Asia FX Talking: Renminbi Remains Under Pressure

Date

4/17/2024 4:16:41 AM

(MENAFN- ING) Main ING Asia FX forecasts

| | USD/CNY | USD/KRW | USD/INR |

| 1M | 7.25 | ↑ | 1350.00 | ↓ | 83.00 | ↓ |

| 3M | 7.27 | ↑ | 1320.00 | ↓ | 83.00 | ↓ |

| 6M | 7.17 | ↑ | 1280.00 | ↓ | 83.00 | ↓ |

| 12M | 7.05 | ↑ | 1300.00 | ↓ | 82.50 | ↓ |

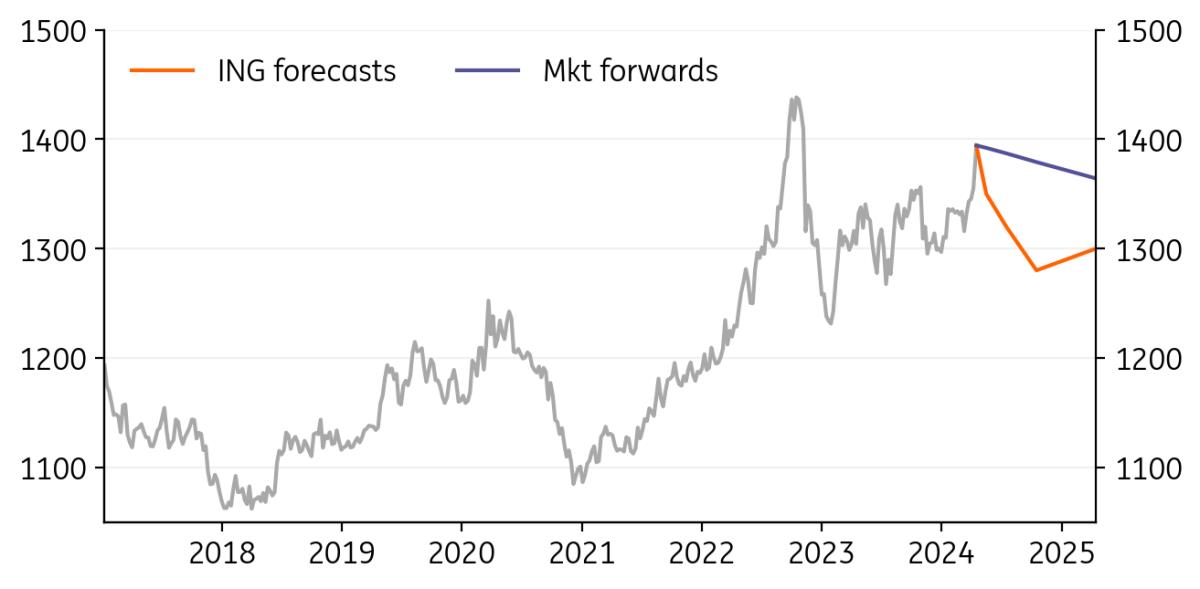

USD/CNY: PBoC clamps down on depreciation bets

Spot One month bias 1M 3M 6M 12M

| USD/CNY 7.24 | Neutral | 7.25 | 7.27 | 7.17 | 7.05 |

The renminbi has come under pressure and the People's Bank of China has continued to push back against depreciation. USD/CNY has traded near the weak end of the 2% band, prompting speculation about whether we will see further intervention, or if the PBoC will allow for weakening. We expect the central bank to continue to resist against rapid depreciation, and see low odds for last year's 7.34 level to be breached. Rate cuts may be delayed until the pressure subsides. The latest weakness is mostly due to a stronger dollar rather than domestic developments. Given our updated house view on Fed rate cuts, we have pushed back the timeline for a CNY rebound.

Refinitiv, ING USD/KRW: KRW will be in gridlock

Spot One month bias 1M 3M 6M 12M

| USD/KRW 1394.20 | Mildly Bearish | 1350.00 | 1320.00 | 1280.00 | 1300.00 |

The Korean won broke the 1350 level again as the policy vacuum is expected to be extended longer than expected. The Korean dividend payout season may have also fuelled the move. Semiconductor-driven export gains are likely to drive overall growth, but inflation rebounded to the 3% range recently. This means that the BoK will remain hawkish for a while. The end of 2Q24 is likely to be the time to see a clear sign of appreciation, once the BoK and Fed signal rate cuts. Slowing US growth and rising uncertainty about US macro policies will work against the KRW towards year-end.

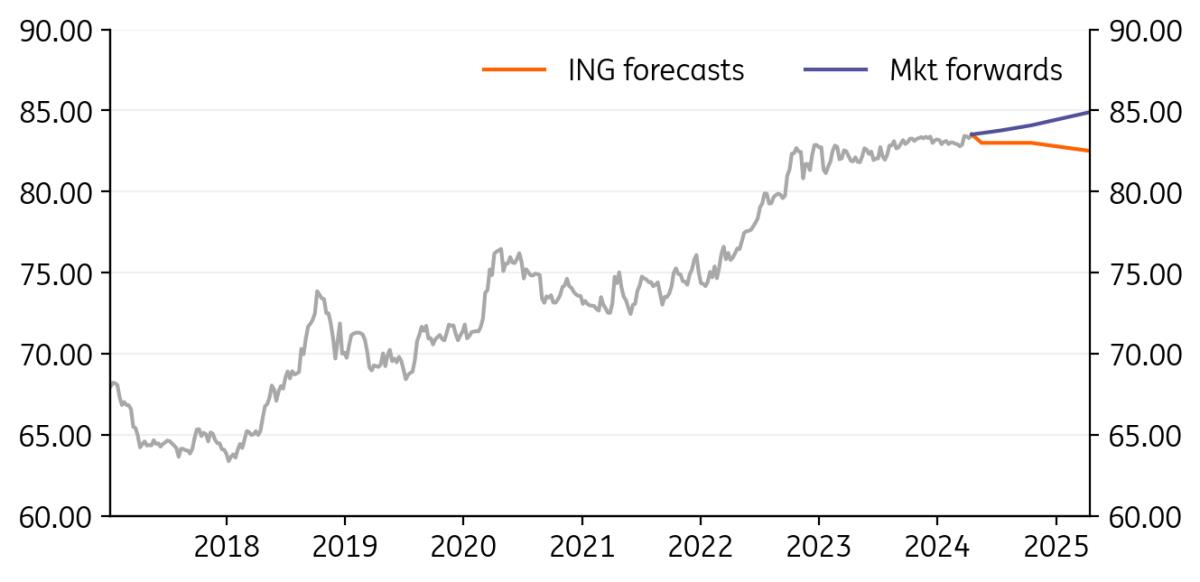

Refinitiv, ING USD/INR: De-facto peg softens

Spot One month bias 1M 3M 6M 12M

| USD/INR 83.52 | Neutral | 83.00 | 83.00 | 83.00 | 82.50 |

The last month has seen more volatility in the Indian rupee. In early March, USD/INR hit an intraday low of 82.65 on generalised USD weakness, but as doubts crept in about the speed and scale of any Fed easing this year, USD/INR has drifted higher. It is now back above 83.0, where it has been trading since last October. Although small in relative terms, recent swings show that the INR is no longer a de-facto peg but is acting more like a very dirty float and is not immune to the ebbs and flows of other currencies. We expect the Reserve Bank of India to hold the topside of the recent INR range (83.50) in the coming months if the USD strengthens further.

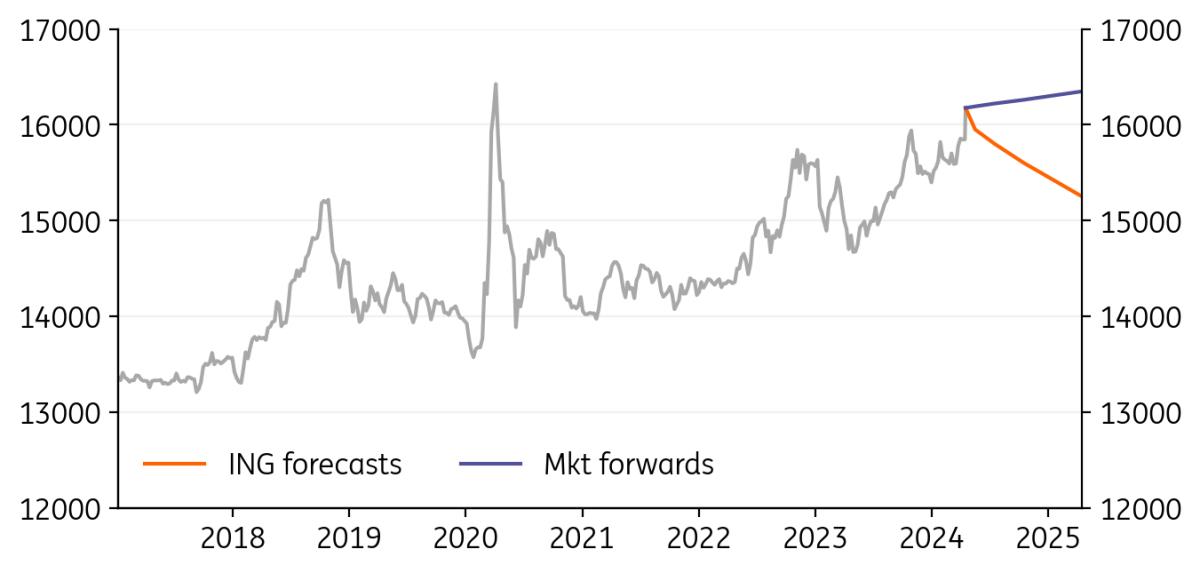

Refinitiv, ING USD/IDR: IDR backpedals on fading trade surplus support

Spot One month bias 1M 3M 6M 12M

| USD/IDR 16175.00 | Mildly Bearish | 15950.00 | 15800.00 | 15600.00 | 15250.00 |

The Indonesian rupiah was pressured over the past few weeks as the trade surplus dwindled to a very modest $867m, down from a peak of more than $7.5bn in 2022. The stark narrowing of the trade surplus suggests less support for the IDR. Bank Indonesia kept policy rates unchanged at 6% and still signalled openness to cutting policy rates this year despite renewed pressure on the currency. BI has relied heavily on FX stabilisation efforts, and falling reserves data could have weighed on the IDR as well. The IDR will likely remain pressured on a fading trade surplus and less-than-hawkish statements from the central bank.

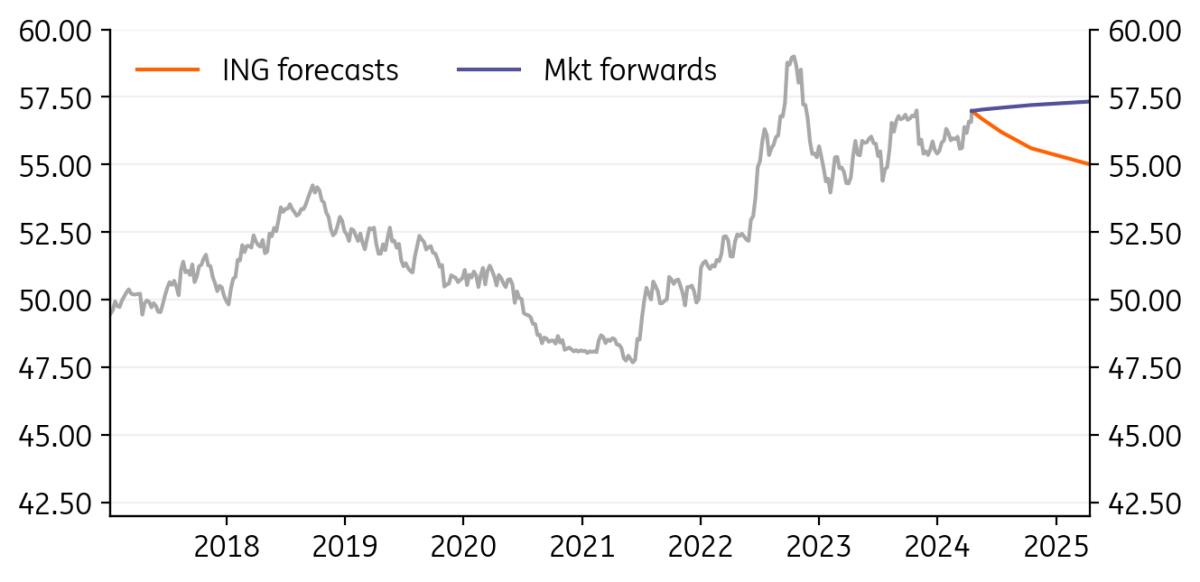

Refinitiv, ING USD/PHP: PHP remains pressured as BSP rules out further hikes

Spot One month bias 1M 3M 6M 12M

| USD/PHP 56.98 | Neutral | 56.70 | 56.20 | 55.60 | 55.00 |

The Philippine peso came under pressure early in the month after January trade data showed a wider-than-anticipated trade deficit. Corporate demand also picked up in the past few weeks, adding pressure to PHP. The PHP did not receive any support from the central bank with Bangko Sentral ng Pilipinas Governor Eli Remolona ruling out further rate hikes this year. The PHP will continue to face pressure in the coming months given the lean season for overseas remittances and with the BSP indicating it is done raising rates.

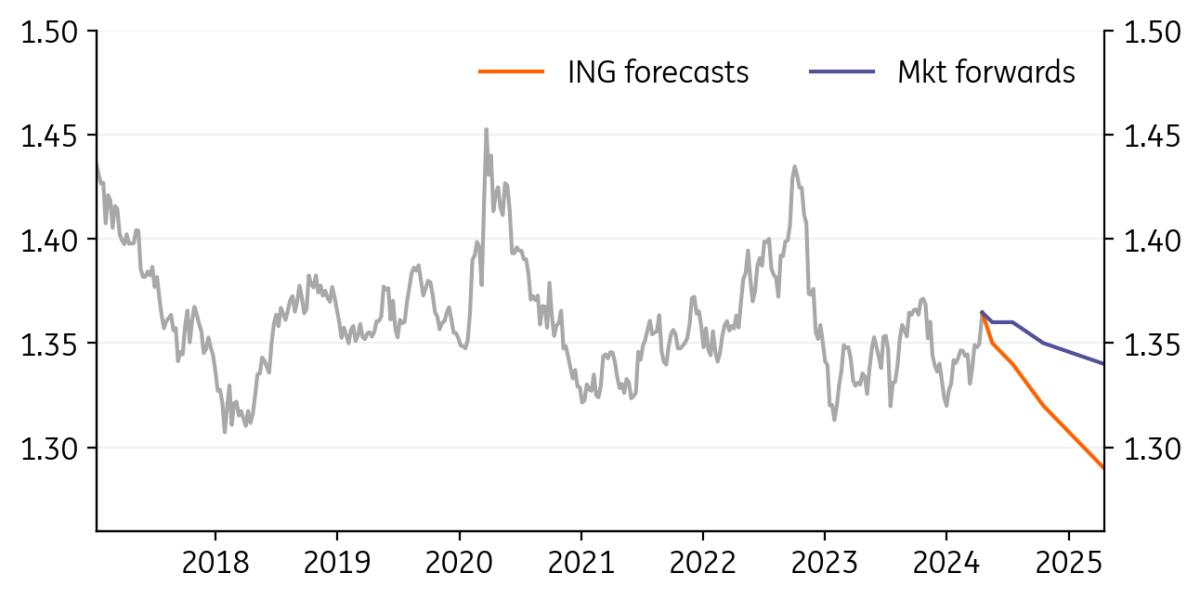

Refinitiv, ING USD/SGD:

Spot One month bias 1M 3M 6M 12M

| USD/SGD 1.3646 | Mildly Bearish | 1.35 | 1.34 | 1.32 | 1.29 |

A string of disappointing data reports put pressure on the Singapore dollar with non-oil domestic exports falling well-short of expectations. Sentiment remained anxious ahead of the Monetary Authority of Singapore meeting in April with most analysts expecting policy settings to be retained despite recent developments such as a pickup in domestic inflation. The SGD NEER should continue its modest appreciation path in 2024 although in the near-term, SGD NEER could take direction from regional peers such as China's yuan, which will be impacted by adjusted expectations on Fed policy.

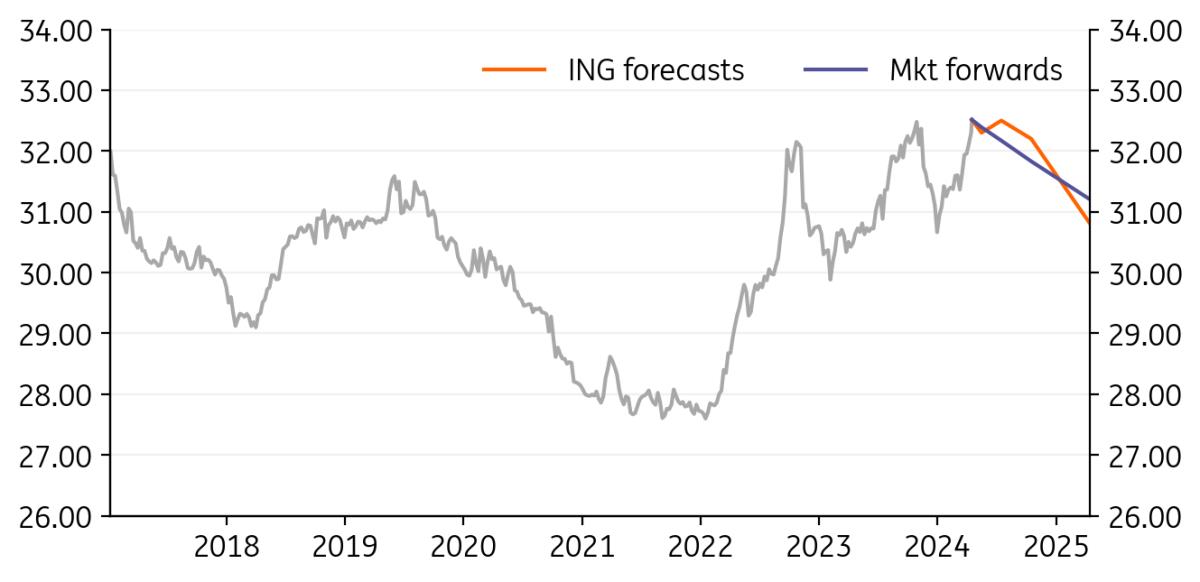

Refinitiv, ING USD/TWD: Surprise rate hike did little to slow depreciation

Spot One month bias 1M 3M 6M 12M

| USD/TWD 32.51 | Neutral | 32.30 | 32.50 | 32.20 | 30.80 |

Despite various factors which in theory were positive for Taiwan's dollar, including a surprise rate hike, a larger trade surplus in February, and subsiding geopolitical headwinds, the TWD continued to weaken over the past month and broke past 32 as portfolio outflows intensified. Interest rate spreads worsened and remained unfavourable to the TWD amid hawkish developments in the US. Two-year yield spreads have widened to the highest level since November 2023. It is possible that geopolitical factors will still play a role in the TWD's trajectory this year, particularly if US-China tensions ramp up.

Refinitiv, ING

MENAFN17042024000222011065ID1108104468

Author:

Min Joo Kang , Nicholas Mapa, Robert Carnell, Lynn Song

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.