Note To Trump: Targeted Tariffs Can Work, Broad Ones Never Do

But Trump is contemplating tariffs that are far broader in scope - a 60% tariff on all Chinese-made products, and a 20% tariff on all imports from anywhere.

There's a fundamental difference between targeted tariffs like Biden's and blanket tariffs like Trump's. I'm not sure whether Trump's trade people, including

Robert Lighthizer , are aware this difference or not, but it's important. Like the fact that

imports don't subtract from GDP , it's something that people who debate trade policy often seem not to understand.

First, let's talk about two different things you might want tariffs to accomplish.

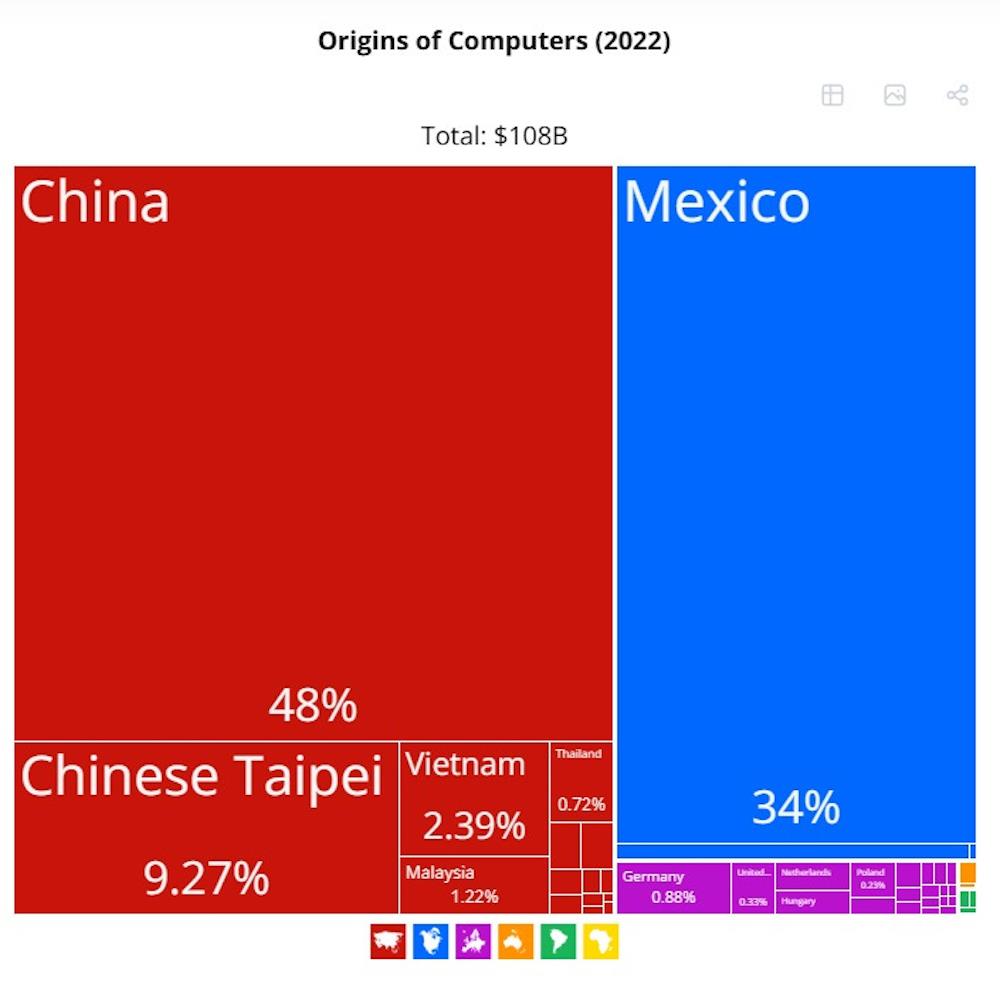

One goal of tariffs is to

reduce US dependence on China

- or on the outside world in general -

in a specific set of critical industries. For example, if China makes all the batteries, they can just decide to cut you off whenever they want to - as

China just did to America's top drone manufacturer , Skydio.

Drones are a key weapon of modern war - perhaps

the

key weapon. And many drones are battery-powered. So if the US imports all its batteries from China, it sort of puts the US at China's mercy. Thus, we might want to use tariffs to make sure that China doesn't make all our batteries.

A second goal of tariffs is to

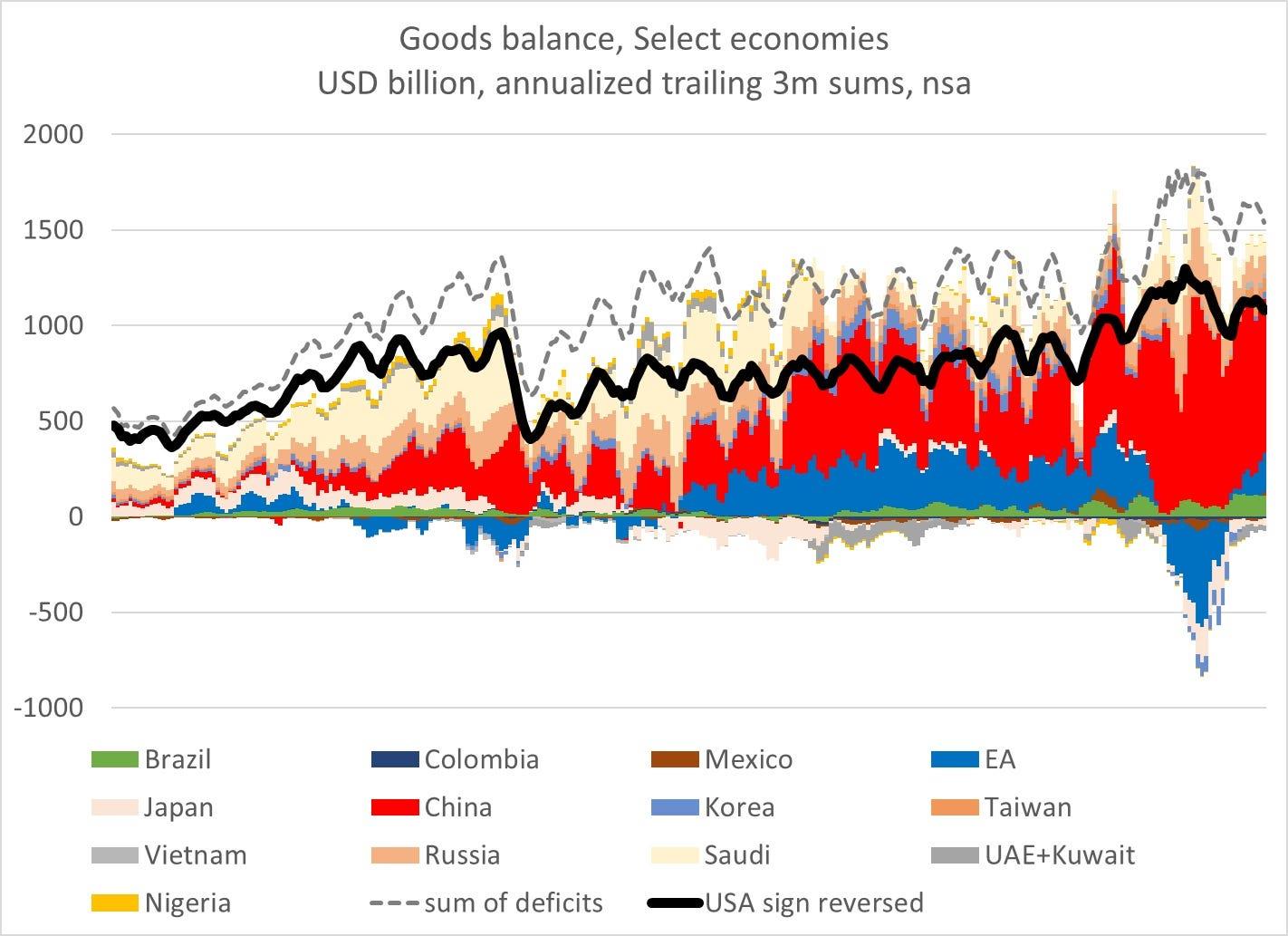

reduce trade imbalances. The US runs a very large trade deficit, and China runs a very large trade surplus. In fact, right now, all the countries in the world except the US and China have largely balanced trade. China's trade surplus accounts for

the vast majority of all global trade surpluses, and America's trade deficit accounts for

the vast majority of global trade deficits:

Source: Brad Setser

A lot of countries have balanced trade because they run a trade deficit with China and a trade surplus with America. That doesn't mean they're buying stuff from China, slapping a new label on it, and selling it on to America. But what it does mean is that America is the world's main“country that buys more than it sells”, while China is the world's main“country that sells more than it buys.”

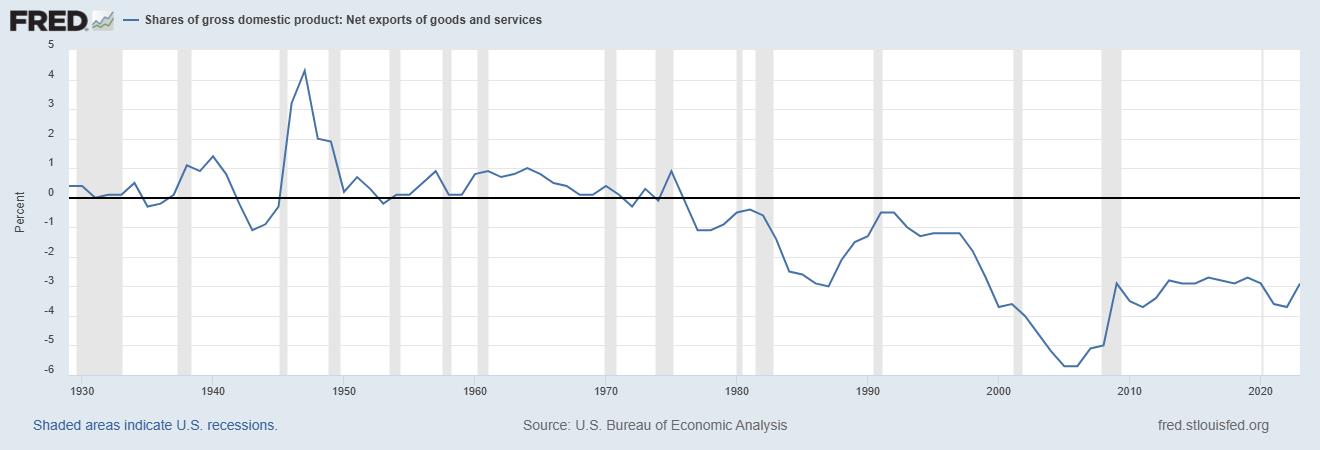

Many people want to reduce those imbalances . Some people believe (probably correctly) that these big trade deficits hurt US manufacturing because they rob American manufacturers of key markets overseas.

Others believe that global trade imbalances lead to various other economic problems - for example, Michael Pettis, who believes imbalances drive inequality . Still others simply view trade deficits as a“loss” and trade surpluses as a“win.”1 Reducing America's trade deficit was one of the major goals of Trump's first term in office .

In fact, both broad tariffs and targeted tariffs have a very hard time reducing trade deficits. But targeted tariffs are capable of reducing US dependencies in specific areas like batteries - in fact, they're better than broad tariffs for this purpose. Let me explain.

Broad tariffs struggle to reduce trade deficitsThere are actually two reasons that broad tariffs, like the ones Trump is proposing, have difficulty reducing trade deficits. The first reason is

exchange rate adjustment.

When you trade stuff internationally, you have to swap currencies. As anyone who has traveled overseas knows, to buy Chinese goods, you need yuan .2 So if you're an American, you need to swap your dollars for yuan in order to buy stuff from China. The price at which dollars and yuan get swapped for each other is called the exchange rate.

When the US puts tariffs on China, that reduces US demand for Chinese goods. And that reduces US demand for Chinese yuan, because when Americans don't need to buy as much Chinese stuff, they don't need as much yuan.

And when demand for yuan goes down, the price of yuan, in terms of dollars, goes down. This is just basic Econ 101, supply-and-demand stuff. The dollar appreciates in value and the yuan depreciates in value. This is called“exchange rate adjustment.”

Exchange rate adjustment partially cancels out the effect of the tariffs. When tariffs make the yuan get cheaper for Americans, that makes

Chinese goods cheaper for American customers. And when tariffs make the dollar get more expensive for Chinese people, that makes

American goods get more expensive for Chinese customers.

This doesn't completely cancel out the effect of tariffs, but it partially cancels it out. It's like if the government put taxes on pizza, pizza restaurants would cut their prices in response in order to reduce the number of people who stop eating pizza.

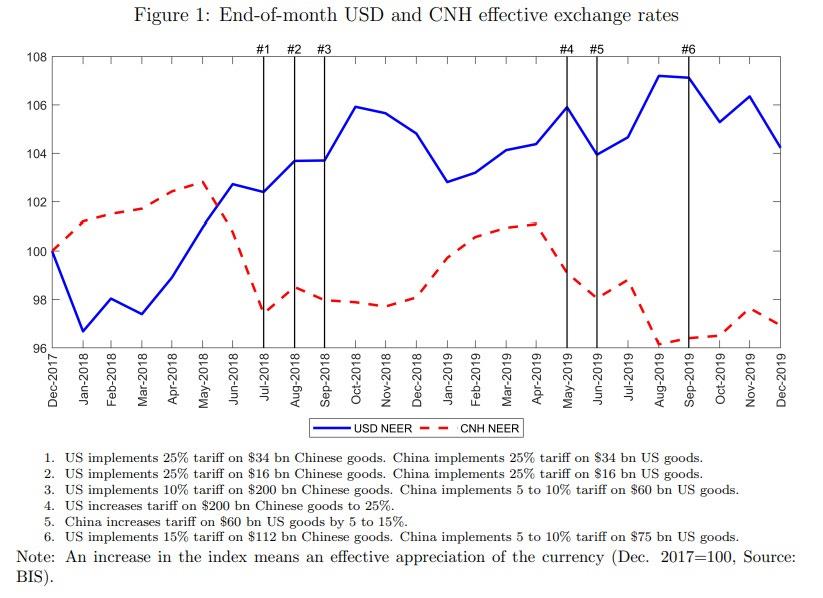

Of course in the real world, there are more than just two currencies, and more than just two countries trading with each other. But if you look at the data, it's not hard to see the impact of Trump's tariffs on China in his first term.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment