(MENAFN- GlobeNewsWire - Nasdaq) TORONTO, Oct. 28, 2024 (GLOBE NEWSWIRE) -- Halcones Precious Metals Corp. (TSX – V: HPM) (the“Company” or“Halcones”) is pleased to announce it has entered into binding agreements to acquire a 100% interest in the Polaris Project (“Polaris” or the“Project”) from Austral Exploraciones SpA (“Austral”), a privately owned Chilean exploration company (the“Transaction”). Polaris is a highly prospective project with multiple past-producing, high grade Gold mines and extensive gold mineralization identified in stockwork zones by recent rock sampling campaigns.

Highlights:

Polaris is a large, highly prospective gold project. 17 former artisanal, high-grade operations have been identified on the Project or in the immediate vicinity. Artisanal small scale mining activity can be traced back over approximately the last 100 years at Polaris. Extensive gold mineralization has been identified by surface rock sampling over 2.7 km of strike length to date and potential extensions of this mineralization remain unsampled.

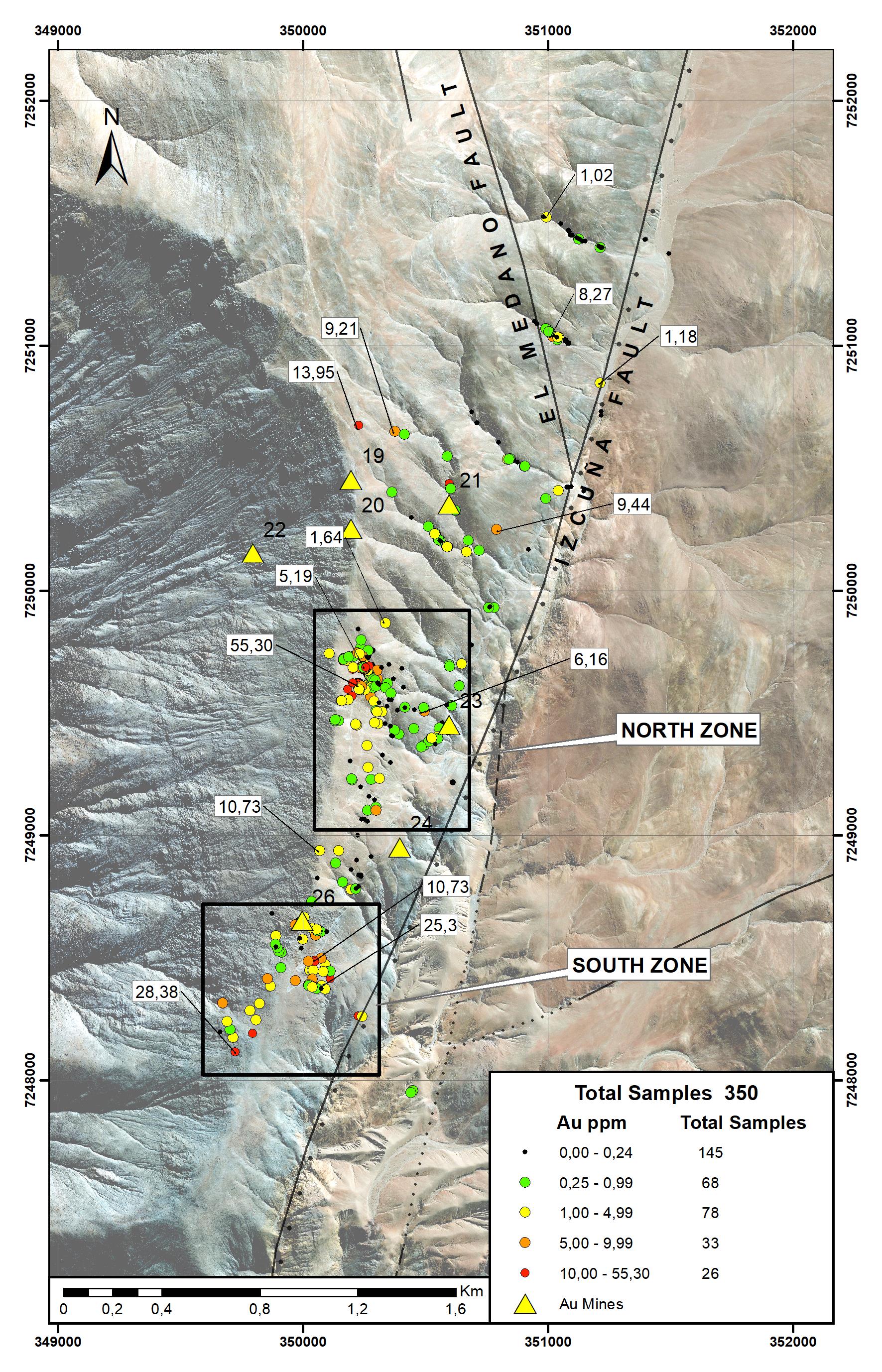

Several sampling campaigns including due diligence work completed by Halcones have returned high-grade results. Of the 350 samples collected from the Polaris gold project to date, 59 returned values greater than 5 g/t. The average gold grade from the 350 surface samples is 2.5 g/t (See figure 1). There is no record of modern exploration other than surface sampling most recently by Austral and Halcones geologists.

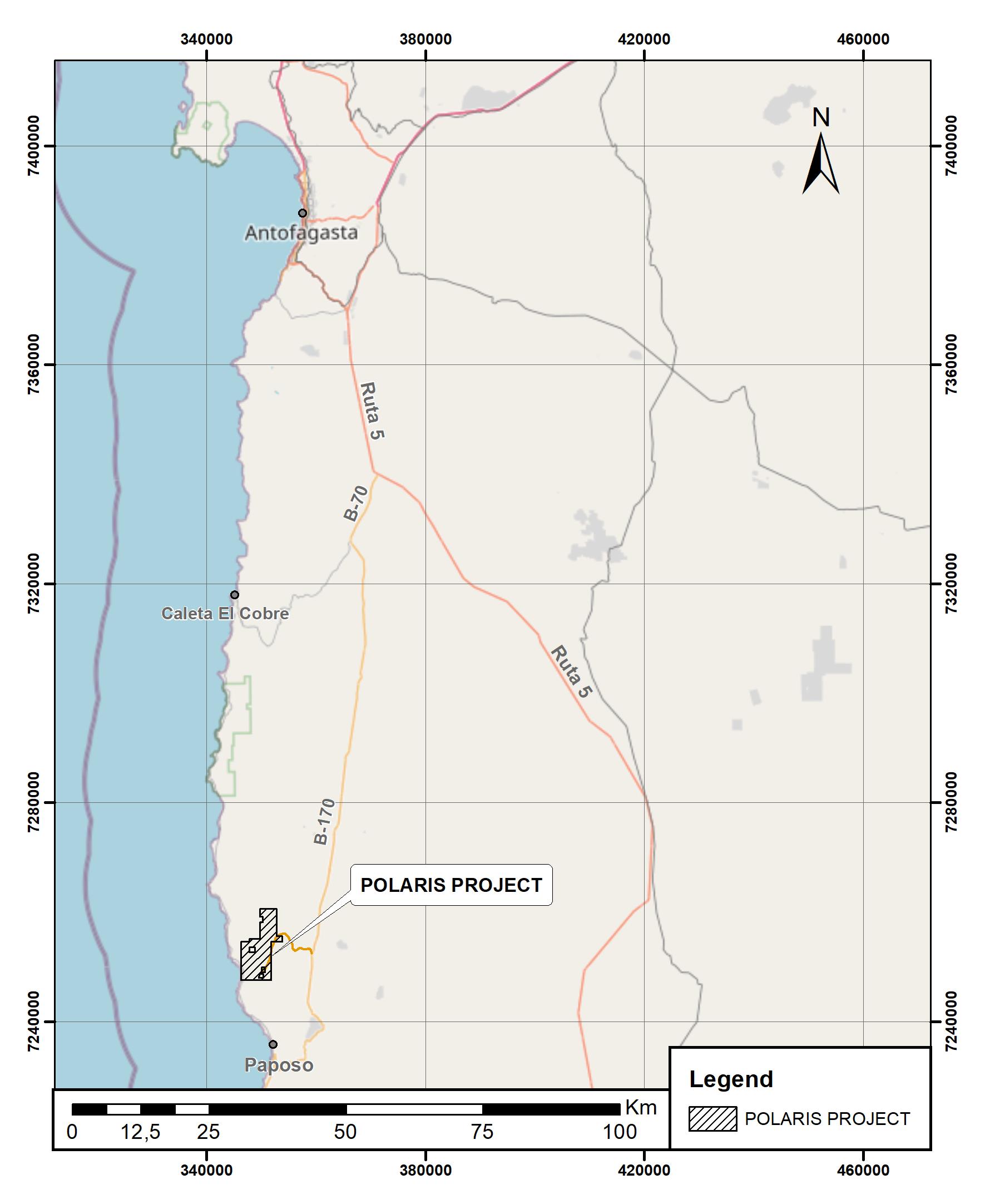

The Project is located in a highly developed mining district between Antofagasta and Taltal, with road access and moderate elevation making the Project workable 12 months of the year. Initial exploration targets are at or near surface.

Ian Parkinson, CEO and Director of Halcones:“Our technical team has evaluated dozens of early-stage projects in South America. The Polaris gold project presents an exceptional exploration opportunity. The high-grade surface samples over an extensive area and widespread artisanal mines demonstrate the property hosts high-grade surface occurrences that have never been explored in a modern sense. The historical artisanal operations focused on very high-grade narrow veins, and only persisted to shallow depths due to ventilation limitations. The extensive mineralized stockwork surrounding the veins was never assessed and could not have been exploited in the historical context of when mining was active. We are excited to get to work on Polaris.”

Figure 1. Polaris Surface Sample Results

About the Polaris Project

The 5,777 hectare Polaris property is located approximately 125km southwest of the city of Antofagasta (the main mining center of northern Chile) and only a few kilometers west of the paved highway B-170 connecting Antofagasta to the town of Taltal on the Pacific coast. Average elevation on site is close to 2,000 meters above sea level, which is considered low by Chilean standards and the property can be worked all year. Access to the site is excellent along a network of historical dirt roads from the highway.

Figure 2. Polaris Location

Historical mining on site dates to the early part of the 20th century when local residents from the town of Taltal extracted material from high grade quartz veins, breccias and veinlets. Artisanal mining was entirely concentrated on the larger exposed quartz veins and breccias and high-grade direct shipping material was transported by mules and horses along trails down to the coast to the fishing village of Paposo approximately 25km to the southwest. Numerous old pits, tunnels, trenches and shafts on the property are evidence of a significant widespread mining operation.

Following this period of activity, the district laid dormant until the early 1970's when a local miner picked up some claims and operated at a small scale mine for approximately ten years. After this period of activity, the property has remained inactive and there are no records of modern exploration (including drilling) ever having been carried out on the property package to date.

Recent sampling taken from mine dumps remaining on site have returned values up to 20g/t Au and historical references from public documentation report past production of up to 60g/t Au from some veins. In addition to the high-grade veins, recent sampling has confirmed the presence of an extensive network of veinlets and mineralized fractures that cover large areas surrounding the known historically mined vein areas opening up the possibility of a large-scale open pit operation. Sampling by Austral has returned long sections of continuous chip samples such as:

1,21 g/t over 85m taken in a NW orientation 1,02 g/t over 30m taken along a tunnel, oriented WSW 1,85 g/t over 14.3m taken from chip samples along a dry stream bed some 2 km north of the currently known mineralized areas

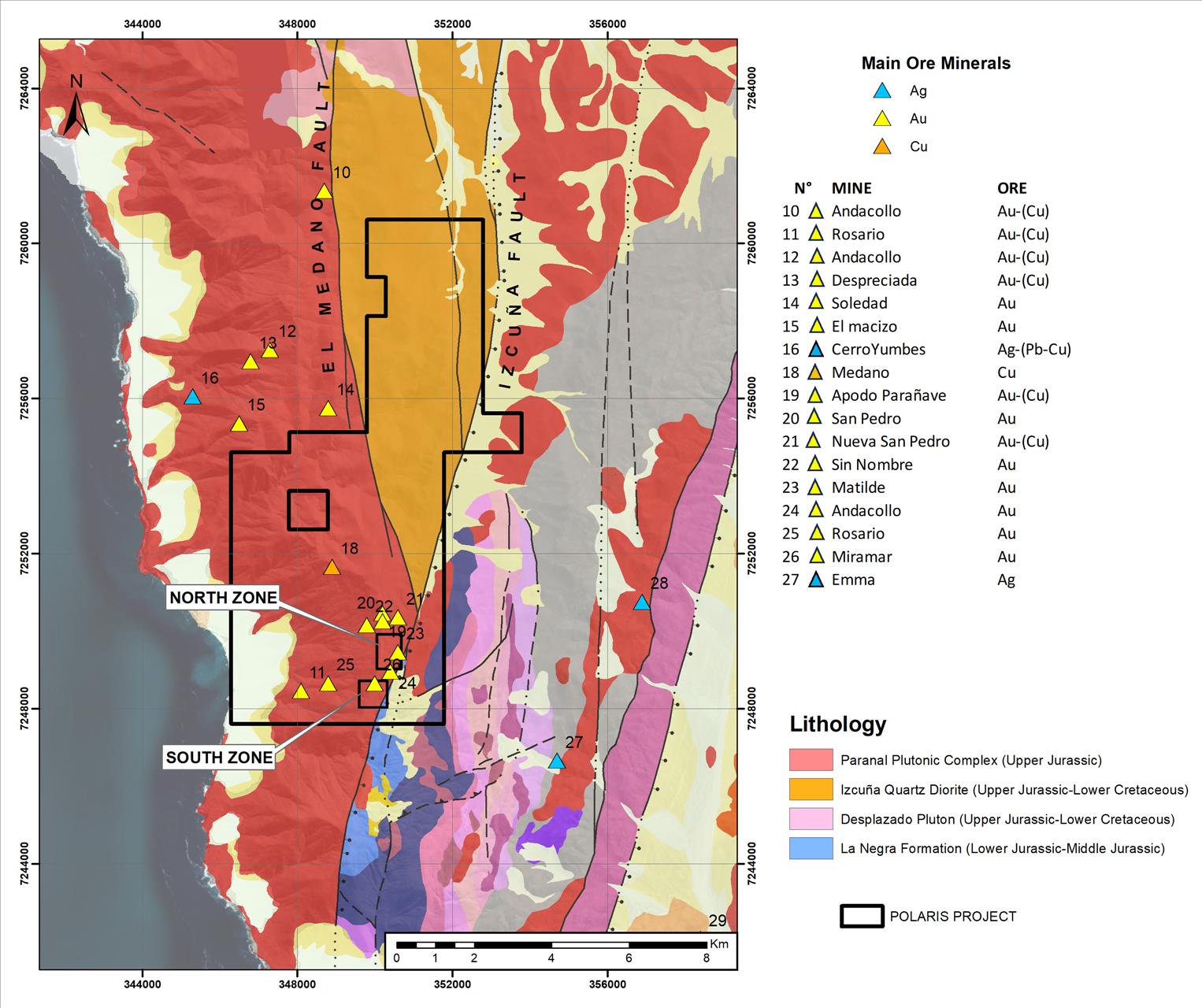

The mineralization identified to date is almost entirely within the Jurassic age Vicuña Mackenna batholith which sits on the west side of the regional Atacama fault system. On the property scale, the east side of the fault system is occupied by andesites and sediments of Jurassic – Triassic age. Halcones geologists believe that mineralization is preferably located in the intrusive due to the brittle nature of the intrusive rock compared to the softer volcanics and sediments to the East. Repeated movement of the fault system over time shattered large portions of the brittle intrusive creating favorable conditions for the mineralized fluids to fill in the open spaces and allow the emplacement of the large veins, veinlets and mineralized fractures. Despite very different geologic ages, Halcones geologists see many similarities in the structural setting between Polaris and the structurally controlled gold deposits along the Cadillac Break fault zone in Ontario and Quebec.

Figure 3. Polaris Regional Geology Setting

Regionally, the Polaris Project is located in the Coastal Mountain Range south of the Antofagasta Region and is part of the Atacama Fault Zone and the Coastal Escarpment. The Atacama Fault Zone (ZFA) is one of the most important structures in the Coastal Range of the Great North of Chile, extending for an order of 800 km. ZFA was subdivided into three main segments from Antofagasta to the north, Antofagasta to Taltal and a third to the south of Taltal. The Polaris Project is located in the second segment.

Vern Arseneau, COO and Director of Halcones:“We are extremely excited to get to work on the highly prospective Polaris project. I have known the owners of Austral for many years and look forward to this new partnership with them. They have been long-term shareholders of Halcones and now, with this deal, become major shareholders. As a sign of their long-term view of the potential at Polaris they have agreed to lock-up agreements.”

Transaction Terms

Pursuant to (i) a binding letter agreement dated October 23, 2024 between Halcones and the shareholders of Austral (the“Vendors”), and (ii) a binding Contrato de Opcion Unilateral de Compra de Concesiones Mineras dated October 25, 2024 between Minera Los Halcones SpA (“Minera Halcones”), Halcones' wholly-owned subsidiary, and Austral, Halcones shall pay the following consideration for the Project:

Issuance of an aggregate of 50 million shares to the Vendors at a deemed price of $0.05 per share and payment of USD$100K in cash to Austral upon obtaining TSX Venture Exchange approval and closing of the Transaction;

Payment of US$100K in cash to Austral upon the 12 month anniversary of closing the Transaction;

Payment of US$150K in cash to Austral upon the 24 month anniversary of closing the Transaction;

Payment of US$250K in cash to Austral upon the 36 month anniversary of closing the Transaction;

Payment of US$2M in cash to Austral upon the 48 month anniversary of closing the Transaction;

Issuance of an aggregate of 15 million shares to the Vendors upon Halcones publicly filing a NI 43-101 compliant technical report for the Project with a mineral resource estimate of greater than 2 million ounces of gold (at a minimum of 1g/t of heap leachable material at a 0.25 g/t minimum cut-off grade);

Issuance of an aggregate of 15 million shares to the Vendors upon Halcones publicly filing a NI 43-101 compliant economic study for the Project;

Issuance of an aggregate of 15 million shares to the Vendors upon Halcones publicly filing a NI 43-101 compliant feasibility study for the Project; and

Issuance of a 2% NSR over the Project to Austral.

The Vendors have agreed to a lock up agreement on the Halcones shares to be issued to them with 30% released at 4 months following closing of the Transaction, 40% released at 12 months following closing of the Transaction and the balance at 18 months.

The Transaction is subject to customary closing conditions, including the approval of the TSX Venture Exchange. The Transaction is an arm's length transaction and Halcones is not paying any finder's fees in connection with the Transaction.

The Transaction amounts to a reviewable transaction under TSXV Policy 5.3 – Acquisitions and Dispositions of Non-Cash Assets and the Halcones common shares will remain halted pending receipt and review of acceptable documentation pursuant to TSXV Policy 5.3.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Mr. David Gower, P.Geo., as defined by National Instrument 43-101 of the Canadian Securities Administrators.

About Halcones Precious Metals Corp.

Halcones is focused on exploring for and developing gold-silver projects in the Maricunga Belt, Chile, the premiere gold mining district in South America. The Company has a team with a strong background of exploration success in the region.

For further information, please contact:

Ian Parkinson

Chief Executive Officer

...

+1 416-358-7501

Cautionary Note Regarding Forward-looking Information

This press release contains“forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, regarding the prospectivity of the Project, the mineralization of the Project, the Company's exploration program, the Transaction and the Company's ability to close the Transaction, the Company's ability to explore and develop the Project and the Company's future plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as“plans”,“expects” or“does not expect”,“is expected”,“budget”,“scheduled”,“estimates”,“forecasts”,“intends”,“anticipates” or“does not anticipate”, or“believes”, or variations of such words and phrases or state that certain actions, events or results“may”,“could”,“would”,“might” or“will be taken”,“occur” or“be achieved”. Forward- looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Halcones, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; risks associated with operation in foreign jurisdictions; ability to successfully integrate the purchased properties; foreign operations risks; and other risks inherent in the mining industry. Although Halcones has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Halcones does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Photos accompanying this announcement are available at

MENAFN28102024004107003653ID1108825416