(MENAFN- DailyFX) Advertisement British Pound Outlook:

- After blue skies through the start of the year, it's been nothing short of April showers for the British Pound .

- That said, April tends to be a bullish month for the British Pound from a seasonal perspective, so losses may be stemmed as several GBP-crosses approach significant support.

- Recent changes in retail trader positioning suggest a mostly mixed bias for the British Pound.

Sterling Slides Towards Support

At the onset of the quarter, it was noted that 'even as some concerns arise about vaccination supplies due to shifts in EU export policy, the UK economy appears to remain on track to return to its pre-pandemic output faster than most other developed economies. It appears that this concern was underappreciated. As UK vaccination rates have slowed thanks in part to supply issues the British Pound's appeal has worn off.

Despite global equity markets pushing record highs, the Sterling has been unable to post further gains versus the safe haven currencies, and even the once-beleaguered Euro has staged an impressive comeback. Now, the British Pound finds itself hurtling towards key support among each off the major GBP-crosses, suggesting that critical technical tests lie ahead.

GBP/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (February 2020 to April 2021) (CHART 1)

In the prior GBP/JPY rates forecast update, it was noted that 'GBP/JPY rates remain in a relative ascending channel dating back to late-February…despite little progress made over the past two weeks, the pair remains well-positioned for more gains, with the charts having digested some of the extreme bullish momentum readings seen earlier in the month. After touching channel resistance, the pair has fallen back quickly in the past two weeks back to channel support, where GBP/JPY finds itself today.

Momentum has shifted to a nearly complete bearish posture, underscoring the acute change in circumstances over the past two weeks. GBP/JPY rates are below their daily 5-, 8-, 13-, and 21-EMA envelope, which is in bearish sequential order. Daily MACD continues to pullback and is on course to move below its signal line, while daily Slow Stochastics have already dropped into bearish territory.

GBP/JPY is enduring a critical test of its uptrend, and a break below the confluence of the late-March swing low and the 76.4% Fibonacci retracement of the 2020 high/low range around 148.53/91 would suggest that the uptrend has officially ended; bulls need support to hold around current price action.

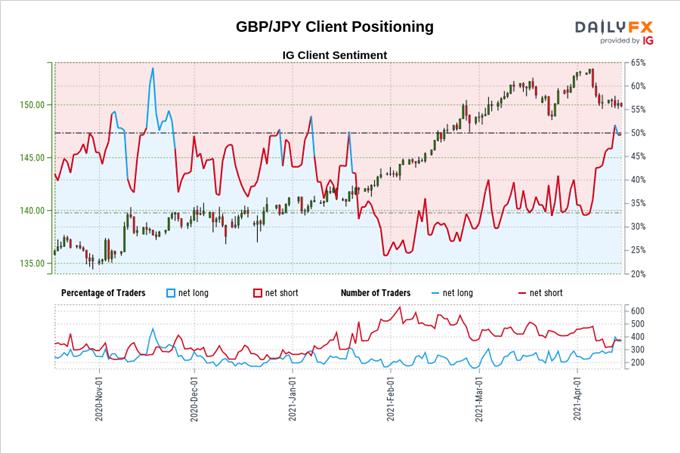

IG Client Sentiment Index: GBP/JPY Rate Forecast (April 15, 2021) (Chart 2)

GBP/JPY: Retail trader data shows 48.83% of traders are net-long with the ratio of traders short to long at 1.05 to 1. The number of traders net-long is 6.73% lower than yesterday and 15.79% higher from last week, while the number of traders net-short is 2.89% higher than yesterday and 2.97% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/JPY prices may continue to rise.

Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/JPY trading bias.

GBP/USD RATE TECHNICAL ANALYSIS: DAILY CHART (FEBRUARY 2020 TO APRIL 2021) (CHART 3)

The last time we checked in, it was noted that 'GBP/USD has recently lost the uptrend from the March and November 2020 lows, with price action the past three days resolving itself in a bearish manner an evening star candle cluster, treating the pandemic trendline as resistance. The key test is arriving at the 76.4% Fibonacci retracement of the 2018 high/2020 low range at 1.3677, which has thus far contained the pullback. A drop below said level would also constitute a break of the March lows, suggesting that a deeper setback is due.

More context is needed to highlight the importance of the current support region. GBP/USD rates are also contending with the 38.2% retracement of the July 2014 high/March 2020 low range at 1.3614 and the 23.6% retracement of the November 2007 high (all-time high)/March 2020 low range at 1.3711. In effect, the near-100-pip area between 1.3614/711 can be defined as the make or break level for GBP/USD bulls.

The upshot for GBP/USD bulls is that the pair has been climbing away from this support in recent days, buttressed by broader US Dollar weakness. But it's still too soon to think the worst may be over. After all, the pair remains within the downtrend from the February and March swing highs, as well as the pandemic uptrend. As the saying goes, 'more wood needs to be chopped before any sort of clarity is achieved.

IG Client Sentiment Index: GBP/USD Rate Forecast (April 15, 2021) (Chart 4)

GBP/USD: Retail trader data shows 61.63% of traders are net-long with the ratio of traders long to short at 1.61 to 1. The number of traders net-long is 3.39% higher than yesterday and 2.31% lower from last week, while the number of traders net-short is 0.64% lower than yesterday and 10.25% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

EUR/GBP RATE TECHNICAL ANALYSIS: DAILY CHART (February 2020 to April 2021) (CHART 5)

A false bearish breakout emerged during the inter-update period. The last time we reviewed the charts, it was suggested that 'the breakout has failed and reversed course; EUR/GBP is back above descending trendline resistance, suggesting that a return back to consolidation resistance is possible at 0.8731.

Consistent with the ethos that ‘failed breakouts that return to their prior consolidations often seeing the other side of the consolidation tested, EUR/GBP rates have been climbing towards the late-February swing high at 0.8731, as well as the 61.8% Fibonacci retracement of the 2020 low/high range at 0.8747. With bullish momentum firm daily Stochastics are nestled in overbought territory, daily MACD is trending higher through its signal line, and the daily EMA envelope is in bullish sequential order more gains may be ahead towards the resistance zone around 0.8731/47.

IG Client Sentiment Index: EUR/GBP Rate Forecast (April 15, 2021) (Chart 6)

EUR/GBP: Retail trader data shows 48.17% of traders are net-long with the ratio of traders short to long at 1.08 to 1. The number of traders net-long is 4.55% lower than yesterday and 11.91% lower from last week, while the number of traders net-short is 0.18% higher than yesterday and 13.45% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBP prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bullish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

MENAFN15042021000076011015ID1101923395

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.