Korea: Consumer Prices Slow To 3.3% In May

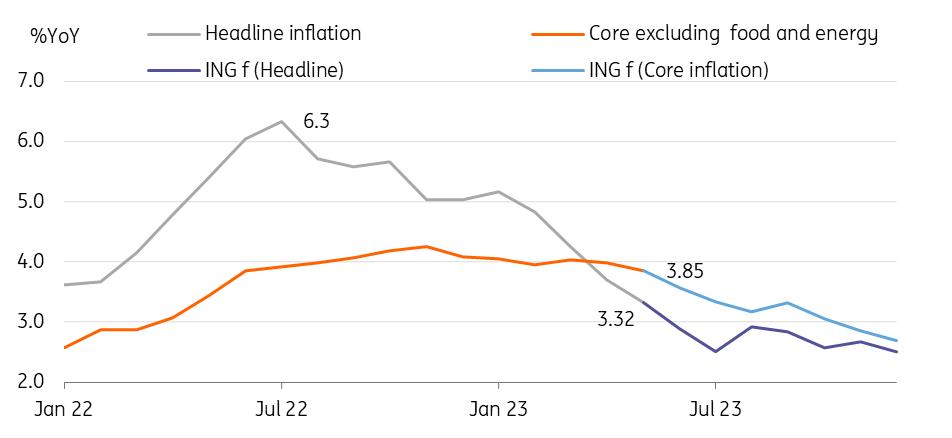

(MENAFN- ING) We expect headline

inflation to touch the 2% range as early as June, but the bank of Korea will likely pay more attention to stickier

core inflation and keep its hawkish stance

Consumer prices continued to slow in May Consumer prices in Korea rose 3.3% last month from a year earlier, compared with a 3.7% year-on-year rise in April.

Utility prices shot up by 23.2% YoY in May, reflecting the recent hikes in power and city gas prices from the middle of May, but the decline of diesel (-24%) and gasoline (-16.5%) prices led to the slowdown in headline inflation. In a monthly comparison, prices reaccelerated by 0.3% month-on-month (vs 0.2% in April). We think some lingering effects of utility fee hikes will stay for a couple of months but strong base effects will contribute to bringing headline inflation down further. Given recent weak global commodity prices, we believe that inflation is expected to come down to the 2% level as early as June.

Meanwhile, core inflation excluding food and energy only edged down to 3.9% YoY in May from the previous month's 4.0%, showing the stickiness of core prices and staying above the headline inflation.

Inflation forecasts

CEIC, ING estimates Bank of Korea watch We think that even if headline inflation hits the 2% range in June or July, the Bank of Korea (BoK) will likely maintain its hawkish stance by highlighting that core inflation is still at the 3% level and by projecting headline inflation will hit the 3% level by year-end.

We also think that risks are skewed to the upside because public service fees – usually decided by local governments – are set to increase over the summer and the second-round effects of such hikes could push prices back up. However, if global oil prices run below $70 per barrel, then the deceleration trend will likely continue. We maintain our long-standing view that the BoK will stay pat throughout the third quarter.

Share

Author

More on South Korea

the bank of korea again keeps its policy rate on hold asia morning bites

MENAFN04062023000222011065ID1106383243

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.