Digital Agriculture Market Size, Share, Industry Overview, Growth Drivers, Opportunities, Key Segments, And Leading Players

"MarketsandMarketsTM"Digital Agriculture Market Offering, Technology (Peripheral, Core), Operation (Farming & Feeding, Monitoring & Scouting, Marketing & Demand Generation), Type (Hardware, Software, Services), Region - Global Forecast to 2029

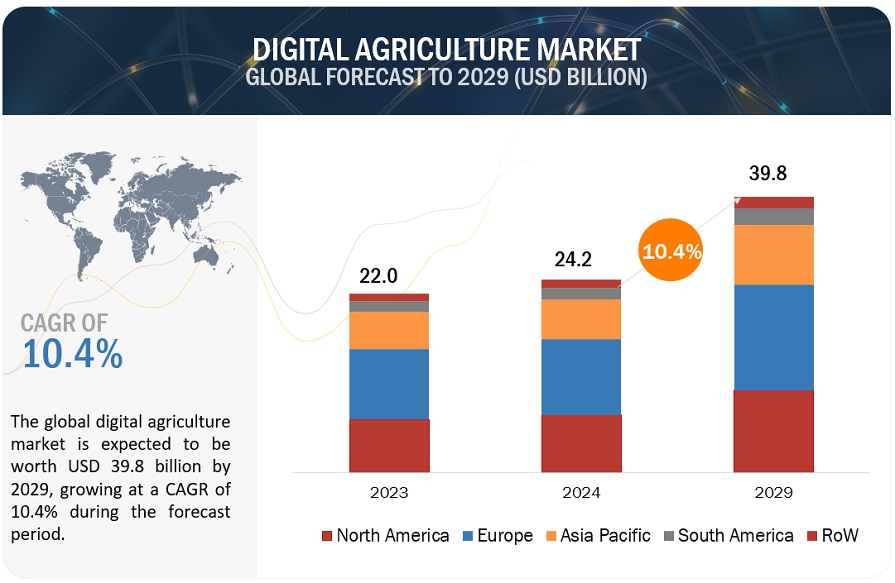

The global digital agriculture market , valued at USD 24.2 billion in 2024, showcases a remarkable growth projection, anticipated to escalate to USD 39.8 billion by 2029, indicating a robust compound annual growth rate (CAGR) of 10.4% during the forecast period. This sector is undergoing significant transformation, fueled by a variety of factors. Key drivers include the increasing demand for precision farming solutions, heightened awareness of the advantages of digital technologies in agriculture, advancements in sensor technologies, resource scarcity, economic incentives, supportive government policies, and the necessity for sustainable farming practices to address emerging environmental challenges. This dynamic environment presents a lucrative market filled with opportunities for growth and innovation.

Digital Agriculture Market Trends

The digital agriculture market is experiencing significant growth driven by advancements in technology and the increasing need for efficient farming practices. Here are some key trends shaping the landscape of digital agriculture:

Precision Agriculture: Farmers are increasingly adopting precision agriculture techniques that utilize data analytics, GPS technology, and IoT devices to optimize crop yields and resource management. This trend helps in making data-driven decisions to improve productivity and reduce waste.

Data Analytics and AI: The use of big data analytics and artificial intelligence is growing in digital agriculture. Farmers leverage data from various sources, including sensors, drones, and satellite imagery, to gain insights into soil health, weather patterns, and crop conditions, leading to better planning and management.

Remote Sensing and Drones: Remote sensing technologies and drones are being utilized for monitoring crop health, soil conditions, and irrigation needs. These tools provide real-time data, enabling farmers to respond quickly to any issues and manage their resources more effectively.

Blockchain Technology: Blockchain is gaining traction in agriculture for improving traceability and transparency in supply chains. This technology helps in tracking the origin of products, ensuring food safety, and enhancing trust among consumers and producers.

Mobile Applications: Mobile apps are increasingly being used by farmers for accessing information, managing operations, and connecting with suppliers and buyers. These applications provide valuable resources such as market prices, weather forecasts, and best farming practices.

Sustainable Practices: There is a growing focus on sustainability in agriculture, driven by consumer demand for eco-friendly products. Digital agriculture tools help farmers adopt sustainable practices by optimizing resource use and minimizing environmental impact.

Integration of Robotics and Automation: Robotics and automation technologies are being integrated into farming practices to enhance efficiency and reduce labor costs. Automated machinery for planting, harvesting, and monitoring crops is becoming more prevalent.

Smart Irrigation Systems: The development of smart irrigation systems that utilize sensors and data analytics is helping farmers manage water usage more efficiently, promoting conservation and sustainability.

Cybersecurity Concerns: As digital agriculture grows, so do concerns over cybersecurity. Protecting sensitive agricultural data from cyber threats is becoming increasingly important, prompting investments in robust security measures.

Investment and Partnerships: There is a surge in investments and partnerships among technology companies, agricultural firms, and startups. Collaborations are focused on developing innovative solutions that address the challenges faced by the agricultural sector.

Download PDF Brochure:

The hardware segment held the largest market share throughout the study period.

Hardware is a fundamental element of digital agriculture, serving as the backbone for various agricultural activities, including crop monitoring, sensing, surveying, and field intelligence systems. This hardware segment encompasses automation and control systems, as well as sensing and monitoring devices.

Automation and control systems assist farmers by enhancing crop protection through effective field surveying, real-time monitoring, efficient irrigation, timely harvesting, and precise pesticide application using robotic systems and field sensors. Meanwhile, sensing and monitoring devices are essential for collecting vital data about crops and fields, facilitating comprehensive analysis for informed decision-making, and supporting farmers in their agricultural practices. The increasing demand for farmers to make well-informed decisions and improve productivity is driving the adoption of hardware devices, thereby fueling market growth.

Advisory services within the offering segment are expected to experience the highest CAGR throughout the forecast period.

The integration of advanced technologies like virtual assistants and AI-powered chatbots has significantly transformed advisory services in agriculture over the years. These services can be utilized in various ways to tackle challenges faced by farmers across different crop types. For example, digital advisory services can alert farmers when a specific plot is ready for harvest, even earlier than anticipated. This allows farmers to quickly assess how different scenarios might impact the profitability of their crops.

According to the Food and Agriculture Organization of the United Nations (FAO), digital agricultural extension and advisory services (AEAS) have enormous potential to enhance information access and improve farming outcomes for smallholder farmers, especially in developing nations. Governments worldwide are actively supporting these advisory services to assist farmers.

Additionally, a variety of service providers deliver these advisory services, including Agri VAS providers, mobile network operators (MNOs), non-governmental organizations (NGOs), and sometimes technology vendors, government bodies, and regulatory agencies, often in collaboration with MNOs. The growing accessibility of these services, combined with government incentives, increased mobile internet connectivity, and the pressing need to boost farm productivity, is driving the advisory services market and reinforcing its role in the digital agriculture landscape.

Asia Pacific Region dominates the Digital Agriculture Market Share .

The digital agriculture market in the Asia Pacific region is significantly shaped by government incentives, enhanced internet access, growing awareness of technological advancements, the demand for increased agricultural yields, and efficient resource utilization. Government policies and initiatives focused on educating farmers have raised awareness of digital agriculture throughout the region. China plays a crucial role in establishing the region's leadership in this field, with India rapidly emerging as a key player. Meanwhile, Australia, New Zealand, and Japan continue to show steady growth in digital agriculture.

Additionally, the support from major stakeholders in the agriculture sector is driving the expansion of digital agriculture in the area. For example, in November 2022, Syngenta and Plantix collaborated to provide smallholder farmers in the Asia Pacific with AI-powered farming tools via the Cropwise Grower app. This initiative aims to reach 500,000 farmers across five countries, granting them access to a comprehensive database of crops, diseases, and best practices. The app also features localized content, offline capabilities, and early warnings for pests and diseases. This partnership seeks to close the information gap for rural farmers, enhance decision-making, and ultimately improve agricultural yields and livelihoods.

Top Digital Agriculture Companies

The key players in this market include Cisco Systems, Inc. (US), IBM Corporation (US), Microsoft (US), Accenture (Ireland), AGCO Corporation. (US), Deere & Company (US), Topcon Corporation (Japan), Kubota Corporation (Japan), CLAAS KGaA mbH (Germany), Epicor Software Corporation (US), Hexagon AB (Sweden), Bayer AG (Germany), and Vodafone Group PLC (UK). The top players in the market have been focusing on expanding their market presence, enhancing their solutions, and partnering with many channel partners and technology companies to cater to consumers across the globe. The key players have a strong presence in North America, Europe, Asia Pacific, South America, and RoW, and well-established distribution networks spanning these regions.

Cisco Systems, Inc.

Cisco Systems, Inc., is a global leader in networking technology, playing a crucial role in building the infrastructure that powers the Internet. They offer a wide range of hardware, software, and services that help businesses, governments, and individuals connect securely and efficiently. The company offers smart agriculture solutions aimed at boosting farm efficiency, income, and supply chain connections. Using tools like data analytics, sensors, and satellite imagery, Cisco Systems, Inc.,

builds a central platform integrating data-driven insights, collaboration tools, secure networks, and web portals. This creates an IoT ecosystem that enhances agricultural yield and profitability.

Deere & Company

Deere & Company is an American multinational corporation that manufactures and distributes agricultural, construction, and forestry equipment. The company offers various products for precision farming, such as display systems, guidance and machine control systems, mowers, tractors and loaders, field and crop systems, and utility vehicles. Deere & Company mainly operates through five business segments: Production and Precision Agriculture, Small Agriculture and Turf, Construction and Forestry Operations, Financial Operations, and Others. the company's precision technology helps farmers boost efficiency, reduce costs, and increase yields.

Digital Agriculture Industry Developments:

In May 2024, CNH Industrial N.V. and Intelsat collaborated to offer farmers reliable internet access through a ruggedized satellite communications (SATCOM) service. Through this initiative, they aim

to provide internet connectivity for CNH equipment operating in remote and challenging environments. Intelsat will offer multi-orbit internet access, using their SATCOM experience and capabilities across geosynchronous and low-Earth orbits. The service will first be available in Brazil in the second half of 2024, in the areas where there is a prominent gap in high-speed internet access for agricultural use. The installation and support of Intelsat hardware services will be handled by Case IH and New Holland dealers. The collaboration plans to expand the service across U.S., Australia, and other regions, widening the reach of reliable satellite internet connectivity for farmers across the globe.

In April 2024, AGCO Corporation and Trimble entered into a joint venture known as PTx Trimble. AGCO owns an 85% stake in PTx Trimble, and Trimble will hold a 15% stake. This is a combination of Trimble's precision agriculture business and AGCO's JCA Technologies to form a new company that will aid in providing better services to farmers with various factory fit and retrofit applications in the mixed-fleet precision agriculture market.

About MarketsandMarkets

MarketsandMarketsTM has been recognized as one of America's best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment