(MENAFN- Asia Times)

A TechInsights report stating that a bitcoin mining integrated circuit (IC) sold by MinerVa“appears to be manufactured in SMIC 7-nm technology node” has triggered an outburst of commentary about the failure of American sanctions to stop the advance of Chinese Semiconductor technology.

TechInsights is a Canadian provider of semiconductor-related analysis and intellectual property services to Technology companies and other subscribers. It is known for its reverse engineering capability.

Referred to as“China-based” by Bloomberg, MinerVa Semiconductor is registered in Canada. But the three directors listed in its registration are Chinese and the address given for one of them is in China's Henan province. The“About Us” section on the company's website is blank.

MinerVA Semiconductor claims that its MinerVa7 is“one of the best-valued chips” for mining Bitcoin and that it“utilizes mature foundry technology to ensure chip yield, quality and reliability.”

Semiconductor Manufacturing International Corp, or SMIC, is China's largest semiconductor foundry (contract manufacturer) and a prominent target of US technology sanctions aimed at curbing China's access to advanced chips and the capacity to produce them.

The report describes SMIC's efforts to put 7-nm process technology into production as a qualified success. After noting similarities with Taiwan Semiconductor Manufacturing Company's (TSMC) 7-nm process, it goes on to say that SMIC's System-on-Chip (SoC) device seems to be a low-volume“steppingstone” that has the logic but not the memory aspects of a standard TSMC or Samsung product.

This is possible because“bitcoin miners have limited RAM [random access memory] requirements,” the report said. For reference, an SoC is an IC that incorporates a processing unit (logic), memory and other components, creating a specialized computer or other type of electronic system in a single device.

TechInsights also points out that SMIC's use of Deep Ultra-Violet (DUV) lithography has resulted in a more complex and costly process that probably has lower yields than the Extreme Ultra-Violet (EUV) lithography-based processes now used by TSMC and Samsung.

But SMIC has no choice. It must use DUV because the US Commerce Department put in on its Entity List in December 2020, stating at the time that“Items uniquely required to produce semiconductors at advanced technology nodes – 10 nanometers or below – will be subject to a presumption of denial to prevent such key enabling technology from supporting China's military-civil fusion efforts.”

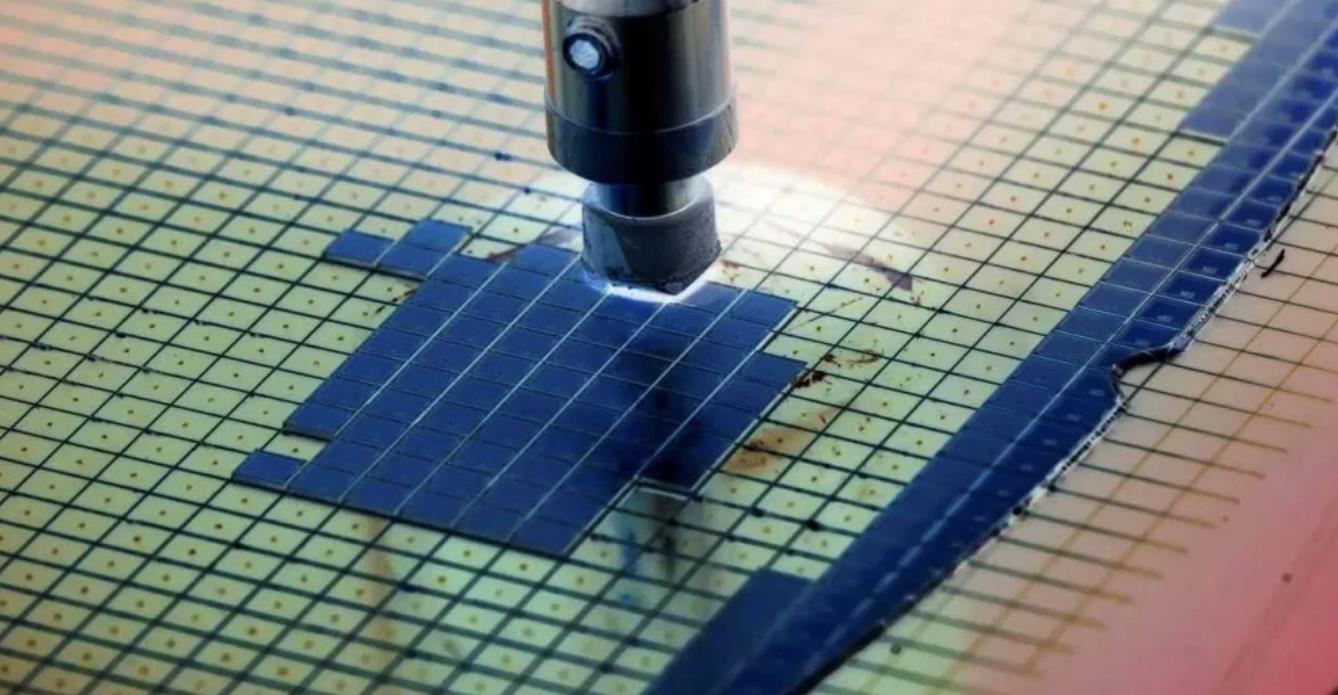

The US is urging lithography tool-makers to stop selling to China. Image: Facebook

The Entity List restricts trade with foreign entities – persons, corporations, governments – without a license from the Commerce Department. In practice, this has meant that sales of EUV lithography equipment to SMIC and other Chinese semiconductor makers are banned. Sales of other types of equipment – quite a lot of it, according to media reports – has been permitted.

The production of EUV equipment is monopolized by ASML of the Netherlands, but it incorporates a light source made by an American company, Cymer, which ASML acquired in 2013. The Dutch government has to date supported the sanctions.

US sanctions may prevent SMIC from upgrading from DUV to EUV, but they have not stopped it from developing process technology at 10-nm and below. As a result, the US government is now seeking to ban sales of DUV lithography equipment to SMIC.

Read:“US pressing even tougher chip bans on China”

The TechInsights report has generated headlines but its basic message – that SMIC has crossed the line drawn by the US government – has been known for more than a year. On April 5, 2021, ComputeNorth – an American supplier of cryptocurrency, blockchain and other distributed computing services based in Minnesota – reported that:

“Previously available exclusively to private industrial clients, the MinerVa MV7 Pro is now becoming available on a global scale as one of the latest and most popular high-performance bitcoin miners on the market today. The MV7 utilizes the latest SMIC 7nm chip, and while its outlook appears promising, there is still much to be revealed regarding the miner and its longer-term performance.”

7-nm is the actual limit of DUV lithography: The 5-nm and 3-nm processes developed by TSMC and Samsung will not work without EUV.

It is quite likely that the US government has until recently not tried or not been able to impose a ban on the sale of DUV equipment to China because it would have forced ASML to abandon a large and fast-growing market.

It would also have hurt second source supplier Nikon and had a severe knock-on impact on makers of other semiconductor production equipment, including American market leaders Applied Materials, Lam Research and KLA.

While US sanctions have targeted the leading edge, SMIC has built a substantial business serving the bulk of the semiconductor market. Founded in 2000, it now ranks fifth in the world in terms of semiconductor foundry revenues after TSMC, Samsung Foundry, UMC and Global Foundries.

A SMIC stand at an exhibition in Shanghai, China, on October 26, 2017. Photo: AFP

SMIC is the smallest of the middle-ranking foundries. Data from Gartner shows that in 2021, industry leader TSMC was 10 times larger than SMIC, Samsung Foundry 1.6 times larger and Global Foundries 21% larger. Other foundries in Taiwan, China and elsewhere are much smaller than SMIC.

SMIC fabricates a wide range of products for its customers, including power management ICs, microprocessors, image sensors, radio frequency and other devices used in wireless communications. It also makes touch controller ICs. In 2021, 64% of its sales were made in China, 22% in North America and 14% in Eurasia.

SMIC operates 200mm and 300mm wafer fabs (factories) in Shanghai, Beijing, Tianjin and Shenzhen, and has three new 300mm fabs under construction. Semiconductor foundry services generate more than 90% of SMIC's revenues, with the rest coming from mask making, testing and other related services.

Headquartered in Shanghai, SMIC is traded on the Shanghai Stock Exchange Star Market and the Stock Exchange of Hong Kong. Its largest shareholder is China's State-owned Assets Supervision and Administration Commission (SASAC), which has a 16% stake in the company.

The MinerVA news has had no significant impact on the share price so far. Meanwhile, it appears that the Americans are trying to close the stable door after the horse has bolted. Like that phrase, their policy may be as outdated.

Follow this writer on Twitter: @ScottFo83517667

MENAFN25072022000159011032ID1104583771

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.