U.S. And European Patient Monitoring Equipment Market Update: Remote Patient Monitoring, Iot, Ascs, And The Rapid EEG Market Idata Research

and European

patient monitoring equipment (PME) markets. The reports highlight the most prevalent trends driving growth, including the integration of patient monitoring devices into Internet of Things (IoT) settings and the expansion of remote patient monitoring (RPM) in both regions. Continue Reading

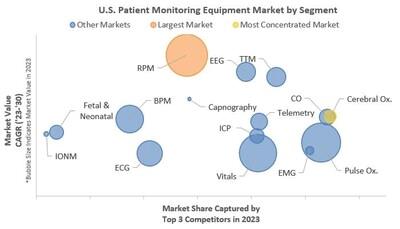

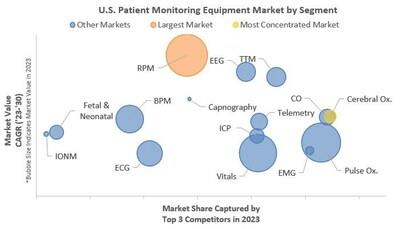

Patient Monitoring Equipment Market by Segment, U.S., 2023 (CNW Group/iData Research Inc.)

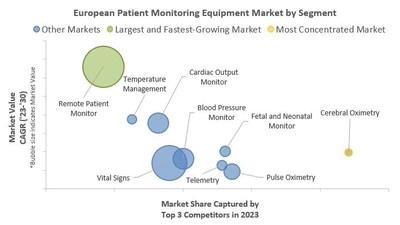

Patient Monitoring Equipment Market by Segment, Europe, 2023 (CNW Group/iData Research Inc.)

U.S. Patient Monitoring Equipment Market Growth, 2020-2030 (CNW Group/iData Research Inc.)

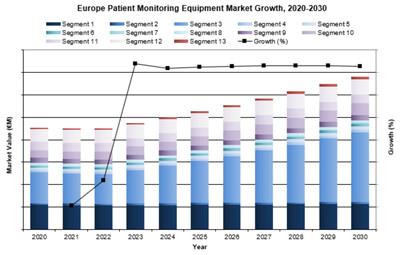

Europe Patient Monitoring Equipment Market Growth, 2020-2030 (CNW Group/iData Research Inc.)

Rapid Electrocardiogram (EEG) U.S. Market Growth, 2020-2030. (CNW Group/iData Research Inc.)

According to iData's findings, the RPM market has shown strong high-single-digit growth across the U.S. and Europe, with this upward trajectory expected to continue throughout the forecast period. The increasing demand for monitoring devices, both in and outside of professional healthcare settings, is reshaping the industry. Traditional patient monitoring devices are now being updated to include wireless connectivity and software compatibility, facilitating seamless system integration and enhancing workflow efficiencies in healthcare settings.

U.S. Market Trends : Remote Patient Monitoring Leading the Charge

In the U.S., the largest segment of the patient monitoring market is remote patient monitoring, which is also the fastest-growing segment. Supported by recent improvements in reimbursement policies, RPM is expected to grow at a compound annual growth rate (CAGR) in the high-single-digit range throughout the forecast period. By the end of the forecast period, RPM will remain the highest-value segment of the U.S. market. Following RPM, the pulse oximetry monitoring market is the second-largest segment, highlighting the widespread demand for non-invasive monitoring technologies.

The U.S. market for PME is also being influenced by the rise of alternative care facilities such as micro-hospitals, cardiac hospitals, and orthopedic hospitals, as well as freestanding emergency departments (FEDs). A key trend within this space is the integration of patient monitoring devices into Ambulatory Surgery Centers (ASCs), which are increasingly responsible for outpatient care, particularly for elective and minimally invasive procedures. The expansion of RPM into ASCs is set to create significant opportunities for PME manufacturers to develop portable, wireless, and telemedicine-integrated monitoring devices tailored to the specific needs of outpatient facilities. However, with rising demand comes heightened competition among manufacturers to offer affordable, scalable solutions that meet the unique demands of these centers.

European Market Trends : Home-Based Monitoring on the Rise

Similar to the U.S., Europe has seen rapid growth in the adoption of RPM, particularly during and after the COVID-19 pandemic. Countries with aging populations, such as Germany, Italy, and the UK, are leading the way in RPM adoption as healthcare systems shift more care to home-based settings to reduce the strain on hospitals. The UK and Germany boast the most mature RPM markets, supported by successful pilot studies and the implementation of reimbursement policies. In the coming years, countries with high healthcare spending per capita and large rural populations, including Scandinavian nations, are expected to experience accelerated growth in RPM adoption.

Furthermore, countries with a greater proportion of privately insured citizens, such as France, Benelux, and Germany, may see even more robust expansion of the RPM market, driven by private insurers offering complementary telemedicine coverage.

Market Share Leaders in the U.S. and Europe

United States

Medtronic

was the market leader in the total U.S. patient monitoring equipment market in 2023, holding significant shares in several key segments. The company dominated the RPM, cerebral oximetry, pulse oximetry, intraoperative neurophysiological monitoring (IONM), and standalone capnography monitoring markets. Medtronic's strength in these areas has been bolstered by its extensive portfolio of innovative, connected monitoring solutions.

Philips Healthcare

ranked as the second-largest competitor in the U.S. PME market in 2023, with a strong presence in multi-parameter vital signs monitoring, wireless ambulatory telemetry, RPM, and fetal and neonatal monitoring markets. The company's leadership in multiple product categories highlights its comprehensive approach to addressing the diverse monitoring needs of healthcare facilities across the U.S.

GE HealthCare , the third-largest player in the U.S. market, excelled in the multi-parameter vital signs, fetal and neonatal, ECG monitoring, and blood pressure monitoring markets. GE HealthCare's MAC product line , particularly in ECG monitoring, continues to set the standard for performance and reliability in the U.S. healthcare industry.

Other notable competitors are: Abbott, Ambu, Avanos Medical, B. Braun, Biotronik, Boston Scientific, Cardinal Health, ConMed, Cooper Surgical, Dexcom, Dräger Medical, Fukuda Denshi, Getinge, Medline, Omron Healthcare, Teleflex Medical, Tensys, Terumo, and more.

Europe

In 2023, Philips Healthcare led the total European patient monitoring equipment market, building on its long history of innovation. The company's success was partly driven by the release of its Rapid Equipment Deployment Kit during the COVID-19 pandemic, which allowed European hospitals to quickly scale up their intensive care unit (ICU) monitoring capabilities. Combining advanced patient monitoring technology with predictive patient-centric algorithms, this kit enabled care teams to respond efficiently during periods of high demand.

GE HealthCare

followed closely behind as the second-largest competitor in the European PME market, with a strong foothold in multi-parameter vital signs, wireless ambulatory telemetry, fetal and neonatal, blood pressure, and ECG monitoring markets. GE Healthcare's dominance in the Electrocephalogram (ECG) monitoring segment, particularly with its MAC product line , further solidifies its role as a critical player in the European PME landscape.

Another notable player in Europe is Tunstall Healthcare , which has pioneered the telehealth space over the past 60 years. Supporting over five million people globally, Tunstall's Lifeline Smart Hub is a standout innovation. This cloud-based system integrates all telehealth solutions into one home unit, working on cellular networks without the need for a landline. The Lifeline Smart Hub has removed location limitations, further driving Tunstall's influence in the RPM and telehealth markets across Europe.

Other notable competitors are: Abbott, B. Braun, Baxter, Cardinal Health, Compumedics, Conmed, Heyer Medical AG, Holtex, ICU Medical, LivaNova, Nonin, Noraxon, Osypka Medical, Progetti Medical, Promed Medical, Siemens, Smiths Medical, Teleflex, and more.

Growth in the Rapid EEG Market

Among the emerging segments within the PME market, the dedicated rapid Electrocardiogram (EEG) market stands out for its rapid expansion. The exponential growth in this segment is being driven by increasing unit sales as well as a gradual rise in the average selling price (ASP) of each monitor. From 2023 to 2030, the rapid EEG market is projected to grow at a CAGR exceeding 5%. As of November 2023, there are fewer than five major competitors in the rapid EEG market, creating significant opportunities for new entrants in the coming years.

Future Outlook

As the U.S. and European healthcare markets continue to embrace IoT-enabled patient monitoring devices, iData's reports indicate that manufacturers capable of delivering interoperable, wireless, and cost-effective monitoring systems will be well-positioned for success. The combination of technological advancements, favorable reimbursement policies, and the shift toward home-based and alternate care settings is expected to fuel sustained growth in the RPM market.

"Our latest reports highlight the critical role that patient monitoring devices are playing in shaping the future of healthcare delivery, both in the U.S. and Europe," said Dr. Kamran Zamanian, CEO of iData Research. "The integration of these devices into IoT environments, along with the expansion of remote monitoring and alternate care facilities, is transforming patient care, driving efficiency, and creating significant opportunities for device manufacturers."

For more information about iData's U.S.

and European

patient monitoring equipment market reports, or to request a sample, please visit

each report through the hyperlinks.

In addition, for a global overview of these and other notable markets across 65 countries, refer to the Global patient monitoring equipment market report .

About iData Research

iData Research is a global consulting and market research firm dedicated to providing actionable insights and data-driven intelligence for the medical device, dental, and pharmaceutical industries. By combining in-depth research methodologies with a global network of key opinion leaders, iData provides reliable data that companies use to make informed decisions about market strategies, product development, and expansion.

SOURCE iData Research Inc.

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE? 440k+Newsrooms &

Influencers 9k+

Digital Media

Outlets 270k+

Journalists

Opted In GET STARTED

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment