(MENAFN- Asia Times) TOKYO – The White House study is entitled ''Building Resilient supply Chains, Revitalizing American manufacturing and Fostering Broad-based Growth: 100-Day Reviews under Executive Order 14017.'' And when it was released this month it aroused some alarm in Asia.

Japan's Nikkei Asia just published an article entitled ''Taiwan tech firms fear fallout after US raises supply chain alarm: White House report also cites over-reliance on Japan and South Korea as risk.''

President Biden talks about working with allies to push back against China. But do America's Asian allies also need to worry?

In my analysis, not so much. I''ll explain why.

The White House report covers semiconductor manufacturing and advanced packaging; large capacity batteries, like those for electric vehicles; critical minerals and materials; and pharmaceuticals and advanced pharmaceutical ingredients (APIs).

It was compiled by the Department of Commerce, the Department of Energy, the Department of Defense and the Department of Health and Human Services (Food and Drug Administration) under the guidance of Jake Sullivan, advisor to the president for national security affairs.

The report identifies the following major supply chain vulnerabilities:

Insufficient US manufacturing capacity Misaligned incentives and short-termism in private markets Industrial policies adopted by allied, partner, and competitor nations Geographic concentration in global sourcing Limited international coordination Its policy recommendations, the implementation of which began already, include:

Rebuild production and innovation capabilities; Support the development of markets that invest in workers, value sustainability, and drive quality; Leverage the government's role as a purchaser of and investor in critical goods; Strengthen international trade rules, including trade enforcement mechanisms; Work with allies and partners to decrease vulnerabilities in the global supply chains; Partner with industry to take immediate action to address existing shortages. Biden's supply chain initiative also has a second phase, already underway, which reviews six critical industrial base sectors that underpin America's economic and national security: the defense industrial base, public health and biological preparedness industrial base, information and communications technology industrial base, energy sector industrial base, transportation industrial base, and supply chains for production of agricultural commodities and food products.

These reviews are due to be completed by February 24, 2022.

All this appears to be the well-considered beginning of a long-overdue industrial policy aimed at rebuilding American industry in a world economy that is now dominated by industrial policy but no longer dominated by the United States.

Is that all it is? As is frequently the case, the devil is in the details.

The report examines four critical supply chains:

Semiconductor manufacturing and advanced packaging Large capacity batteries for electric vehicles and grid storage Critical minerals and materials including lithium, graphite and rare earths Pharmaceuticals and active pharmaceutical ingredients (APIs)

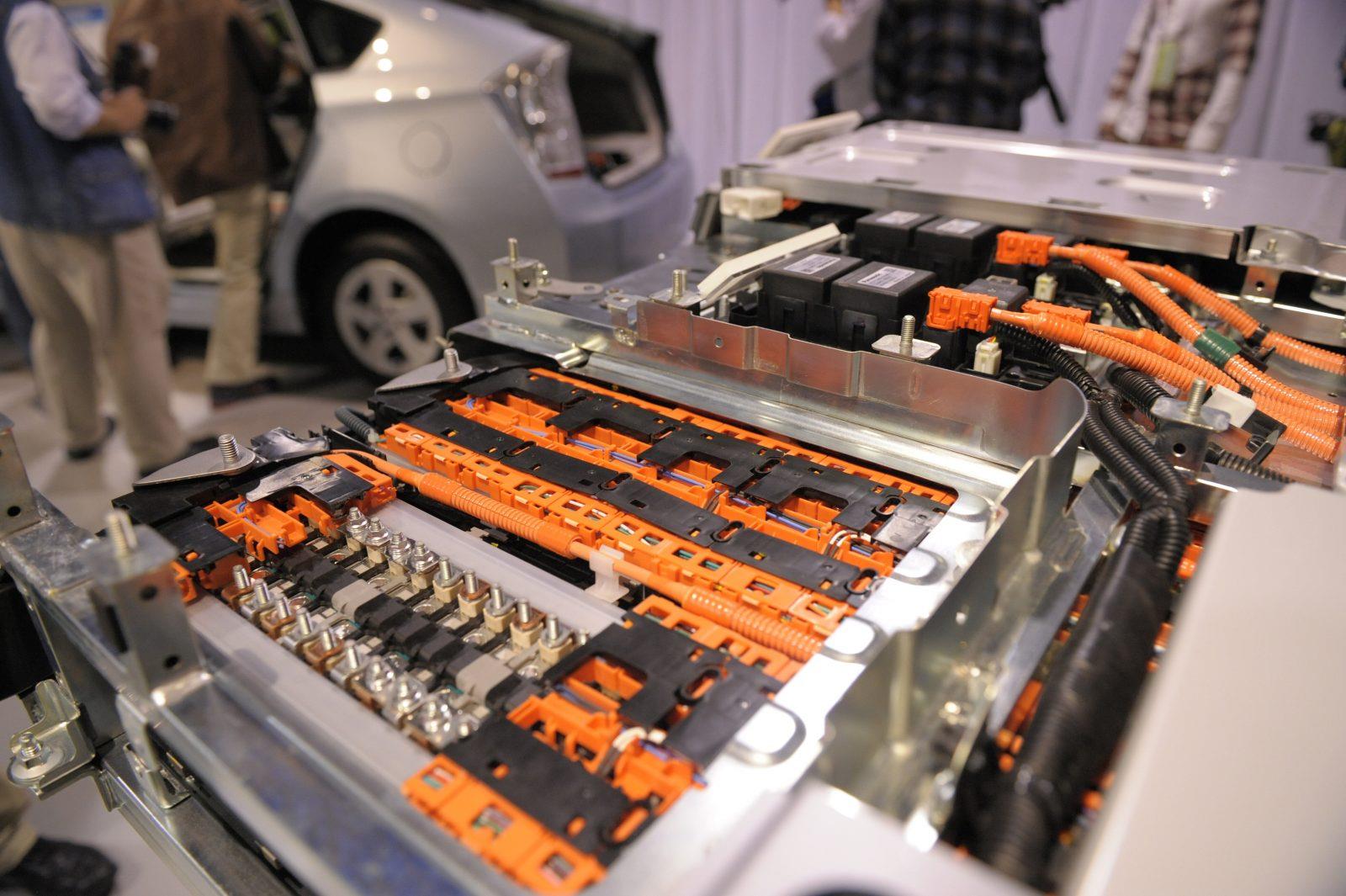

A sample showing the insides of a new lithium-ion battery is on display during a Toyota Motors event. Photo: AFP / Toshifumi Kitamura

It notes that not only China, but also the EU, Taiwan, South Korea and Singapore have provided substantial subsidies and incentives to their semiconductor and EV battery industries.

''As a result, the 10-year cost of a new fab [manufacturing plant] in the United States may be 30% – $6 billion on average – higher than building the same fab in Taiwan, South Korea or Singapore, and up to 50% higher than in China. Much of the cost differential (estimated 40-70%) is specifically due to government incentives.''

Extreme concentration of the production of semiconductors and related equipment and materials (Taiwan, South Korea, Japan), lithium-ion batteries (Chinese, South Korean and Japanese companies), rare earths and battery cell fabrication (China), and APIs (China) also creates geopolitical, climate and pandemic-related risks.

And extreme dependence on TSMC and other Taiwanese suppliers makes Taiwan a major part of the China risk.

Dependence on sales to China (i.e., success in the China market) is also seen as a risk, as is China's heavy investment in semiconductors, batteries, EVs and other high-tech industries – investment that creates the demand that makes these sales possible.

In short, the report identifies the outperformance of East Asian – not just Chinese – high tech as a strategic risk and strongly recommends diversifying sources of supply and bringing production back to the United States. To wit,

Is the semiconductor supply chain really ''fragile'' or has America simply made itself over-dependent on one company, TSMC, that is situated in both a political and a geologic earthquake zone? Are we verging on paranoia here or has America finally awakened to the consequences of its self-absorbed hubris?

Whatever, Taiwanese, South Korean, Japanese and Singaporean high-tech companies will have to contribute to take advantage of the rebuilding of American industry while resisting American efforts to shut down their business in China.

In high-profile cases, this is not possible. Last year, TSMC was forced to cut off Huawei, which was one of its largest clients, and agree to build a new factory in Arizona even though that was not one of its priorities at the time.

TSMC is at the heart of the US-China tech war. Photo: CNA

But it is a politically rational investment and probably a rational long-term investment as well.

If, as now seems likely, the US does rebuild its domestic high-tech production and supply chains, TSMC and other Asian companies are likely to benefit greatly, both by securing new sources of demand and by having two large growth markets rather than just one (China).

That should hold true as long as America does not generalize its treatment of Huawei to include all Chinese high-tech and does not turn its trade guns on East Asian industrial policy.

As things stand now, neither seems likely. Decoupling from China is not supported in East Asia, Europe or even the Biden administration, and America is now joining the others with subsidies and other incentives to counter the 'short-termism'' of the free market.

Although that 'short-termism'' has lasted for decades. TSMC, we should recall, was founded in 1987. ASML of the Netherlands overtook Nikon of Japan to became the world's top semiconductor lithography toolmaker in 2002.

What we are seeing now is another major inflection point in technology markets. Samsung and TSMC have already announced plans to build new semiconductor factories in the United States. Five or ten years from now, TSMC could be the largest semiconductor foundry in North America.

Meanwhile, TSMC plans to spend $2.8 billion to expand capacity at its factory in Nanjing. New lines are reportedly scheduled to start production of 28nm devices for automotive applications by the end of 2022.

The US government has not opposed this because leading-edge technology is not involved and the shortage of automotive semiconductors is a serious problem worldwide.

And (as noted in my recent article ''''Car guy'' Biden aims to overtake China in EV race ''), America's domestic EV battery supply chain is dominated by Panasonic of Japan and LG Chem and SK Innovation of South Korea. And TSMC is expanding production in Nanjing.

This suggests that America's new industrial policy is more of an opportunity than a threat to East Asian suppliers who get with the program.

Scott Foster is an analyst with Lightstream Research, Tokyo.

MENAFN17062021000159011032ID1102296743