Polish CPI Revised Upwards Core And Services Inflation Remain High

Date

4/15/2024 2:24:14 PM

(MENAFN- ING)

Poland's StatOffice revised March CPI inflation to 2.0% YoY from its flash estimate of 1.9% YoY released earlier. The country's CPI print hit a local low in March, but the details didn't give much comfort to the sustainability of lower inflation.

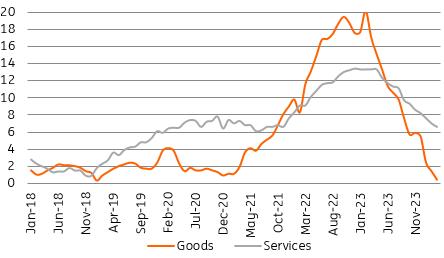

Services prices rose by 6.6% YoY in March and goods prices by merely 0.4% YoY, compared with 7.0% YoY and 1.4% YoY respectively in February. Food prices fell in month-on-month terms for the second month in a row and were at a slightly lower level in March 2024 than a year ago (-0.3% YoY). fuel prices were broadly unchanged MoM and remain lower than a year earlier (-4.5% YoY). The cost of home energy was also lower than a year ago (-2.5% YoY).

Services price growth remains elevated

%YoY

Source: GUS The increase in prices was mainly driven by price growth in core categories. We estimate that core inflation, excluding food and energy prices, slowed to 4.6% YoY from 5.4% YoY in February and remains uncomfortably high, with still significant momentum (around 0.5% MoM). The low level of inflation in March was mainly a consequence of the unwinding of the energy shock and the high reference base. According to our estimates, the reversal of external supply shocks is responsible for around two-thirds of disinflation, and only one-third is related to the decline in core inflation. The inflation outlook has improved slightly, but we still expect it to rise close to 5% YoY in December this year. We estimate average annual consumer price growth of 3.7% in 2024.

We do not share the NBP's view that the main inflationary threat in Poland is the reintroduction of VAT on food and the planned normalisation of energy prices for households in 2H24. Regulated prices, taxes as well as commodity prices are factors outside the direct control of monetary policy. In our opinion, the monetary policy discussion should focus on core inflation and services prices. A tight labour market, high wage growth and prospects for an economic rebound raise concerns that further declines in core inflation will be limited and that the external environment (low commodity prices) may not be as favourable as they are now in the months ahead. Geopolitical factors have propped up oil prices, while the rebound in China and the tight supply situation are generating upward pressure on metal prices. We believe the MPC should perhaps focus its attention on factors influenced by monetary policy, (i.e. domestic sources of inflationary pressure), not least because we are on the verge of an economic rebound driven by record-high growth in real household incomes.

The persistence of core inflation is a dark spot in the generally optimistic picture of disinflation in Poland and this is the main threat to disinflation sustainability. This does not appear to resonate too strongly in the rhetoric of the NBP, which sees the low level of current inflation as its success and attributes its expected future rise to factors beyond its control.

We see reasons for maintaining a cautious stance in monetary policy and expect the NBP's interest rates to remain unchanged until the end of 2024, although towards the end of the year we can expect to start discussing possible interest rate cuts.

MENAFN15042024000222011065ID1108096772

Author:

Rafal Benecki, Adam Antoniak

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.