Deteriorating Affordability Will Dampen Spanish House Price Growth

to postpone their plans. An ING survey shows that 46% of Spanish renters cannot afford to buy their own home In this article Sales fall by around 9% by 2023 Spanish house prices still show solid price growth New-build homes much more expensive, but expected to level off this year Affordability sharply deteriorated over last two years 46% of Spanish renters cannot afford to buy their own home House price growth expected to slow slightly this year but remain strong Sales fall by around 9% by 2023

The number of property sales fell 9% in the first 11 months of 2023. According to figures released by the Spanish statistical office last Friday, the number of property sales was 15% lower in November compared to the corresponding month in 2022. Mortgage demand experienced an even sharper drop, with an 18% drop in the first 10 months of 2023, compared to the same period in 2022. This shows that first-time buyers, in particular, are struggling to buy amid rising interest rates. Investors, who are less likely to use a mortgage loan to buy a property, are less interest rate sensitive than first-time buyers, which explains the difference. Moreover, investor demand was supported last year by an increase in the number of foreigners buying homes in Spain.

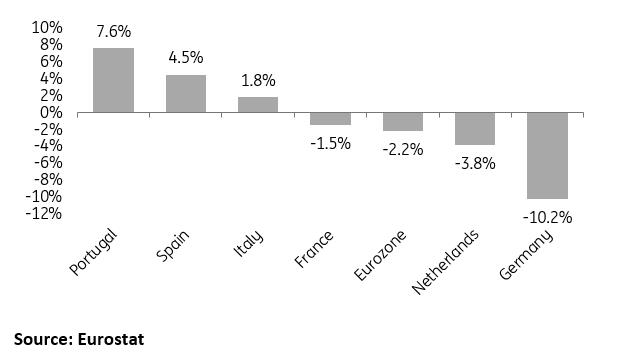

Spanish house prices still show solid price growthDespite the sharp rise in interest rates and the economic slowdown, Spanish house prices are showing strength. While transaction volumes have seen a significant drop, Spanish house prices continue to rise. In late December, INE revealed that Spanish house prices rose 4.5% in 3Q 2023 compared to the previous year, outperforming the eurozone average, which recorded a 2.2% decline. In Germany, prices fell more than 10% year-on-year. Although fourth-quarter figures are still pending, TINSA data shows that house prices will continue their upward trend until the end of 2023, which could result in average house price growth of around 4.5% for the whole year.

Evolution of house prices 3Q 2023 vs 3Q 2022

New-build homes much more expensive, but expected to level off this year

The price of new-build homes rose sharply last year: the price of a new-build home in the third quarter of 2023 was up 11% on last year. In contrast, existing homes experienced a more modest increase of 3.2% over the same period. This year, the strong price increases for new-build homes are expected to level off. Last year, developers still had to pass on a lot of price increases due to sharp increases in the price of building materials due to supply problems following the Covid-19 pandemic. However, this effect will soften in 2024. Construction costs have cooled sharply over the past year. According to figures from the National Bank of Spain, construction costs were slightly (-0.6%) lower than a year ago in October, showing that underlying price pressures have eased sharply.

Construction cost index, % YoY

Affordability sharply deteriorated over last two years

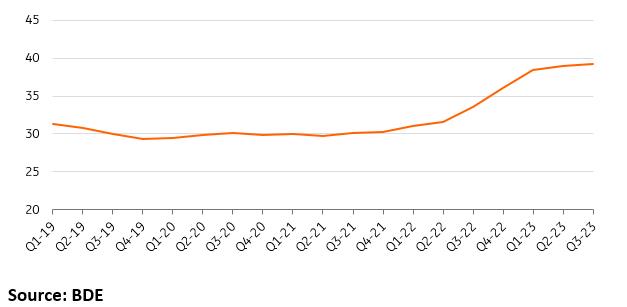

Affordability has worsened significantly over the past two years due to a sharp rise in interest rates since early 2022, combined with robust growth in house prices. Calculations by the National Bank of Spain show that Spanish families now spend on average 39% of their annual disposable income on mortgage payments in the first year after buying a house. By contrast, the figure was 30% in 2021, underlining the challenges newcomers face when buying a home. Consequently, many first-time buyers have had to postpone their plans to buy a home in recent months due to the mounting financial pressures.

Assumptions in compiling the chart below:

Gross amount of monthly payments payable by the median household in the first year after the purchase of a typical home financed with a standard loan for 80% of the value of the flat, as a percentage of the household's annual disposable income.

Housing affordability: theoretical monthly repayments without deductions

46% of Spanish renters cannot afford to buy their own home

The combination of rising interest rates and continued house price growth has significantly worsened affordability for first-time home buyers, forcing many to stay longer in the rental market. According to an ING survey conducted by IPSOS in November, 46% of Spanish renters said they would like to buy their own home but do not have the financial means to do so. As affordability continues to be under pressure for first-time buyers, demand for rental housing is expected to remain high. Moreover, deteriorating affordability is likely to lead young people to live with their parents for longer. According to the latest Eurostat figures available, Spaniards left their parental homes after an average of 30.3 years in 2022, which is already significantly higher than the eurozone average of 26.3 years. The average age at which people leave the parental home is likely to rise in the 2023-2024 period.

House price growth expected to slow slightly this year but remain strongWe expect house price growth of 3% this year, moderating slightly from last year. Several factors that boosted growth last year will slow down now that the catch-up effect has worn off, including the gradual weakening of price increases for new-build homes and less strong demand from foreigners buying a home in Spain. In addition, affordability for first-time buyers will remain under strong pressure, which will put a brake on further price increases. Although interest rates have fallen somewhat in the last few weeks of 2023, affordability remains worse than a few years ago.

Moreover, the further downside potential for fixed interest rates is relatively limited. Markets have already strongly anticipated the European Central Bank's first rate cuts this year. Moreover, the ECB will continue to reduce its bond portfolio next year and the precarious state of public finances also limits further downside potential. Therefore, we think long-term interest rates will end this year at about the same level as now. However, floating rates could fall more sharply, especially if the ECB starts cutting policy rates. This could support the market in the second half of the year.

In addition, further growth in demand will be a key driver of house prices in the coming years. According to projections by the Spanish statistical office, the number of Spanish households will increase by 2.7 million between 2022 and 2037, representing growth of 14.5%. This will put upward pressure on prices. Moreover, Spaniards themselves are very optimistic about the development of house prices. An ING survey conducted by IPSOS in late November showed that only a minority of 7% thought house prices would fall in 2024.

All in all, we expect 3% growth for this year, which in real terms amounts to de facto stagnation, considering the expected inflation of around 3%.

House price evolution Spain, including forecasts ING

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment