(MENAFN- Asia Times)

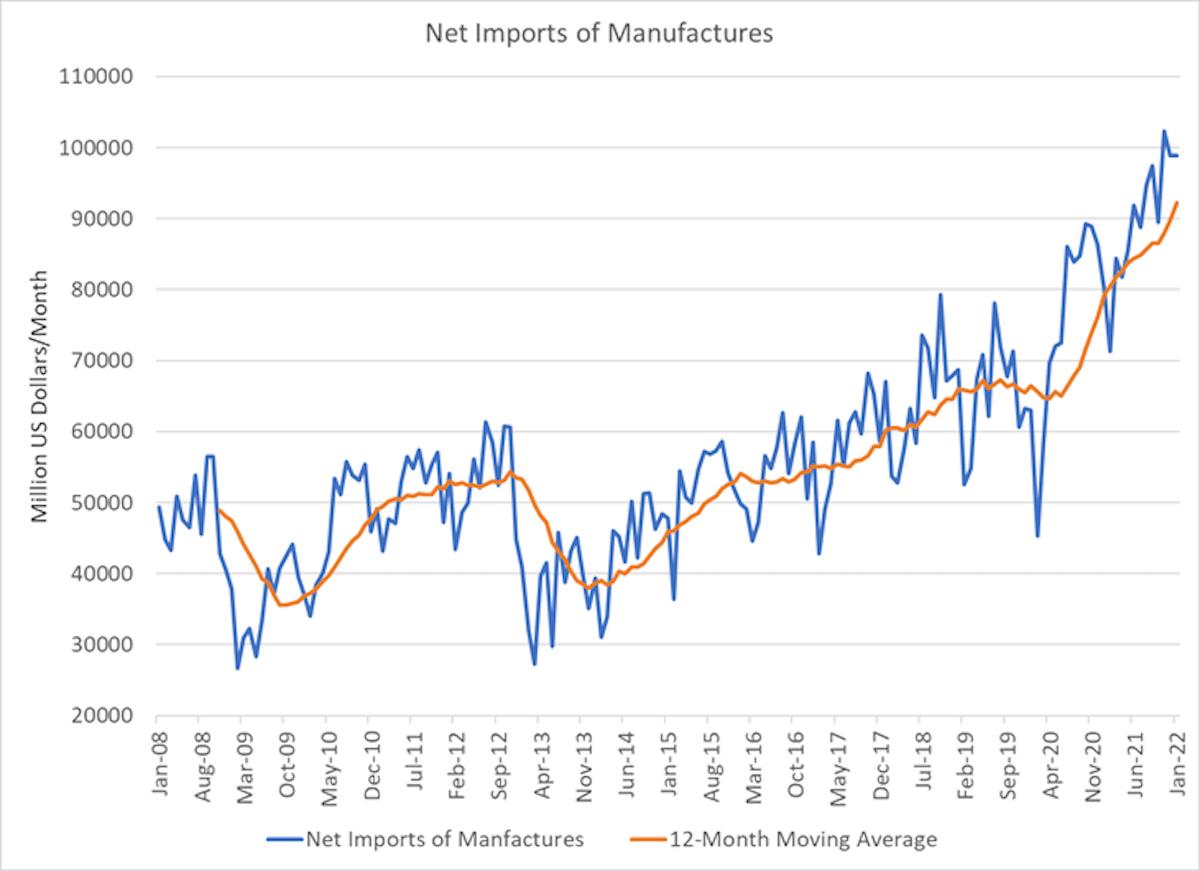

The US trade deficit in manufactured products has been growing for many years as production moved out of the country. In the 2009 period, the 12-month moving average of the monthly deficit was about US$40 billion.

It has increased markedly during the past several years. In October 2021, that average reached about $90 billion – a sharp 50% increase from about $60 billion in February 2020.

The trade deficit has not been a secret – it received a great deal of public attention with notions that manufacturing would return domestically thanks to actions that would improve the profitability of locally produced goods.

To that end, tariffs were imposed on some products during the Trump administration. There is no evidence that imports were reduced significantly by those tariffs.

More recently, imports have been disrupted during the Covid pandemic, stimulating renewed interest in the possibilities of domestic production.

Given big disruptions in the international supply chain, with resulting shortages of goods – and price increases not seen for many years – one would have thought that domestic manufacturing of goods normally imported would substantially increase.

This did not happen. Domestic manufacturing of industrial goods has not increased meaningfully, as the trade deficit statistics show.

This is not surprising in the short term, For products no longer produced domestically, there is no way for their supply to increase rapidly to compensate for import shortages. This includes large industries such as garments, computers and communications equipment, including cell phones – items that are now manufactured overseas.

In the longer term, the big question is whether the recent disruptions will give an impetus to a re-emergence of manufacturing in the United States. Moving manufacturing is always a big process.

The migration from the US was caused by perceived big benefits. Reversing the process requires big economic, technological or supply incentives.

It is not simply a matter of moving plants. An efficient production supply chain is essential. Rebuilding supplier networks is never simple or costless.

Here is an example of a company making relatively simple products. I spoke to the partner of a major supplier of steel fasteners used in the garment industry. His family business was started in 1970 in Kansas City.

In 1995 it was moved to Shenzhen, China, where a local financial partner bought a controlling interest and various local financial incentives were provided to finance a new, modern plant.

Originally, the materials needed for production came from the US. Over the years, all the materials needed to produce the fasteners come from China, from reliable and cost-effective vendors. This company will not move back to the US anytime soon.

Moving factories from countries such as China with strong industrial policies have other hurdles – local incentives that promise to balance incentives offered by the US to induce their migration.

For example, the government's“Made in China 2025” initiative aims to make China self-sufficient in major industries by 2025 through incentives and other efforts to encourage industrial innovation. Hence, the attraction of manufacturing in China may grow compared with other locations, including the US.

Chinese workers prepare boxes of desktop computers at the computer factory of Tsinghua Tongfang Co, Ltd in Beijing on May 29. 2005. Photo: AFP / Shzq / Imaginechina /

But this is not the end of the corporate decision-making process. Other important factors may sway the decision in favor of domestic manufacturing. An important one is business flexibility and the ability to rapidly shift product strategy.

Keeping corporate functions domestic, from research and design through production, allows more rapid response to market changes and increases flexibility.

New production technologies can dramatically improve the ability to increase the flexibility to deliver high-value products in a timely fashion. With advanced robotics, automation can overcome any labor-cost advantages of overseas locations.

It is obvious that moving industrial production back onshore can only occur when economic factors promise meaningful corporate benefits. Given the international competitive situation in which countries compete for economic growth drivers, financial inducements by themselves are likely to prove nationally costly and of only limited-time value.

What will bring industries back are innovative technologies that can be leveraged in building more flexible and globally competitive businesses.

Providing support for US research and development of manufacturing automation is one way that can encourage migration back to the country. Government support should be aimed at developing technologies that promise to build globally competitive domestic industries supported by innovation – not blank-check government subsidies.

Henry Kressel is a technologist and inventor. Among his achievements is the pioneering of the semiconductor laser device that enables modern communications systems.

MENAFN12042022000159011032ID1103996344

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.