Asia Morning Bites

- Global Markets: The combination of a reduction in quantitative tightening (the cap on maturing Treasury securities was reduced from $60bn to $25bn per month) and only a modest change to the Fed's assessment of the risks to their inflation and employment goals, allowed US Treasuries to rally after the FOMC no-change decision. This occurred even though the statement noted that there had been a“lack of further progress” towards the Fed's inflation target in recent months. See the linked article for more from our US economist, and rates and FX strategists. Powell also hinted that rate cuts could occur if the US labour market softened significantly, even if inflation remained slightly sticky. And this has encouraged conspiracy theorists to anticipate a softer-than-consensus non-farm-payrolls print on Friday.

The net result of the FOMC on Wednesday for bonds was that 2Y US Treasury yields fell 7.5 basis points to 4.96%, while 10Y yields fell 5.2 bp to 4.628%. After falling for much of the session, EURUSD recovered and pushed back above 1.07. It is 1.0714 at the time of writing. Other G-10 currencies followed a similar path and made gains against the USD after earlier losses. The JPY had a more abrupt rally, dropping to 153 at one stage before bouncing back up to the mid-155 level. This has got the market talking again about possible Bank of Japan intervention, though the BoJ remains mute on this issue. With most of Asia off on vacation yesterday, there was little action in Asian FX markets. China is off for the remainder of the week. US stocks initially rallied on the FOMC decision, before having a complete change of heart and making a total reversal. The S&P 500 and NASDAQ ended slightly down on the day, though equity futures suggest that today's open may be positive.

G-7 Macro: Besides the FOMC decision, yesterday was relatively busy for US releases (most of Europe was off for Labour Day). The ADP survey for April showed a 192,000 increase, up from 184,000 in March. However, there was a drop in job openings according to the March JOLTS survey. The US ISM survey dipped back into contraction territory, though the employment sub-index rose slightly. See here for more details on these releases.Today, the US macro calendar looks busy but it is mainly filled with second-tier releases and final numbers for already published data. US trade data for March may be worth a quick look in addition to first-quarter 2024 unit labour costs.

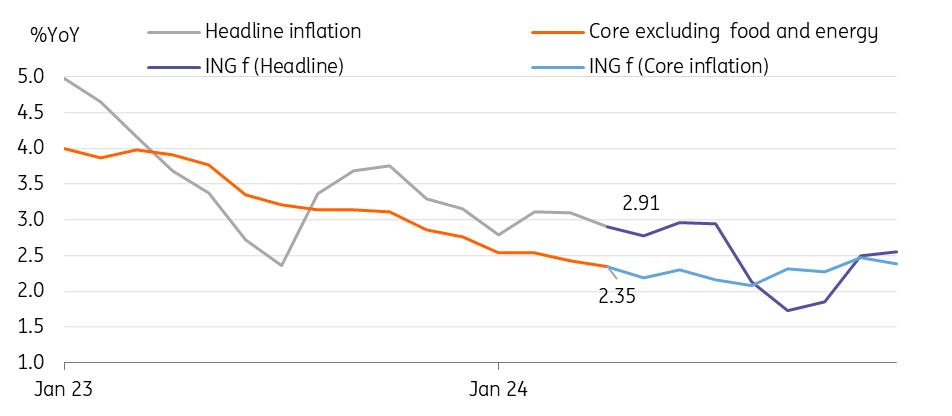

South Korea: Consumer price inflation slowed more than expected to 2.9% YoY in April from 3.1% in March (vs 3.0% market consensus). Headline inflation fell below 3% for the first time in three months, and core inflation excluding food and energy also edged down to 2.3% (vs 2.4% in March, 2.3% market consensus). Both headline and core inflation remained well above the Bank of Korea's (BoK) 2% target. As a result, we believe that the BoK will keep rates unchanged for a considerable time. We have pushed back the first rate cut timing from July to October, and forecast an additional rate cut in 1Q25.Compared to March, the CPI index didn't change in April. The softness in the sequential growth rate was concentrated in food (-1.2%), while transport (0.9%) and service prices such as recreation (0.5%) and restaurant/hotels (0.3%) continued to rise. The recent pick-up in global commodity prices, combined with the weak KRW will likely keep inflation sticky in the coming months. Food prices should fall further with better harvesting and government efforts. But second-round effects from energy price rises and the weak KRW will add more inflationary pressures.

The government's efforts to contain inflation will also continue. Utility prices are likely to remain unchanged, import tariffs on fresh food could be lowered, and fuel tax cuts are likely to be extended. On top of this, base effects will help to push headline inflation down sharply to the low 2% range from August, allowing the BoK to send easing signals and begin its easing cycle early in the fourth quarter.

Indonesia: Indonesia reports CPI inflation today. The market consensus points to a 3.1% year-over-year increase and a 0.3% month-over-month gain. The recent pickup in price pressures coupled with IDR weakness prompted a surprise hike from Bank Indonesia (BI) last month. We could see BI staying hawkish in the near term although additional tightening may not be on the table yet.

Source: CEIC, ING estimates What to look out for: Regional PMI and Australia trade

Regional PMI (2 May)

Australia trade (2 May)

Indonesia CPI inflation (2 May)

Hong Kong GDP (2 May)

US trade and initial jobless claims (2 May)

Singapore retail sales (3 May)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment