(MENAFN- ING) The second

release of second-quarter GDP data confirms the flash print, at a lower-than-expected 1.1% year-on-year. This strengthens our conviction of a below-consenforecast of 1.5% for 2023. Strong wage data and the approaching elections leadto maintain the 2024 forecast at 3.7%

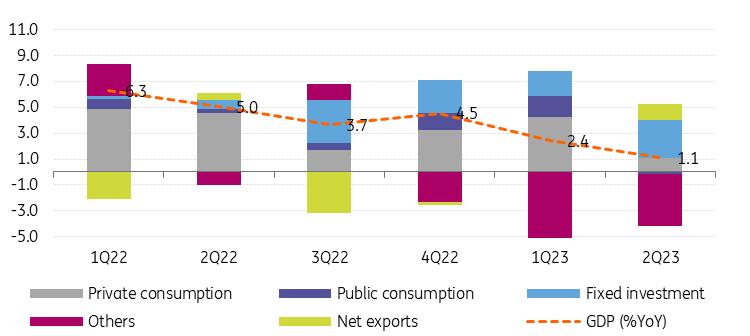

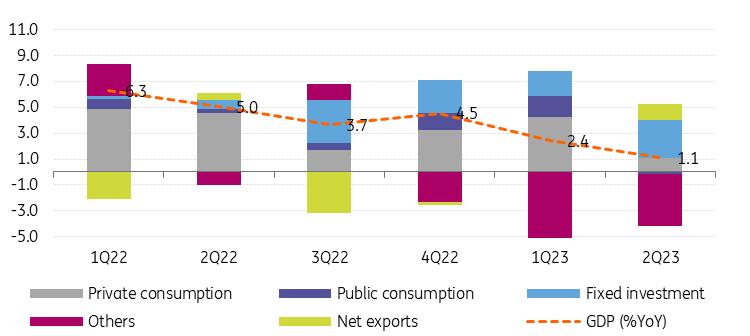

The breakdown of second-quarter GDP shows that strong investment activity – most likely in civil engineering projects as shown by high-frequency construction data – is keeping the economy afloat. That said, slowing private demand, a downturn in public consumption and a weakening external outlook are taking their toll on growth. As such, in the second quarter, fixed investment made up the lion's share of growth contribution, overtaking private consumption.

GDP growth (YoY%) and contributions (ppt)

NSI, ING On the supply side, annual growth in the trade and construction sectors slowed, while agriculture contracted at a steeper rate. The latter might reverse in the second half of the year and pose a positive contribution based on current estimation for crops and prices. Turning to the key growth contributors, private services were by far the strongest positive contributor, while the poor performance of industrial activity was reflected negatively.

From a quarterly sequential perspective, private consumption stands out as it contracted by 2.1% – the largest drop since the second quarter of 2020. In fact, almost all items began to contract in the second quarter compared to the previous, the most notable exception being fixed investments with a 5.6% quarterly advance. This reveals that the economy is essentially working with only one engine: public investments financed largely by EU funds.

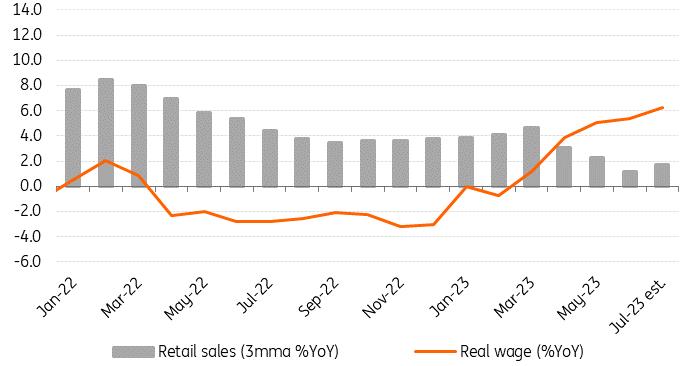

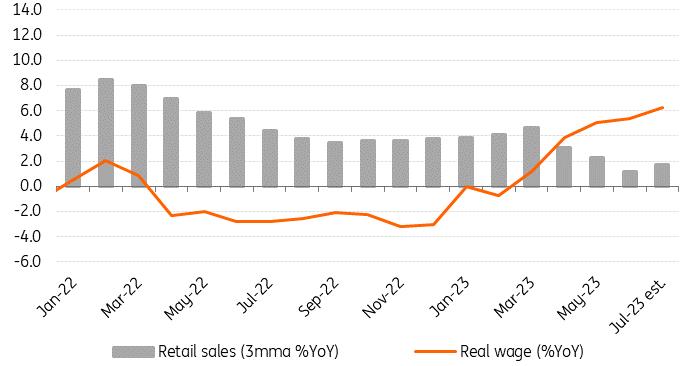

Looking ahead, we expect growth to remain weak in the second half of the year and the economy to grow by only 1.5% YoY in 2023. While still early to confirm, high-frequency data are already showing a step in that direction. Yesterday's weak outturn in July's retail sales activity (+1.2% YoY and -0.3% month-on-month) marked a poor start to the quarter and is so far consistent with a continued slowdown in private consumption. Admittedly, real wage growth should provide support in the second half of 2023 and limit the losses ahead – it turned positive in March and was likely above 6.0% in July, with an upward bias going forward.

Moreover, the recent extension of the essential food items price cap by the government will support disposable income in the months ahead. But significantly weaker prospects of external demand from key trading partners like Germany, where industrial activity is currently suffering a major downturn, will weigh on exports.

Stronger real wages to limit the slowdown

NSI, ING While GDP growth perspectives for 2024 are likely to disappoint, we hold on to our 3.7% estimate. We think that weak external demand, still-high interest rates and the EU-agreed fiscal consolidation could be a drag on output.

That said, a still-strong EU Funds absorption and sustained infrastructure investments should continue to impact growth positively. Moreover, 2024's four rounds of elections might derail the fiscal adjustment and tkeep a larger fiscal stimuin place until 2025.

Comments

No comment