(MENAFN- ING) Why US inflation matters for Europe

I know I need to get out more, but I really was fascinated by Andrew Baliey's post-Bank of England presser. And I can't help thinking that he'd have voted for a rate cut this month if his band of brothers and sisters had been on board .

This line caught my attention:“The outlook [for inflation] has become more predictable... there have been relatively few surprises”. It's a bold shout, but I reckon it's why central banks across Europe are more confident about making predictions about what they really are going to do next.

They seem to be more chilled about their currencies too. The Swedes were quick off the blocks cutting their rates this week, and we know how sensitive their economy has been to interest rate hikes. They're facing up to economic weaknesses despite the fragile krona. They're not going to be the only central bank confronting those dilemmas this year.

Still, try telling officials over in Washington that inflation is becoming easier to predict. First quarter US data was anything but. But what if that's all about to change?

Maybe that's naïve – I suspect many investors would say it is. Markets are only fully pricing one US rate cut this year, with a chance of a second.

Fed Chair Powell, though, was not nearly as hawkish as he could have been last week . He effectively told us that it would take three consecutive months of better inflation data to unlock that first rate cut.

That's a high bar. But it's perfectly attainable. We'll get five CPI releases before September's meeting, including one next week. And as my colleague James Knightley writes in our latest ING Monthly , there are reasons to remain optimistic. He points to“residual seasonality”, or the idea the inflation data is not being properly adjusted for the usual seasonal patterns. Read what he writes about insurance premiums.

That might sound too convenient. Certainly, James K is cautious about assuming this explains the whole story. But it's something the Fed's Jay P has talked about before. Some of the survey data's looking better than the official inflation figures too.

Whatever happens, it's a debate that won't be lost on officials here in Europe. ECB boss, Christine Lagarde may have recently played down the link between American and eurozone inflation. But our Carsten Brzeski, who watches her every move, reckons that isn't a view shared by everyone in Frankfurt. There were hints of that in the Bank's minutes today . As Carsten points out, eurozone inflation has a tendency to lag the US, even if the underlying drivers are different.

A June rate cut looks like a done deal for the eurozone. But beyond the summer, the outlook for the continent's rates looks much less certain.

Chart of the week

What if we're heading for weaker US job numbers? Don't bet on it, although last week's payroll numbers weren't overly impressive. But take a look at this chart from the National Federation of Independent Businesses. It suggests the jobs figures could be less rosy in the coming months.

Lower US jobs numbers are coming, judging by the NFIB hiring plans survey

Macrobond THINK Ahead for developed markets

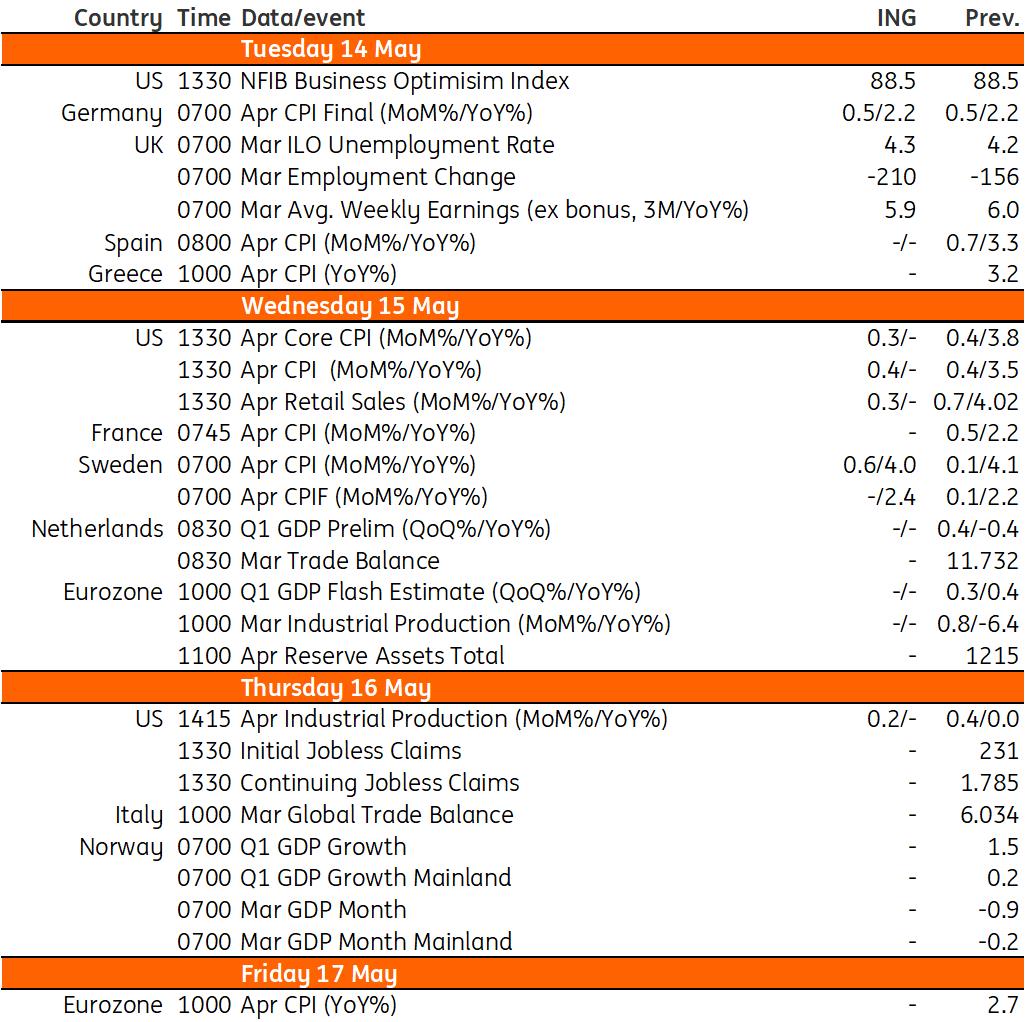

Keep an eye out for all this next week:

US CPI inflation (Weds): Core CPI will be key and after three consecutive 0.4% month-on-month prints, we are desperate to see a lower number for April. If not then the chances of rate cuts will drop sharply once again. We ideally want to see 0.2% or lower to give the Fed some confidence inflation is on a path to 2% annually, but we are doubtful it will happen just yet. We are forecasting 0.3% MoM, while higher energy costs will push up headline prices by 0.4%. James Knightley

US retail sales/industrial production (Weds/Thurs): Both are likely to be weaker than the very strong figures printed for March, but with consumers feeling more stress, as highlighted by rising loan delinquencies, and the ISM manufacturing index back in contraction territory we expect to see more downside risk in coming months. James Knightley

UK jobs report (Tues): The jobs market is cooling and we expect the unemployment rate to nudge higher, albeit the data's reliability is still under question. Wage growth is likely to nudge slightly lower, and this is what matters more for the Bank of England, though it has said it is paying closer attention to services inflation. James Smith

THINK ahead for Central and Eastern Europe

Poland first quarter GDP (Weds): A recovery is underway, but the pace has been moderate so far. We think GDP increased by 1.5% YoY (from 1.0%) on a gradual revival of household consumption and robust real income growth. The NBP will also publish its core inflation estimate, which we expect at 4.0% year-on-year (from 4.5% in March). Adam Antoniak

National Bank of Romania policy meeting (Mon): We expect the NBR to narrowly opt for a no-change decision against a widely anticipated 25 basis points cut. Should a cut come, it is likely to be accompanied by hawkish rhetoric and with no guidance for more cuts. Valentin Tataru

Romania CPI inflation (Tues): Higher excise duties for tobacco and higher fuel prices should keep headline inflation close to 6.6%, similar to the previous month. Valentin Tataru

Czech CPI inflation (Mon): Inflation likely to increase 2.4% in April, which is partly linked to base effects. But this also reflects a rebound in domestic demand, strong retail sales and improved consumer sentiment. David Havrlant

Czech trade balance (Thurs): This likely remained in surplus in March, given the economic recovery in Germany and other major trading partners in the EU. David Havrlant

Key events in developed markets next week

Refinitiv, ING Key events in EMEA next week

Refinitiv, ING

MENAFN10052024000222011065ID1108198848

Author:

James Smith, Carsten Brzeski, James Knightley, Adam Antoniak , Valentin Tataru, David Havrlant

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.