Supply Risks Keep Gas Market On Tenterhooks

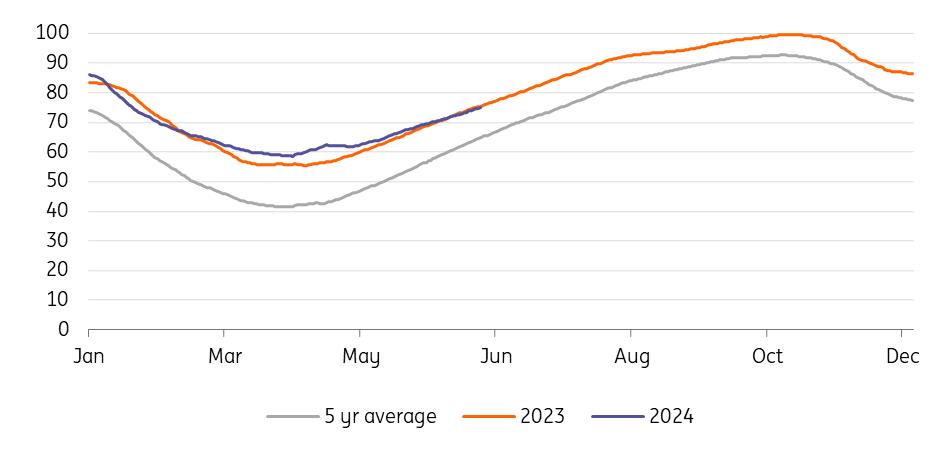

EU gas storage remains comfortable at 75% full, which is well ahead of the five-year average of 65%. The pace of net injections over May and so far in June are below levels seen during the same period last year. However, with net injections averaging 250mcm/day from the start of May through until 18 June, the EU is still on track to hit full storage ahead of 1 November, assuming net injections remain around similar levels. However, injection levels are going to largely depend on LNG imports, which have been under pressure, and on how Russian pipeline flows evolve through the summer, considering the risks that continue to hang over this supply.

We continue to believe that EU storage will be close to full by the start of the next heating season if not 100% full. Fundamentally this should mean that prices at the front end of the curve come under pressure over the next quarter. However, given concerns over supply, coupled with a large amount of speculative money in the market, it may be more challenging for TTF to trade down to our third quarter forecast for this year of EUR25/MWh.

EU natural gas storage builds slow (% full)

Source: GIE, ING Research Russian supply risks linger

Risks to Russian pipeline flows to Europe come in two forms. Firstly, there is the risk that Ukraine will not extend its transit deal with Gazprom, which expires at the end of this year. This would leave the EU looking for roughly 15bcm of alternative annual supply. If lost, this will impact the balance from 1 January 2025. There are efforts to keep gas flowing through Ukraine. However, there is still plenty of uncertainty in what form this may be. There have been suggestions that Azerbaijan could be used as a solution, where Russian gas potentially is swapped with Azeri gas. A swap would be needed, given that Azerbaijan does not have adequate export availability to meet this additional demand and continue to supply current off-takers. If this is achieved, Europe continues to receive natural gas via Ukraine and Ukraine will continue to receive transit fees.

The other key risk if realised, and more imminent, is the risk that Gazprom halts remaining flows to Europe. There is a real risk of this given recent legal developments. OMV warned last month that Gazprom could halt flows to Austria after a court case ruled that payments to Gazprom for gas deliveries could be blocked. This follows some ongoing legal disputes in European courts related to Gazprom's failure to deliver gas. Recently, European courts ruled that Gazprom had to pay damages to Uniper for failure to deliver gas. If Gazprom refuses to pay these damages, buyers in Europe still receiving Russian pipeline gas could see their payments due to Gazprom being redirected as compensation to those parties' awarded damages by the courts.

If Gazprom does not receive payment for its gas deliveries, there is a very real risk that they will halt these flows. The payment deadline for Gazprom is the 20th day of every month and given flows appear to have continued past 20 June, this suggests that Gazprom received its latest due payment. Total Russian flows to the EU in 2023 totalled around 22bcm, while in the absence of disruption, these flows are set to be even higher in 2024 – potentially as high as 28bcm.

Russian pipeline gas makes up 10% of total EU gas imports (Jan-May 2024) Source: ENTSOG, GIE, ING Research The EU targets Russian LNGThe EU is set to impose restrictions on Russian LNG in its latest sanction package. However, rather than banning Russian LNG imports into the bloc, the Commission is set to ban the re-export of Russian LNG from EU ports. The bulk of Russian LNG shipped via EU ports ends up in Asia. However, with the bloc making it more difficult for this trade to occur, it could be left in a situation where more Russian LNG ends up in the EU.

While there appear to be no immediate plans for the EU to ban Russian LNG, several countries are looking to impose bans on a national level. The latest is France, where the senate has recommended banning Russian LNG imports.

The EU imported just shy of 20bcm of Russian LNG in 2023 according to LSEG data, while import volumes in the first five months of 2024 stand at a little over 10bcm, up 16% year-on-year. Political pressure will likely build to address not only these larger LNG volumes, but also the larger amounts of Russian pipeline gas arriving in Europe in recent months. However, contractual obligations make it challenging for the EU to fully ban Russian LNG.

EU gas demand still in the doldrumsEuropean gas demand remains under pressure, with gas demand in the first five months of the year down 2.4% YoY. We had been assuming in our balance for EU demand to grow a little over 3% YoY for the full year. We have revised this down to less than 2% growth, but there is clearly still downside risk to this.

A mild recovery in industrial gas demand is likely to continue given the lower price environment, coupled with reduced volatility (relative to 2022 and 2023). However, this will largely be offset by expectations that demand from the power sector will remain under pressure. Spark spreads are stuck in negative territory and the forward curve suggests they will remain negative. Strong renewables output and higher nuclear availability continue to pressure thermal power margins, weighing on demand for both natural gas and coal.

EU gas demand struggling to make a comeback (bcm) Source: Eurostat, ING Research EU gas imports fallEuropean gas imports in May were down slightly, falling 2% month-on-month towards 23bcm – although YoY flows are down a more significant 10%. And flows have remained under pressure so far in June.

Despite summer maintenance, Norwegian gas flows to the EU in May increased over the month, while some unplanned outages in June have not led to drastically reduced flows. Russian pipeline flows also increased marginally in May. However, Russia remains a key supply risk in the months ahead as previously discussed. Both UK and Azerbaijani flows also saw small increases over the month.

Declines in flows over May were driven by North Africa and LNG. Lower LNG flows were the key driver behind the fall in total import supply. Asian spot LNG continues to trade at a healthy premium to the European market on the back of strong demand. As a result, we are seeing spot cargoes diverted towards Asia. Lower LNG flows have been key to the slower build in EU storage, and LNG send-outs in May were down more than 25% YoY.

Monthly change in EU gas imports- May vs. Apr (bcm) Source: ENTSOG, GIE, ING Research Speculators pile into TTFThe large number of supply disruptions that have faced the gas market in recent months – coupled with the Russian supply risk and strong Asian LNG demand – has been enough of an excuse to see speculators piling into TTF. The latest Commitment of Traders report shows that speculators hold a net long of a little over 129 TWh, having held a net short back in March. Speculators are holding their largest position in TTF since early 2022.

While we hold a relatively bearish view on TTF in the coming months, increased speculative appetite complicates this view. However, when sentiment shifts, there certainly is room for a more aggressive pullback as speculative longs head for the exit. Admittedly, the bulk of the increase in the net long has been driven by short covering in recent months; however, the gross long position is still sizeable.

TTF investment fund net long grows (TWh) Source: ICE, ING Research Stronger Asian LNG demandThe Asian LNG market has been strong, remaining at a healthy premium to the European market. Asian demand has performed well so far this year, with cumulative imports in the first five months of the year up 10% YoY. This increase has been driven largely by China, the return of price-sensitive buyers, and hot weather in parts of Asia increasing demand for cooling needs.

Chinese LNG imports over the first five months of the year are up 18% YoY and it is looking as though China is on course to import a record amount of LNG this year. These stronger flows have been largely driven by a continued recovery in industrial activity. However, as the spot market has moved higher, buying interest has also dried up, highlighting that buyers remain price-sensitive in the region.

Stronger demand has also been accompanied by some supply disruptions in the region. In Australia, Wheatstone LNG has faced disruptions, affecting output at the 8.9mtpa facility. However, operations have fully resumed in recent days. In May, Brunei also suffered an LNG outage.

US natural gas rallies on the back of hot weatherThe US natural gas market has seen significant strength with front-month Henry Hub futures trading from around $1.60/MMBtu in late April to over $3.10/MMBtu in early June. More recently, however, the market has given back some of these gains. Hot weather has driven natural gas prices higher with increased power demand for cooling.

Speculators have also played a crucial role in the scale of the move in Henry Hub. The managed money position in Henry Hub shifted from a net short of a little more than 100k lots in early May to a net long of almost 41k lots more recently.

2024 US gas storage gap to 2023 and 5-year average narrows (%) Source: EIA, ING Research Comfortable US storage but market to tighten in 2025US natural gas storage is still very comfortable standing at 3.05tcf, 12.7% higher YoY and 22.6% above the five-year average. However, the comfortable gap with both last year and the five-year average continues to narrow with domestic production under pressure. Warmer weather would have also supported demand more recently.

The US gas rig count has declined further through May and early June, with the total count standing at just 98 rigs, down 18% year-to-date and its lowest level since October 2021. The oil rig count has also declined since late April, falling from 511 rigs to just 485, the lowest level since January 2022.

In its latest Short Term Energy Outlook, the EIA cut its forecast for domestic gas production once again. Total US dry natural gas production is estimated to fall 1.6% YoY to 102.1bcf/day in 2024.

At the same time, domestic demand is expected to edge higher this year, while stronger exports are also expected in the form of both pipeline and LNG. Stronger LNG exports will be supported by the expected startup of both Plaquemines LNG and Corpus Christi Stage 3, with a combined export capacity of 20mtpa (2.6bcf/day).

We continue to hold a constructive view on the US gas market in the medium to long term, but we believe the scale of the recent rally has likely gotten slightly ahead of fundamentals, with storage still very comfortable. Therefore, we are of the view that in the short term further upside in Henry Hub is limited, and a pullback is more likely. Our forecast for the third quarter of 2024 remains unchanged at $2.50/MMBtu.

For 2025, our average annual forecast for Henry Hub is $3.60/MMBtu. This is, however, on the back of the assumption that there are no significant delays in the start of LNG capacity scheduled for later this year and through 2025.

ING natural gas forecasts Source: ING Research

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment