(MENAFN- DailyFX)

USD/ZAR ANALYSIS

- ZAR pounces on favorable global factors

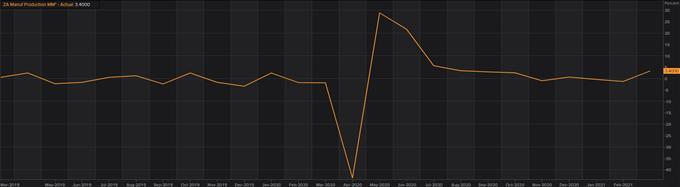

- Local manufacturing production (MAR) at 3.4%

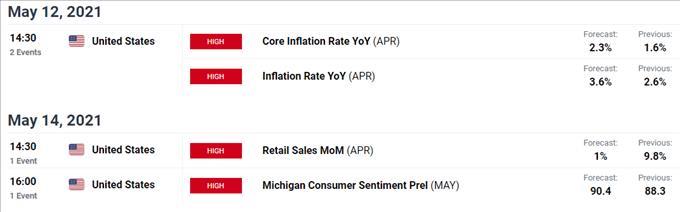

- Upcoming U.S. inflation data

- holding steady around 14.0000

Advertisement

Visit the to discover why news events are Key to Forex Fundamental Analysis

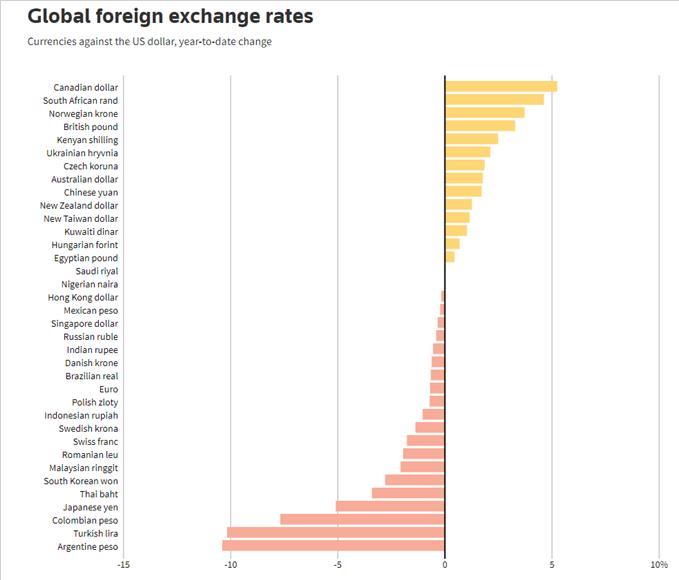

The South African Rand has shown its 'safe-haven” appeal amongst its currency peers in 2021 against the greenback. The ZAR has been the best performing EM currency against the this year (see chart below) primarily due to exceptional negative ongoing circumstances throughout these peer nations.

Source: Reuters

With peer EM countries such as India and Brazil experiencing a severe wave of COVID-19 cases and Turkey and Russia coming with its own geopolitical risks, South Africa and its currency has taken advantage of a bad situation. Although South Africa comes with its own local economic challenges, on a relative basis (currently) South Africa is the optimal choice.

Another potential positive for South Africa is the delayed credit rating by Moody’s which could mean that the rating agency may need more time to analyze the South African financial landscape. Regardless, there was a low probability of a ratings downgrade but with countries crumbling to the effects of COVID-19 around the world, South Africa will need to handle the situation with utmost consideration to exploit financial conditions and potentially come out on the other side with a ratings upgrade.

Manufacturing production data for March 2021 came in today at 3.4%, the highest since August 2020. No initial reaction on /ZAR but this could improve as the market digests the information.

South Africa Manufacturing Production (March 2021)

Chart prepared by , Refinitiv

ALL EYES ON U.S. INFLATION DATA TOMORROW

Source:

U.S. inflation data is flooding financial market headlines this week as analysts and experts contemplate the situation in the U.S. and whether any intervention is needed to curb the possibility of an overheating economy. This would ultimately erode the value of the Dollar and favor further ZAR strength as South African inflation remains relatively subdued. Any significant deviation from expectations (3.6%) may result in large price swings on the USD/ZAR pair therefore, ensuring sound risk management is essential pre and post announcement.

USD/ZAR TECHNICAL ANALYSIS

DailyChart:

Chart prepared by , IG

Yesterday, pushed below the 14.0000 support level and almost touched the January 2020 low at 13.9328. Since then, the U.S. Dollar has clawed back some lost gains as evident from the lower on yesterdays daily candle. The theme seems to be similar today with upbeat manufacturing data and fears around U.S. inflation testing the 13.9328 support level once more.

Downward momentum remains strong despite consolidation in April as bulls attempted to maintain prices above 14.5000. This being said, the shows bullish divergence (blue) which means the recent lower prices do not correspond with a lower reading on the RSI. This is suggestive of bullish divergence which could lead to a reversal to the upside.

has been accelerating to the downside on the back of the aforementioned fundamental factors which has pushed the USD/ZAR pair toward historical key levels. A breach of initial support at 13.9328 could bring into consideration the July 2019 low at 13.8119.

Alternatively, USD/ZAR bulls will look for price rejection below key support levels and look for an upside target of 14.1536.

--- Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter:

MENAFN11052021000076011015ID1102064055

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.