How to Trade the Doji Candlestick Pattern

This article explains what the Doji candlestick is and introduces the five different types of Doji used in forex trading. It will also cover top strategies to trade using the Doji candlestick.

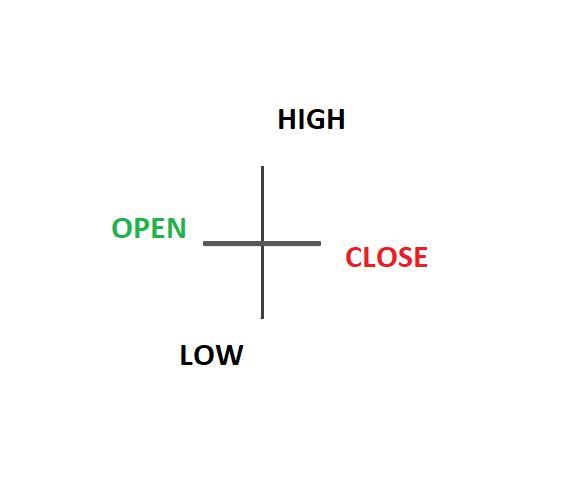

What is a Doji Candlestick and How Does it Work? The Doji candlestick, or Doji star, is characterised by its 'cross' shape. This happens when aforex pairopens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length. Generally, the Doji represents indecision in the market but can also be an indication of slowing momentum of an existing trend. Advantages of Using the Doji Candlestick in Technical Analysis The Doji star can prove invaluable as it provides forex traders with a 'pause and reflect' moment. If the market is trending upwards when the Doji pattern appears this could be viewed as an indication that buying momentum is slowing down or selling momentum is starting to pick up. Traders may view this as a sign to exit an existing long trade.

Advantages of Using the Doji Candlestick in Technical Analysis The Doji star can prove invaluable as it provides forex traders with a 'pause and reflect' moment. If the market is trending upwards when the Doji pattern appears this could be viewed as an indication that buying momentum is slowing down or selling momentum is starting to pick up. Traders may view this as a sign to exit an existing long trade.

Remember, it is possible that the market was undecided for a brief period and then continued to advance in the direction of the trend. Therefore, it is crucial to conduct thorough analysis before exiting a position.

Understanding Doji Candlestick Variations Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. While the traditional Doji star represents indecisiveness, the other variations can tell a different story, and therefore will impact the strategy and decisions traders make.Furthermore, it is very unlikely to see the perfect Doji in the forex market. In reality, traders look for candles that resemble the below patterns as closely as possible and more often than not, the candles will have a tiny body. Below is a summary of the Doji candlestick variations. For an in-depth explanation read our guide to the differentTypes of Doji Candlesticks .

How to Trade the Doji Candlestick There are many ways to trade the various Doji candlestick patterns. However, traders should always look for signals that complement what the Doji candlestick is suggesting in order to execute higher probability trades. Additionally, it is essential to implement soundrisk managementwhen trading the Doji in order to minimise losses if the trade does not work out.

How to Trade the Doji Candlestick There are many ways to trade the various Doji candlestick patterns. However, traders should always look for signals that complement what the Doji candlestick is suggesting in order to execute higher probability trades. Additionally, it is essential to implement soundrisk managementwhen trading the Doji in order to minimise losses if the trade does not work out. Below we explore various Doji Candlestick strategies that can be applied to trading.

1) Trading with the Doji star patternTheGBP/USDchart below shows the Doji star appearing at the bottom of an existing downtrend. The Doji pattern suggests that neither buyers or sellers are in control and that the trend could possibly reverse. At this point it is crucial to note that traders should look for supporting signals that the trend may reverse before executing a trade. The chart below makes use of thestochastic indicator , which shows that the market is currently in overbought territory – adding to the bullish bias.

2) Using the Dragonfly Doji in Trend Trading

2) Using the Dragonfly Doji in Trend Trading A popular Doji candlestick trading strategy involves looking for Dojis to appear near levels ofsupport or resistance . The below chart highlights the Dragonfly Doji appearing near trendline support. In this scenario, the Doji doesn't appear at the top of the uptrend as alluded to previously but traders can still trade based on what the candlestick reveals about the market.

The Dragonfly Doji shows the rejection of lower prices and thereafter, the market moved upwards and closed near the opening price. This potential bullish bias is further supported by the fact that the candle appears neartrendlinesupport and prices had previously bounced off this significant trendline. Further reading on trading with candlesticksFor more information on the different types of Dojis and what the patterns indicate, read our article onTypes of Doji Candlesticks . The Doji is just one of the many candlesticks all traders should know. Boost your trading knowledge by learning theTop 10 Candlestick Patterns . If you are just starting out on your trading journey it is essential to understand the basics of forex trading in ourNew to Forexguide.

Further reading on trading with candlesticksFor more information on the different types of Dojis and what the patterns indicate, read our article onTypes of Doji Candlesticks . The Doji is just one of the many candlesticks all traders should know. Boost your trading knowledge by learning theTop 10 Candlestick Patterns . If you are just starting out on your trading journey it is essential to understand the basics of forex trading in ourNew to Forexguide.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment