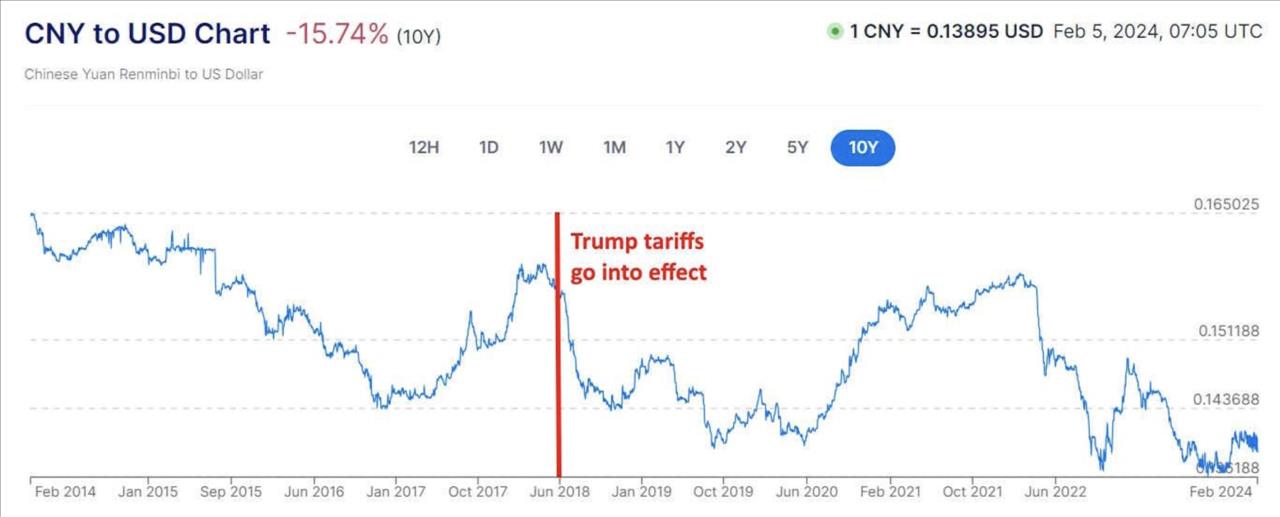

Basically, there are three reasons tariffs tend to be underwhelming. Most importantly, when you put up tariffs against another country's goods, it causes that country's currency to depreciate against your currency.

That makes your exports more expensive and makes imports cheaper for your consumers. This partially cancels out the intended effect of the tariffs. In fact, in the year and a half after Trump put tariffs on China in his first term, the Chinese currency depreciated significantly:

Source for original chart: Xe

Another factor reducing tariffs' effectiveness is the many ways that Chinese companies can get around them. They can“re-export” - basically, ship something to a third country, slap a“Made in Vietnam” or a“Made in Thailand” label on it, and then sell it to America, free of tariffs.

They can set up factories in third countries so that their products are actually made in those countries. They can sell parts and components to assemblers in third countries, in which case the US doesn't even know they're importing a bunch of Chinese goods.

They can take advantage of loopholes like

the“de minimis” rule

that allows China to sell small packages to America free of tariffs. And so on. All of these strategies can in theory be fixed with enough investment in data and monitoring. In practice they rarely are.

The third problem with tariffs is that they make intermediate goods – materials, parts, and components – more expensive for US manufacturers. Tariffs on steel and aluminum raise prices for American carmakers, aerospace companies, appliance makers, and so on.

Tariffs on batteries make it more expensive to build EVs in America. Tariffs on solar panels make it more expensive to produce energy for US manufacturing. And so on. This

weakens US manufacturing

and can hurt US exports.1

So between circumvention strategies, currency movements and damage to American manufacturers, Trump's tariffs on China ended up reducing the trade deficit a lot less than their architects had hoped.

And although Biden's tariffs are much higher – and Trump's tariffs in a second term would likely be higher still – these factors will continue to exert an effect. This is not to claim that tariffs are

ineffectual

- they're just a weaker policy tool than their proponents like to think.

Despite these inherent weaknesses, tariffs are still

an important piece of the toolkit

for preserving supply chains and defense manufacturing capacity against the possibility of a major war.

But it's also possible that tariffs will have some unexpected benefits for people around the world - Chinese consumers who are getting a bad deal from the country's current economic model, and developing countries that could benefit greatly from Chinese investment.

When we think about tariffs, we should think about these positive side effects as well.

Tariffs might help China to rethink its economic model

Zongyuan Zoe Liu has

a widely read article

in Foreign Affairs this week about the drawbacks of China's manufacturing-focused economic model.

The article gives an excellent explanation of how China promotes manufacturing. Basically, it's all about bank finance - banks loan huge amounts of money very cheaply to manufacturers, who then compete fiercely, resulting in a flood of cheap, often undifferentiated products.

These price wars result in collapsing profit margins, as all the Chinese manufacturers glut the market with products no one wants to buy. It also results in a flood of exports, as Chinese manufacturers try to

sell their excess capacity overseas . And it results in a mountain of corporate debt, forcing Chinese companies to stay on the treadmill of unprofitable production just to keep making their interest payments.

MENAFN08082024000159011032ID1108531424

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.