(MENAFN- ValueWalk)

3844328 / Pixabay

The previously announced demerger of the US business, Jackson , completed on 13 September 2021. Prudential plc (LON:PRU) has now announced it plans to raise up to $2.89bn by issuing new shares on the Hong Kong stock exchange. 95% of the new shares will be from a share placing. The remaining 5% will be from a public offer of new shares, available to Hong Kong residents, with a preferential offer for some Prudential employees.

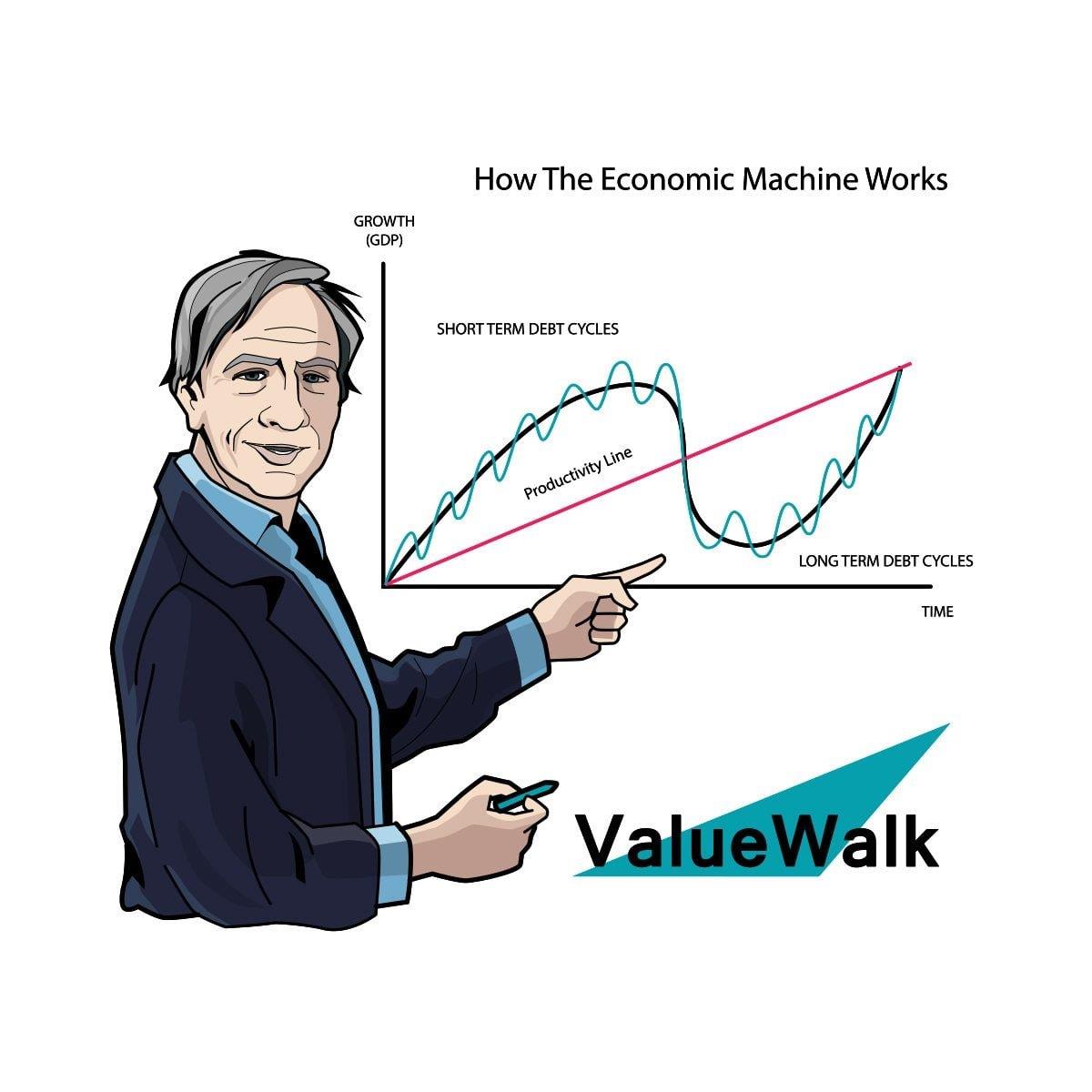

Get The Full Ray Dalio Series in PDF

Get the entire 10-part series on Ray Dalio in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Q2 2021 hedge fund letters, conferences and more

SALT New York 2021: Wences Casares And Peter Briger On The Macro Case For Bitcoin

At this year's SALT New York conference, Wences Casares, the chairman of XAPO, and Peter Briger, the principal and co-chief executive officer of Fortress Investment Group discussed the macro case for Bitcoin. Q2 2021 hedge fund letters, conferences and more XAPO describes itself as the first digital bank of its kind, which offers the "convenience" Read More

The majority of the proceeds will be used to repay debt, while the rest is earmarked to help Prudential make the most of growth opportunities in Asia.

The shares fell 4.1% following the announcement.

Prudential Is Looking To Make The Most Of Opportunities In Asia

Sophie Lund-Yates, equity analyst at Hargreaves Lansdown:

“Prudential is closing the book on a messy chapter, with the breakup of the American and Asian businesses now complete, it's looking to make the most of opportunities in Asia. The addressable market here is huge, so coming to the market cap-in-hand does make sense. The scale of the amount needed might be a bit disappointing, but it also adds risk. When you've asked for money, the reaction will be harsh if things don't go to plan.

The mammoth task ahead is also limiting returns to shareholders, with the dividend yield a little under 1%. Again, this is by no means a huge issue. However, the biggest question now is one of execution. Grandiose opportunity is very different to pulling it off.”

About Hargreaves Lansdown

Over 1.64 million clients trust us with £135.5 billion (as at 30 June 2021), making us the UK's largest digital wealth management service. More than 98% of client activity is done through our digital channels and over 600,000 access our mobile app each month.

MENAFN20092021005205011743ID1102832628

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.