Latest stories

Who's to blame for losing Ukraine? China, of course

Japan eyes muscling up Australia's rebuilding navy

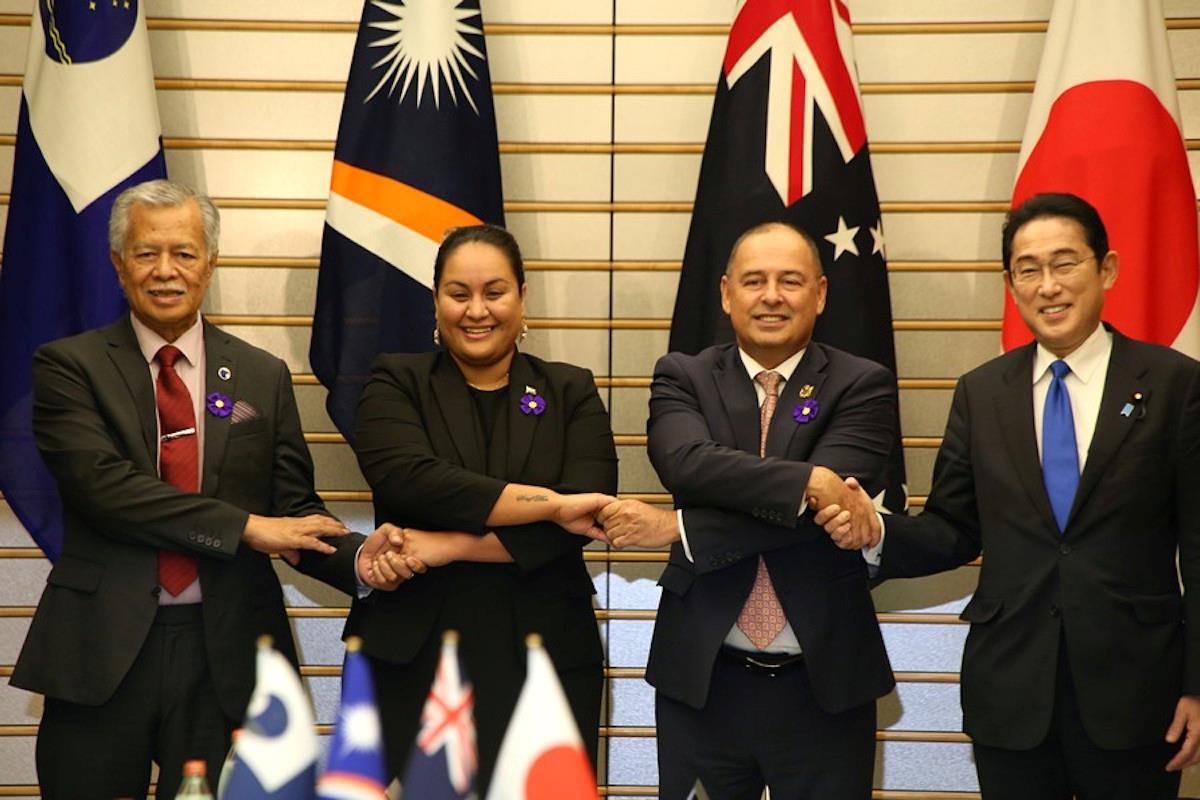

PALM10: Japan's extended hand to the Pacific Islands Columbia University economist Adam Tooze speaks for many when he calls Trump's plans a“recipe” for an inflationary surge. Goldman Sachs economist Ronnie Walker thinks Trump's new China taxes will dent US gross domestic product (GDP).

“The direct impact of higher tariffs on GDP is likely to be modestly negative, with the hit to real income and consumer spending from higher prices outweighing the decline in the trade deficit,” Walker says.“There are also uncertain indirect effects, such as a hit to business sentiment and supply-chain upheaval, that could heighten the negative effect.”

Adds Biden campaign spokesperson James Singer:“What Trump and his allies are proposing will bring chaos to markets, raise costs on working families and send inflation skyrocketing.” It goes beyond tariffs, too.

“Most of the major policy initiatives being suggested by Donald Trump's campaign would be inflationary,” says economist Paul Ashworth at Capital Economics.“Whether it's narrowing the trade deficit via tariffs or a dollar devaluation, curbing immigration or, now we learn, compromising the

Fed's independence .”

Enter the Biden campaign to increase the intensity of a trade war arms race ahead of November. In a recent report, the Economist Intelligence Unit warns that Sino-US relations will experience“a sustained worsening” in economic and diplomatic ties for the rest of the decade whether the Democrats or the Republicans win.

“Either president will pursue policies aimed at exerting further pressure on China's technology sector, while also justifying future trade and investment restrictions based on national security

concerns,” EIU analysts write.

Yet neither trade war policy mix, be it from Biden or Trump, is likely to halt China's increasing dominance – not even in EVs, says Michael

Dunne, CEO of auto industry advisory ZoZoGo.“Imagine a world in which

China

builds every single car,” Dunne says.“Unthinkable, right? Think again.”

China today, Dunne points out, has enough capacity to manufacture half of the world's 80 million vehicles. By 2030, China's capacity could climb to 75% of the world's volume, according to Global Data.

This year China will export 6 million vehicles to more than 140 countries worldwide, blowing past Japan for global leadership.

Dunne notes that Chinese brands like SAIC's MG, Chery, Geely's Volvo and BYD are leading the way, winning in every time zone from Brazil to Thailand, from the UK to Australia.

“Call it the coming China car colossus,” he says.

EVs are merely a microcosm of a broader dynamic. While Trump was tossing grenades at the global trade system during his first term, Beijing was investing aggressively in making China the dominant power in 5G, EVs, semiconductors, artificial intelligence, renewable energy and other dominant“future” industries.

Four more years of Trump dragging America back to 1985 would be just the thing for Chinese leader Xi Jinping. Though Trump's tariffs would slam Chinese growth in the short run, his domestic policies would put Xi's“Made in China 2025” gambit even further ahead.

Biden risks a similar own goal if he resorts to the economic playbook of 40 years ago.

Rewind to the mid-1980s, Japan was cast in the villain's role now occupied by China. American media was transfixed over the idea of Japan Inc taking over the world economy. At the time, Japanese buyers were scooping up New York's Rockefeller Center, golf courses like California's Pebble Beach and Hollywood studios. They hoovered up any Rembrandts, Monets, Picassos and other masterworks on auction to hang in Tokyo.

Lawmakers and pundits warned of an

economic Pearl Harbor and of America becoming a commercial“colony” of Japan. As Trump the businessman said in an interview at the time, Japan had“systematically sucked the blood out of America - sucked the blood out! They have gotten away with murder. They have ended up winning the war.”

That was back when then-US president Ronald Reagan started his second term with a mercantilist gambit that still inspires Trump. In 1985, Reagan's Treasury Secretary, James Baker, managed to cajole the most powerful industrialized nations to push the yen sharply higher and the dollar lower.

The pact was signed at the Plaza Hotel, a New York institution that Trump once owned. Early in his presidency, then-Treasury Secretary Steven Mnuchin and advisors like Peter Navarro hinted at Trump's desire for a“new Plaza Accord” that would send the Chinese yuan soaring.

That never materialized. A Trump 2.0 White House might indeed give the strategy another try. Beijing would surely refuse. Chinese officials know how the 1985 currency deal precipitated Japan's asset bubble in the late 1980s, leading to decades of economic stagnation.

Also, Xi is determined to increase the yuan's use in global trade and finance. Knowing this, Trump's economic advisers and mulling steps to punish nations turning away from the

dollar . As Bloomberg reported in late April, Team Trump is keen to head off moves among key emerging markets to reduce their exposure to the US currency.

Sign up for one of our free newsletters The Daily ReportStart your day right with Asia Times' top stories AT Weekly ReportA weekly roundup of Asia Times' most-read stories

Possible steps include penalties for any country, friend or foe, that entered into a bilateral trade arrangement in currencies other than the dollar. These might entail currency manipulation charges, tariffs or export controls.

All this, though, might merely slow the inevitable. With the US national debt racing toward US$35 trillion and Congress paralyzed by extreme polarization, investors might do China's work for Xi. The US only has one AAA credit rating left and Moody's Investors Service warns a downgrade might be coming.

Not that Biden has done anything to slow the de-dollarization movement. Efforts by Brazil, Russia, India, China and South Africa, the BRICS, and others including Saudi Arabia and the United Arab Emirates, gained new momentum in 2022.

That was when Biden's Treasury Department led efforts to harness currencies to punish Russia over its Ukraine invasion. They included freezing portions of Vladimir Putin's foreign exchange reserves.

Last month, Congress granted Biden's White House authority to seize Russian dollar assets to aid Ukraine. This so-called REPO provision allows Treasury Secretary Janet Yellen's team to transfer Russian government assets to a Ukraine reconstruction fund. It fueled fresh debate about the long-term costs of“weaponizing” the dollar.

“China may accelerate the process of de-dollarization,” says JPMorgan analyst Katherine Lei, noting that roughly 70% of Chinese international trade is still held in dollars.

Quadrupling tariffs on

Chinese EVs , batteries, solar panels or other technologies might make for nice election-year headlines. But returning to 1985 won't help the globe's biggest economy find a higher gear vis-a-vis China.

If Biden wants to get Xi's attention, he must think and spend bigger on building economic and innovative muscle at home. Trump prioritized trying to trip China on the racecourse, not limbering up to beat it organically. Biden must go the other way and limber up for a challenging decade to come.

Follow William Pesek on X at @WilliamPesek

Already have an account?Sign in Sign up here to comment on Asia Times stories OR Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.