(MENAFN- Asia Times)

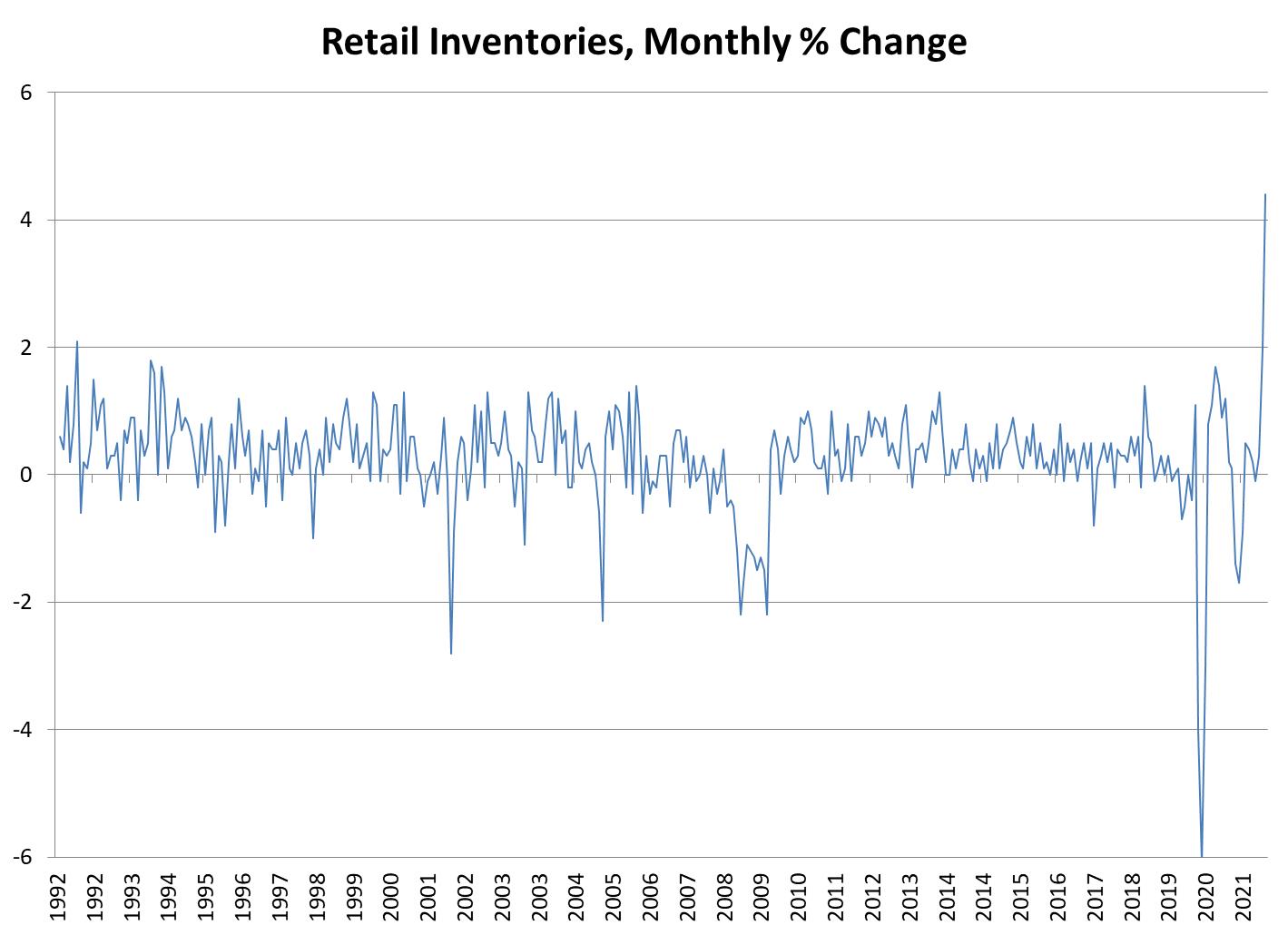

One of the typically least interesting pieces of data routinely published by the US government got the undivided attention of economists the morning of January 26. Retail inventories for December 2021 registered the biggest monthly increase since the data were first published in 1992. Retail sales dropped unexpectedly in November and December, leaving stores with unsold goods.

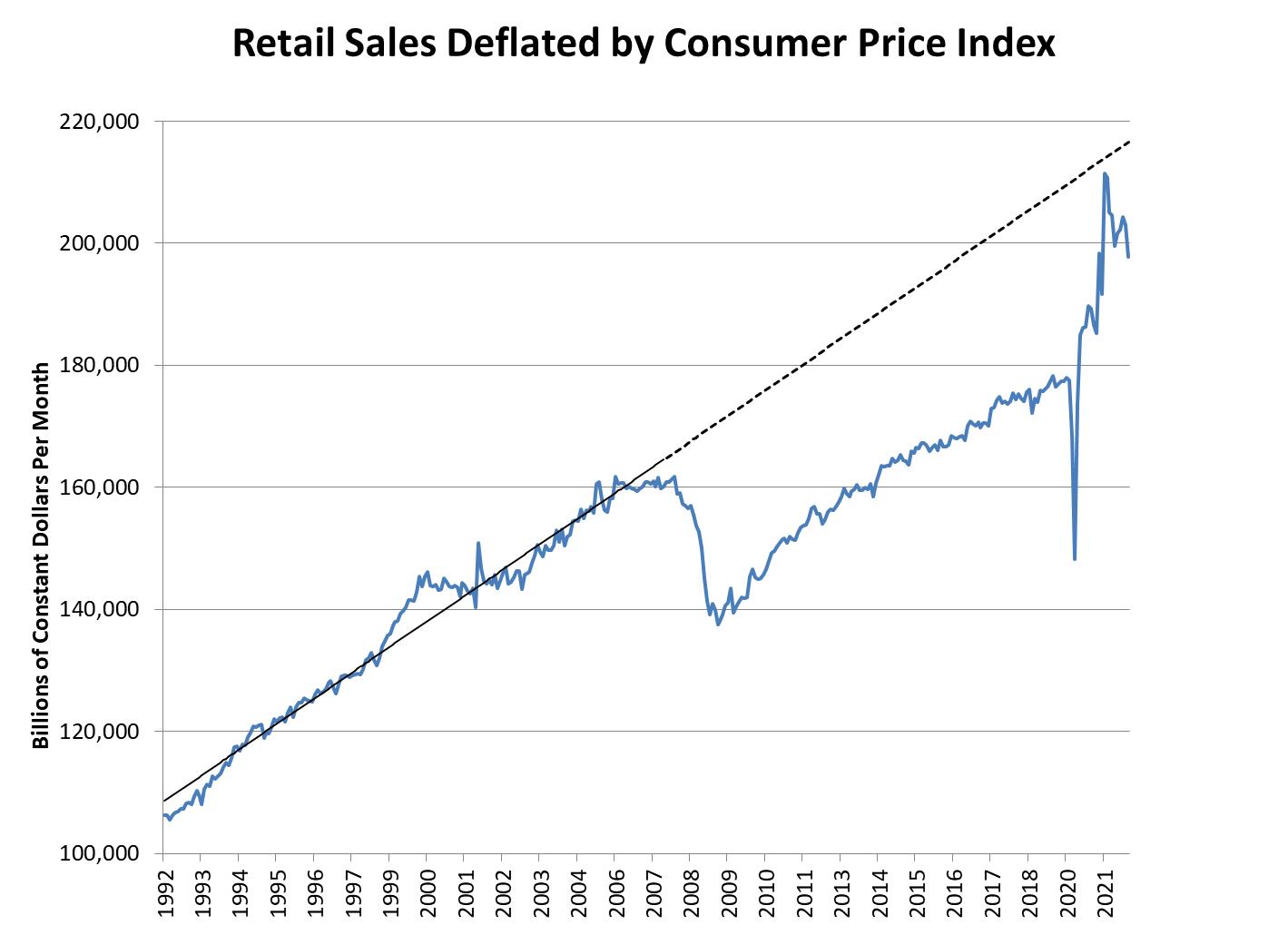

That's a bad sign for an economy that has run on government-funded consumption since the pandemic hit in March 2020. The $6 trillion in federal stimulus pushed the level of retail sales back up to the pre-2008 trend. American consumers never caught up to the earlier trend line during the dozen years of post-2008 recovery, until federal subsidies occasioned the biggest increase in household income in US history.

Charts: David P. Goldman

In a matter of months, US consumers made up for twelve years of below-trend retail spending. America's sclerotic supply chains couldn't keep up with the surge in demand. The result was the highest inflation rate since 1982.

Now, it seems, consumers are refusing to pay the higher prices. Retail sales adjusted for the Consumer Price Index were about 4% lower in December than in October. The retailers evidently miscalculated, as the unprecedented jump in inventories indicates.

Some Wall Street analysts told their clients that the inventory spike portended lower goods prices. Consumers, they argued, would spend less on goods (electronics for remote work) and more on services (food and entertainment) as conditions normalized. And lower spending on goods, some averred, would suppress headline inflation numbers.

That beneficent outcome isn't the only, or even the most likely, scenario. Consumers may spend less altogether, especially as inflation erodes their savings, and as the prospect of tighter money batters their stock portfolios. Prices for electronics may moderate, but the biggest item in the so-called core inflation rate – shelter – will continue to rise. With the average monthly rent in the US up 14% year-on-year, according to the Zillow Index, there are probably another two or three percentage points of CPI increase built into the 2022 data. The shelter component of CPI lags behind changes in the Zillow Index by up to eight months.

As rates rise, moreover, fewer people can afford to buy homes and must rent instead. That keeps upward pressure on rent inflation, and that in turn keeps pressure on the Federal Reserve to raise interest rates. That doesn't add up to a US recession in 2022, but it points to rising inflation, economic weakness and a soggy stock market.

MENAFN26012022000159011032ID1103598553

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.