Capital Insurrection

Meme via r/WallStreetBets

Table of Contents show- 1. The Meme Stock Uprising

- 2. Viewed From The Right

- 3. Viewed From The Left

- 4. Corporate Sponsorship Or Crackdown

- 5. Looking At Current Meme Stocks

- 6. A Hedged Bet On BlackBerry

- 7. Heads You Win, Tails You Don't Lose Too Much

We've got a trade idea where you can join in the meme stock uprising without losing your shirt. More on that below, but first let's look at the big picture of what's happening now . It's fascinating in its own right, but the way the conventional wisdom sets with respect to the meme stock uprising may lead to real consequences. Before you discount that, consider that a veteran of the meme war of 2016 was just indicted by the Department of Justice.

Spruce Point Is In The Green With Its Short Positions This Year [Exclusive]Spruce Point Research Activism Partners was up 2% net in July, compared to the Russell 1000's inverse return of -2.08% and the BarclayHedge Equity Market Neutral Index's return of 1.2%. On a year-to-date basis, the fund is up 7.5%, compared to the inverse Russell 1000's return of -17.3% and the BarclayHedge Equity Market Neutral's return Read More

Power hates mockery.

Viewed From The RightIn our last post (GameStopped ), we mentioned that the r/WallStreetBets squeezes on GameStop (GME) and other meme stocks such as AMC (AMC) were a revolt against the establishment:

The Cohen he refers to there is Stephen A. Cohen, whose Point72 Asset Management, along with Citadel, had to pour additional billions into Melvin Capital as Melvin got GameStopped.

As of Wednesday night, some pundits on the center right were making similar points,

Can we call the GameStop thing what it really is?

A Capital Insurrection

— Melissa Chen (@MsMelChen) January 28, 2021

GameStop is the first populist uprising without Trump we've had since 2015. It will go on without him.

— Ryan James Girdusky (@RyanGirdusky) January 28, 2021

Viewed From The LeftBut some on the left had other ideas. Monopoly scholar Matt Stoller suspected that Wall Street market makers were behind the short squeezes, and using Reddit as a cover.

Good. I've changed my mind on what's happening. This isn't some populist revolt against market-rigging hedge funds, it's a puppet show where shorts are being eviscerated by giant cynical market-makers using Reddit populism as cover.

— Matt Stoller (@matthewstoller) January 27, 2021

This, despite market maker Citadel pouring billions into Melvin Capital , which got torched by the GameStop short squeeze.

Meanwhile, former hedge fund manager and current bitcoin enthusiast Mike Novogratz compared WallStreetBets to BLM protestors. Novogratz also suggested what they were really crying for was“DeFi” (decentralized finance, i.e., crypto).

2)its a revolution that started with people not trusting central authority.Its a call for transparency and fairness. in many ways its happening in parallel with the social unrest we see in our country.the mob attacking the capitol,the BLM protests following George Floyd's murder

— Mike Novogratz (@novogratz) January 27, 2021

One difference between BLM and r/WallStreetBets comes to mind immediately. The BLM riots destroyed small businesses in cities across America , while WallStreetBets so far has saved at least one business, AMC. Thanks to Redditors bidding up its stock price, the movie theater chain was able to complete a secondary offering , raising hundreds of millions of much-needed dollars. Novogratz should know something about the damage caused by BLM – his fund bailed out many of the rioters.

With respect to Novogratz's thoughts about decentralized finance, if you read popular posts on WallStreetBets like this one (“An Open Letter To Melvin Capital, CNBC, Boomers, and WSB”), you don't see anything about“DeFi”. You see still-lingering rage about what happened in 2008.

Corporate Sponsorship Or CrackdownNovogratz's mention of BLM is instructive though, as it suggests one possible resolution of the meme stock revolt: corporate sponsorship .

Maybe big Wall Street firms will donate money to an AstroTurfed nonprofit that claims to advocate for small investors.

Another possible resolution is a crackdown. WSB got a taste of that on Wednesday when Discord shut down its server .

Time will tell. Let's look at how you might make some money in the meantime.

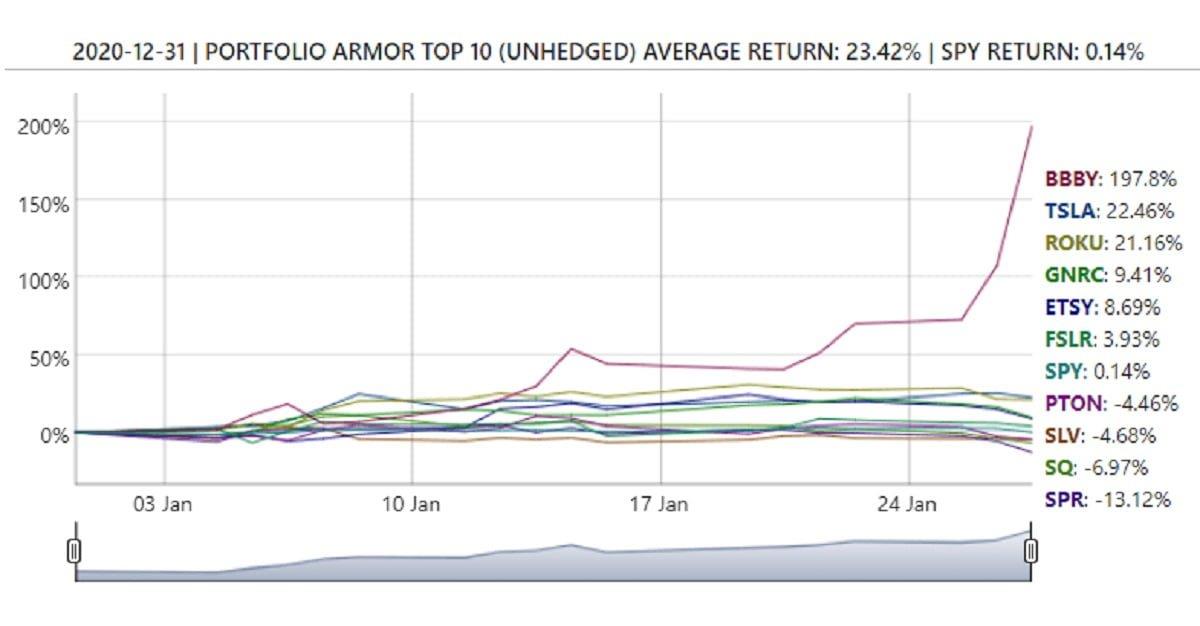

Looking At Current Meme StocksIn our previous post, we mentioned that GameStop never made our system's top names (every trading day, we post a top ten based on our analysis of returns and options market sentiment). Of the YOLO stocks posted here on WallStreetBets, Nokia, (NOK), BlackBerry (BB), Bed Bath & Beyond (BBBY), GameStop, AMC, and Express, Inc. (EXPR), only BBBY made our top ten names recently. That was on December 31st of last year.

Our top ten names on 12/31, via Portfolio Armor .

As of Wednesday's close, BBBY was up 197.8% since 12/31.

But our system is no longer bullish on BBBY at current levels. The only YOLO stock it's currently bullish on is BlackBerry. This has nothing directly to do with WSB's gamma squeeze prediction, and everything to do with our analysis of options market sentiment on it. In a nutshell, the OTM calls on BlackBerry our system looks at are getting bid up more than the OTM puts it looks at. That makes the trade below possible for BlackBerry, but not for the other names we listed above.

A Hedged Bet On BlackBerryHere's a way to bet on BlackBerry without losing your shirt if it heads south. This was the optimal collar, as of Wednesday's close, to hedge 100 shares of BB against a >30% drop over the next month while capping your upside on the stock at 59% (the highest cap at which this worked).

Screen capture via the Portfolio Armor iPhone app .

Note the negative hedging cost there. When opening that collar, you would have collected a net credit of $883, or 35.18% of position value , assuming, to be conservative, that you placed both trades at the worst ends of their respective spreads (buying the puts at the ask and selling the calls at the bid – in practice, you can often buy and sell options at some price within the spread).

Heads You Win, Tails You Don't Lose Too MuchSince you bank a net credit equal to ~35% of your position with that hedge , your maximum upside over the next month is your 59% cap on the stock plus that: 35% + 59% = 94%. Your worst case scenario is a loss of 30%. Heads you win, tails you don't lose too much. BlackBerry's down a bit in the pre-market as I type this, so be sure to scan for an updated optimal collar for it before placing any trades.

Updated on Jul 19, 2021, 7:38 pm

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment