GPCA Research On Rising Private Capital Investment In India, SE Asia, Latam, Africa & Middle East

GPCA Research's latest Private Capital Investment data and insight for Asia, Latin America, Africa, Central & Eastern Europe and the Middle East.

Highlights

Get The Full Series in PDF

Get the entire 10-part series on Charlie Munger in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues.

Q2 2022 hedge fund letters, conferences and more

Hayden Capital 2Q22 Performance UpdateHayden Capital's performance update for the second quarter ended June 30, 2022. Q2 2021 hedge fund letters, conferences and more Dear Partners and Friends, The markets continued to sell-off in the second quarter, especially for internet-based businesses. This year continues to be the toughest stretch for us, since the Hayden's inception. Inflation concerns and the Read More

Table of Contents show

- 1. Private Capital Investment Expanded Analysis

- 2. China

- 3. Global VC Activity

- 4. Energy

- 5. Investment In Food And Agriculture

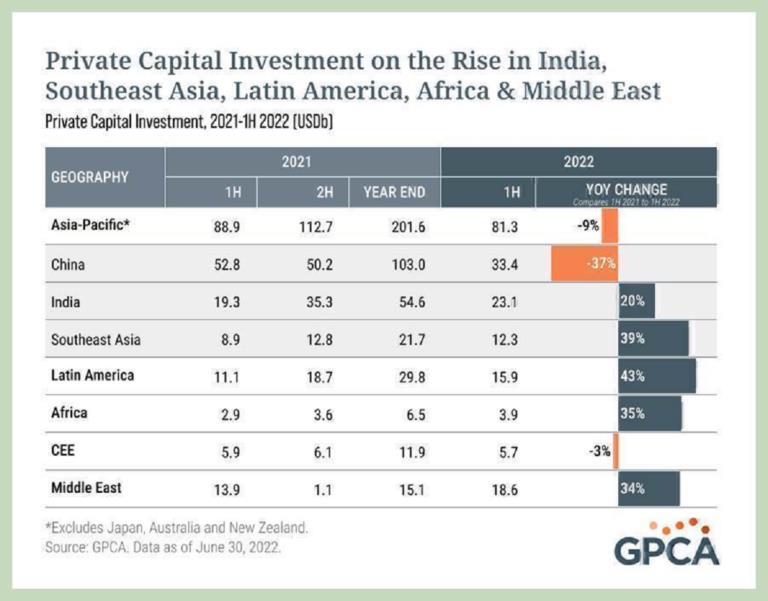

Private capital investors deployed USD126b across 3,110 transactions in GPC markets in 1H 2022, the second-highest half-year total on record.

China private capital activity declined by 37%, year over year, driven by prolonged lockdowns that have affected the economic outlook.

Africa, the Middle East, India, Southeast Asia and CEE represent global bright spots for VC activity.

Financial inclusion is driving momentum within African VC, which reached USD1.8b in 1H 2022, an 85% increase year over year. Fintech accounted for 40% of all VC deals and 57% of capital invested, with Moove Africa 's USD105m Series A, Egypt-based Paymob 's USD50m Series B and Ghana-based Fido Solutions ' USD30m Series A among the standout examples.

Private capital investors deployed USD18.5b in conventional and new energy platforms in 1H 2022.

BlackRock and Hassana's USD15.5b sale and lease-back deal for Saudi Arabia 's Aramco Gas Pipelines was the largest investment in global private capital markets in 1H 2022. Oil & gas assets continue to attract investment despite calls for the energy transition. Governments including Saudi Arabia and the UAE are monetizing legacy assets to subsidize local innovation.

Patria Investments' USD334m acquisition of CountourGlobal 's Brazilian hydro assets was the largest renewable power deal disclosed in 1H 2022.

Investment activity in green industries like electric vehicles continues to grow, no longer confined to first-mover countries like China , with notable EV deals for Croatia-based Rimac , which raised aUSD535m Series D from Goldman Sachs, Investindustrial, Porsche Ventures and SoftBank, and India's Ola Electric , which raised USD200m from Alpine Capital, Edelweiss and Tekne.

Investment In Food And Agriculture

Private capital investments in food and agriculture have increased since the beginning of the pandemic. Continued supply disruptions due to COVID-19 and the war in Ukraine are driving investment in local food producers and tech-enabled platforms in Asia and the Middle East.

View our methodology .

Updated on Aug 19, 2022, 2:48 pm

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment