Russian capital flows, not current account, remain key in determining ruble trends

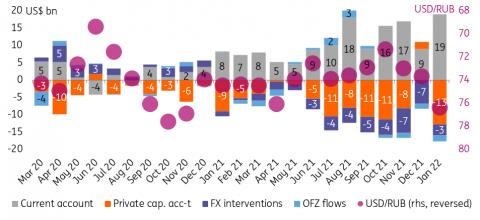

According to preliminary estimates , the Russian current account surplus reached a historical high of US$19.0bn, close to the high end of our US$15-20bn forecast range. The strong result was driven by the sharp spike in commodity prices and deceleration in imports growth. We have the following observations and takeaways:

- Despite the strong current account and suspension of market FX purchases by the Central Bank of Russia on 24 of January (at which point month-to-date purchases totaled US$3.2 bn), average monthly USDRUB weakened by 3.5% month-on-month in January.

- Ruble failed to benefit from the strong current account in January (Figure 1) as the spike in foreign policy tensions and increased sanction risk perception contributed to US$12.8bn net private capital outlows (the highest monthly outflow since November 2018) and US$1.7bn outflows of foreign portfolio investments out of local currency public debt (OFZ). We believe the local private sector may have temporarily suspended FX sales and intensified foreign debt redemption last month.

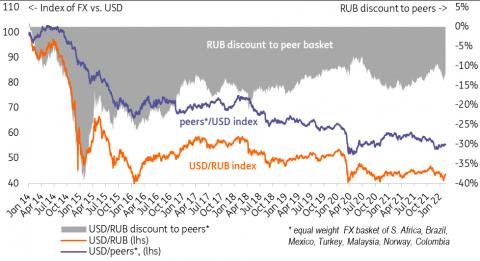

- The good news is that following the CBR decision to suspend FX purchases and some cautious signs of de-escalation in foreign policy tensions, USDRUB returned to levels seen at year-end 2021. At the same time, ruble's peers showed around 1.5-2.0% appreciation to USD year-to-date on better risk perception (Figure 2). As a result, the country discount embedded into the Russian FX remains elevated, suggesting residual nervousness about foreign policy risks.

Bank of Russia, Refinitiv, National Settlement Depository, Finance Ministry, ING

Figure 2: Despite the rally in early February, USDRUB's discount to peers is still 1-2 percentage points higher than at year-end 2021

Refinitiv, ING

There should be no rush to reinstate FX purchases

We reiterate , that the potential timing of market FX purchases remains one of the key questions for the FX market, and it is likely to be addressed in some way during Governor Nabiullina's press-conference on 11 February. While some market participants expect a fast restart of interventions we see some arguments in favour of CBR taking its time:

- The January experience confirms our take that the current account is not the key driver of ruble performance. If oil prices remain unchanged, the 1Q22 current account surplus may reach US$50-55bn, which seems more than enough to cover the expected US$8-9bn monthly FX purchases. However, capital outflow remains the key uncertainty.

- While the foreign policy context no longer gives reasons for a market panic, some uncertainties lie ahead, which is reflected by the still elevated RUB country discount to its peers. The near-term events calendar include a possible introduction of the bipartisan DUSA 2022 bill (outlining sanctions against Russia in case of hostilities towards Ukraine) in the US Congress, negotiations between UK, German, Ukrainian, and Russian leaders, Russia-Belarus military exercises, and Russia's written response to NATO security counterproposals.

- Reinstatement of FX purchases immediately after the USDRUB rate is back to pre-panic levels could be misinterpreted by some market participants as a sign that Bank of Russia is targeting certain nominal FX levels.

- Theoretically, CBR would be comfortable with an FX purchase backlog of up to US$36bn, as that is the sum that the government may allocate for local infrastructure investments out of the sovereign fund (NWF) in 2022-24. This means that at current oil & gas prices, CBR can hypothetically keep the market purchases suspended until the end of May, treating it as a frontrun mirroring of upcoming investments.

With the foreign policy-related panic largely over, ruble trading should keep returning back to fundamentals. We reiterate our initial constructive call , meaning a high chance of USDRUB return to 72-73 range in 1H22. That said, risks to this baseline view include a premature restart of CBR FX purchases, new round of foreign policy tensions, and negative global market reaction to elevated inflationary risks and faster-than-expected tightening in the monetary policy by the Federal Reserve and European Central Bank.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment