403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Blinken says chip export limits target tech tensions between US, China

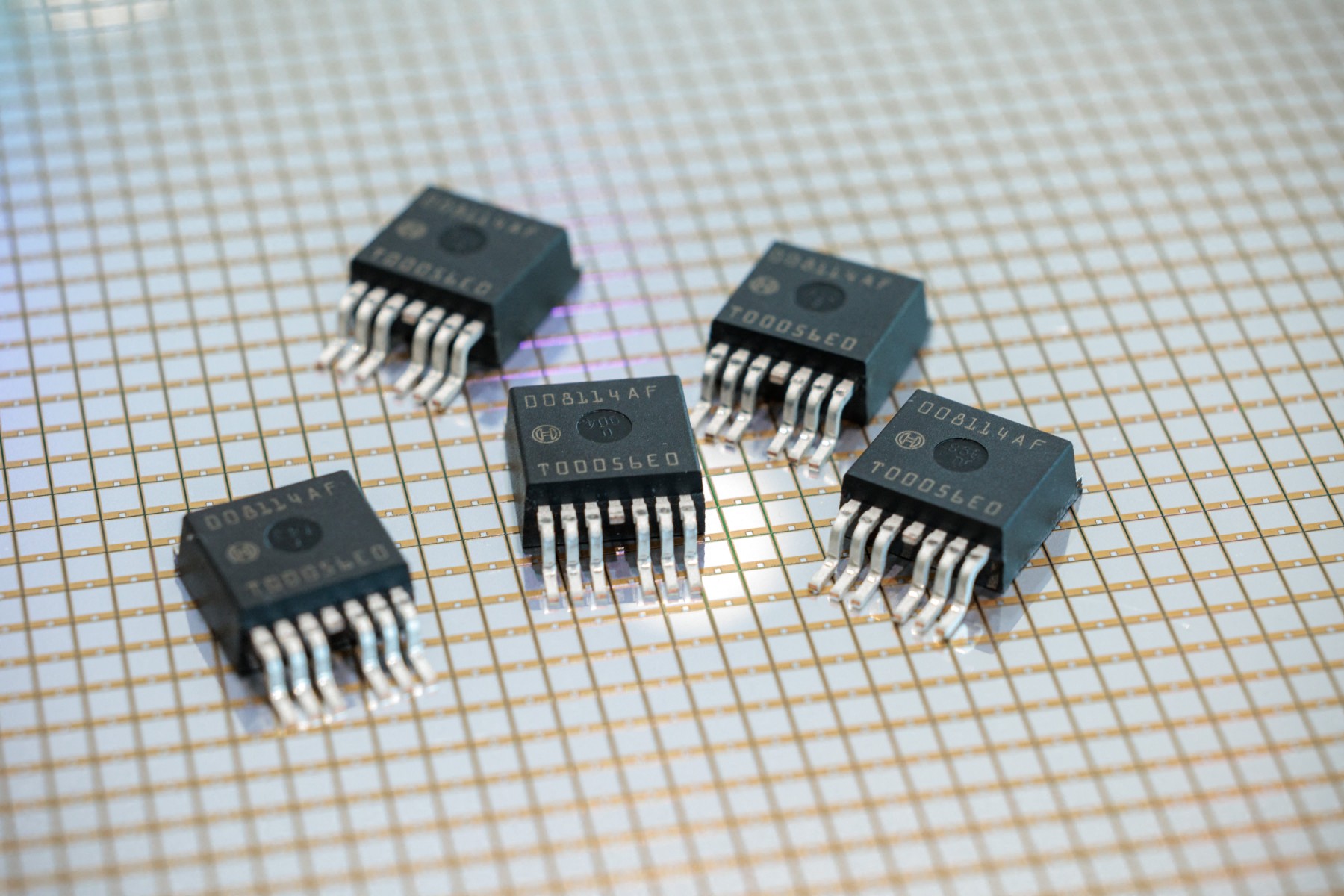

(MENAFN) US Secretary of State Anthony Blinken addressed concerns regarding the restrictions imposed by the United States on chip exports to China, emphasizing that the measures are not intended to hinder Chinese technological advancement or economic growth. Blinken's remarks come amidst a backdrop of escalating tensions between the US and China in the semiconductor industry.

The US administration has implemented broad restrictions on the export of certain types of electronic chips to China, leading to a noticeable decline in chip sales from American technology giants like NVIDIA, Advanced Micro Devices, and Intel to the Chinese market. This move signifies a significant intensification in the ongoing confrontation between the two economic powerhouses, particularly in the realm of semiconductor technology.

The escalation in tensions regarding chip exports between the US and China traces back to October 2022 when the United States imposed stringent controls on the export of "ultra-advanced" chips to Chinese companies. This was followed by a subsequent decision in October 2023, prohibiting the export of "legacy" American chips to China. Additionally, the US has extended its restrictions beyond American companies, preventing Dutch and Japanese manufacturers of chip manufacturing equipment from selling their products to China under the threat of sanctions.

While these measures underscore the increasing friction between the US and China in the semiconductor sector, Secretary Blinken's remarks seek to clarify that the restrictions are not aimed at impeding Chinese technological progress or economic development. Instead, they reflect broader geopolitical dynamics and concerns regarding national security and intellectual property protection in the context of strategic industries.

The US administration has implemented broad restrictions on the export of certain types of electronic chips to China, leading to a noticeable decline in chip sales from American technology giants like NVIDIA, Advanced Micro Devices, and Intel to the Chinese market. This move signifies a significant intensification in the ongoing confrontation between the two economic powerhouses, particularly in the realm of semiconductor technology.

The escalation in tensions regarding chip exports between the US and China traces back to October 2022 when the United States imposed stringent controls on the export of "ultra-advanced" chips to Chinese companies. This was followed by a subsequent decision in October 2023, prohibiting the export of "legacy" American chips to China. Additionally, the US has extended its restrictions beyond American companies, preventing Dutch and Japanese manufacturers of chip manufacturing equipment from selling their products to China under the threat of sanctions.

While these measures underscore the increasing friction between the US and China in the semiconductor sector, Secretary Blinken's remarks seek to clarify that the restrictions are not aimed at impeding Chinese technological progress or economic development. Instead, they reflect broader geopolitical dynamics and concerns regarding national security and intellectual property protection in the context of strategic industries.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment