New York Climate Week Calls For Accelerated Decarbonisation Efforts Amid The Global Energy Crisis

Lots happened in 2022. Just as the world continued to recover from the pandemic, the invasion of Russia in Ukraine – the former being one of the largest natural gas exporters in the world – sparked an energy crisis, heightened inflation, and added a new wave of supply chain disruptions. These geopolitical events and macroeconomic headwinds have prompted the sustainability community – including corporates, investors, and governments – to rethink the energy transition and sustainable finance within a widened context of energy security.

We saw a flavour of this at the New York Climate Week too. In contrast to last year's events, which spent quite some time on showcasing commitments and efforts, this year's Climate Week emphasised the importance of keeping up with the decarbonisation efforts during such times of uncertainty. It has become evident that the path to net-zero is not linear. Along the way, there have been and will continue to be disruptions that can temporarily frustrate immediate ambitions, but these disruptions also remind us that walking away from decarbonisation is not an option.

Clean energy should be accelerated faster despite the short-term need for fossil fuelsThe war has reignited discussion on how much fossil fuel the world actually needs – now or in the future, under peaceful or turbulent times. Ahead of winter, participants at the Climate Week acknowledge that governments and companies need to ensure the demand for energy is met, even if that might come from (temporary increases in the use of) fossil fuels, but they also emphasise that the energy crisis should not become an excuse to structurally expand use of fossil fuels and downplay the urgency to decarbonise the fossil fuel industry. Moreover, the war has demonstrated that significant reliance on natural gas from one importer imposes huge risks if that supply is suddenly turned off.

The solution, as echoed during New York Climate Week, is not only to diversify natural gas supply sources, but also to roll out renewable energy more aggressively. Germany, a country heavily dependent on Russian gas and at the forefront of gas shortages, saw the share of conventional fuel (including nuclear) in its electricity generation mix during the first half of 2022 decline from 56% to 52%, despite an increase in the use of coal. That decline was driven by less use of gas and nuclear, but the key takeaway here is that renewable energy managed to play an important role in replacing some of the drop in gas and nuclear electricity generation.

At least in the short to medium term, the development of renewable energy can slash emissions and boost energy security, which is defined as secured access to reliable fuels (fossil fuels for now). Yet it is worth noting that the notion of energy security will eventually switch to having secure access to and control over the renewable energy supply chain, as a few countries, such as China, produce most of the raw materials for renewable equipment such as solar PVs.

What should businesses focus on in their sustainability efforts?Under such a context, the pressure on business leaders to decarbonise will only grow. How can they do it? Climate Week speakers, who were from consultancies, non-governmental organisations (NGOs), and leading companies in managing sustainability, listed a few action points. Here are the key ones:

- Setting interim goals in addition to the long-term net-zero target : Data shows that more than a third of the Forbes 2000 companies have set net-zero targets by June 2022, up from a fifth at the end of December 2020. However, of those with net-zero targets, two-thirds have not disclosed how they plan to achieve their goals. Having interim targets will help hold companies accountable for their climate commitments, while also providing them with a better guidance to decarbonise.

- Establish long-term sustainability strategies as opposed to only short-term progress measurements : Having a forward-looking climate strategy can help companies allocate capital to areas that are more important throughout the path to net-zero. It can also more effectively mobilise natural and human resources toward achieving sustainability targets. And this can lead to long-run radical changes. As captured by a nice turn of phrase; this decade needs to be 'the decade of delivery', not the just the 'decade of disclosure'.

- Green supply chains in partnership with other players in the business ecosystem : Companies need to more actively engage with suppliers to decarbonise their entire value chain (Scope 3 emissions). This can help suppliers develop decarbonisation know-how, and advance product innovation that can not only cut emissions but also expand revenue growth drivers.

- Better manage climate risks : In addition to reducing emissions, another imperative task for companies is to set up a game plan to map the physical and transition climate risks that are likely going to affect their businesses, embed these risks into their cost projections, and improve operations to mitigate these risks.

- Don't forget about environmental justice : Climate change is going to increasingly affect the disadvantaged, and the transition to clean energy might also disproportionally burden them. To tackle this, companies can develop support programmes for the local community where they conduct business. For instance, up-skilling and re-skilling the local community can both ensure a just energy transition and accelerate supply chain decarbonisation.

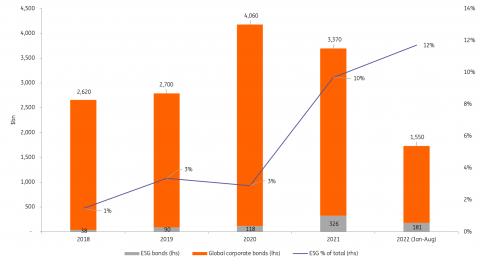

Global sustainable finance has experienced a special year so far as well. After several years of phenomenal growth, global issuance of green, social, sustainability, and sustainability-linked bonds totaled $561bn between January and August 2022, down from $689bn during the same period last year. However, as pointed out at the Climate Week, if we only look at corporate bond issuance (excluding financial institutions, sovereigns, supernationals, and agencies), the slowdown in Environmental, Social and Governance (ESG) bond issuance is not as deep as vanilla bond issuance. For the first eight months of 2022, ESG corporate bond issuance is estimated to have fallen by 17% compared to the same period in 2021, versus a 31% drop in global corporate bond issuance. This is evidence that corporates have been capable of advancing their sustainability agenda during some quite testing times.

Global corporate ESG bond issuance vs. total corporate issuance

Bloomberg New Energy Finance, Informa Financial Intelligence, ING Research

In addition to the issuance volumes, we think that this year has prompted the sustainable finance market to think more deeply about green credentials. We have seen several regulators around the world investigating companies' and asset managers' ESG-related practices and claims. We have also seen more regulating entities start the process toward mandating climate-related data closure. This will in a way reduce greenwashing, while also providing the sustainable finance market with an achievable pivot from high-speed growth to quality growth.

Still, much remains to be done to ensure this pivoting. First, disclosing detailed sustainability data will be key in helping investors better assess an issuer's progress. Quality reporting is then linked to interim target setting, as the latter can not only lay a solid groundwork for reporting, but also enhance investor confidence on an issuer's sustainability commitments. Moreover, timely and transparent communication is needed between issuers and investors, especially under fast-changing macroeconomic and geopolitical conditions.

Finally, the Climate Week also touched on how sustainable finance can and should help with energy transition. We think that it works best when capital is dedicated in a way that can boost the efficiency of the decarbonisation process – this means investing simultaneously in clean energy deployment, hard-to-abate sector emissions reduction, and the emerging technologies that can achieve the previous two.

The US is catching up on climate change and clean energy policyThe Climate Week also focused on the enhanced policies of the US to realize its climate targets. At Climate Week 2021, we heard many speakers say that the US was falling behind compared to major economies, whereas this year, companies and investors were euphoric that the US was taking a more meaningful stand, with the signing of the Infrastructure Investment and Jobs Act and the Inflation Reduction Act. And the proposal from the SEC on mandating climate-related data disclosure was noteworthy too.

Market players believe and we agree that these measures are putting the US on a level playfield with jurisdictions such as the EU, and in some cases, like carbon capture and hydrogen, the US are set to claim a leading role. Of course, these measures alone will not get the US to net-zero, but they are likely to snowball – the two bills are forecast to be able to together cut US emissions by 31%-44% by 2030.

US greenhouse gas emissions (historical and forecast)

Rhodium Group, Climate Action Tracker, ING Research

One thing is clear from the point of view of those at Climate Week: there is no way back – both from a climate science point of view and a business/investment point of view – but to work toward deep decarbonisation. Sustainability has not only gone mainstream, but also front and centre when companies think about mitigating risks and growing businesses. Accelerated efforts from all parts of the global economy are needed to deliver commitments this decade – deemed a crucial decade if the catastrophic results of global warming are to be avoided.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment