(MENAFN- ING) Rate hikes remind us that market rates are vulnerable to the upside now

We saw more stable conditions evolve through yesterday.

Credit Suisse

now has a CHF50bn line to the Swiss National Bank, and First Republic has access to $30bn in deposits from US SIBs. This is unlikely to be the end of it for these two names but it has, importantly, taken the sting from wider banking angst.

The ECB went ahead and hiked by 50bp

without any particular hitch; the Fed likely delivers a 25bp hike next week. Put simply, if central banks can hike, there is no perceived system threat. The bank risk uncovered so far is proving to be idiosyncratic in nature.

That said, the blanket response from the US last weekend was remarkable – all deposits insured, and cheap 1yr loans for banks. Banks that access such loans no doubt would open themselves to heightened scrutiny by the regulator, and in that sense, the facility should help to uncover future problem banks. We're in a better place than we were at the beginning of the week, but this remains a day-by-day scrutiny exercise.

Risk barometers are in off highs, but not in by enough to declare the all clear. And even if they were, an undercurrent of angst will remain for some time. At the same time, there has been a deep dive in market rates over the course of just

a couple of weeks back. From here, we doubt there is huge room to the downside in terms of the level of rates... that is until something really breaks. This market is vulnerable to a re-focus on some of the macro positives for a little while to come.

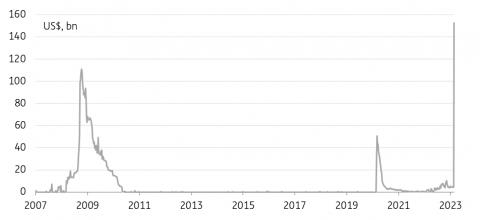

Discount window borrowing from the Fed (primary credit) surges to record

FRED, ING

ECB data dependence is dovish as markets see more lasting effects from the financial shock

Amid the market turmoil, the ecb

stuck to its guns and raised all policy rates by 50bp – underlying inflation remains too high. However, what gives this hike clearly a dovish tilt this time around was the absence of any guidance for action at the upcoming meetings. Finally, it seems the ECB has switched to a more pure form of data dependence. It's also understandable in light of the many occasions that the ECB had previously painted itself into a corner, including going into today's meeting.

Immediately after the press conference, rates dropped moderately. The view is now that the ECB can, at most,

push through another 25bp of tightening until summer. This showed that the market's key concern remains the heightened risks in the banking system. Mind you, the market did not react

in any risk-off fashion to the hike, which itself signals sentiment is on the mend,. But it can take a good while before a shock and its cascading effects wash out of the system, be it only that it has instilled greater awareness for risk and a sense of caution, which

can lead to a more lasting tightening of financial conditions, even if solutions are found to address the immediate problems.

ECB President Lagarde has sought to make clear that there wasn't any trade-off between monetary policy and financial stability. The ECB would tackle both separately with different instruments, but she also admitted that financial conditions would feed into the projections on which ultimately policy is decided. With regard to the market fears at hand, she offered no new instruments or liquidity lines but

instilled confidence by pointing out the ECB always stood ready to intervene quickly if needed. There were no changes made to the communication around quantitative tightening or the targeted longer-term refinancing operations (TLTROs).

Even as a semblance of calm returns, ECB rate hike expectations remain lower

Refinitiv, ING

Today's events and market view

Today's data calendar features US industrial production and the preliminary University

of Michigan consumer sentiment index. The latter also includes surveyed inflation expectations. In the eurozone, we will see the final inflation readings for February.

Both may help remind the market that central banks still have another important task at hand. The ECB, for one, has just shown that it is undeterred from its inflation fight and that further substantial hikes are possible, and the Fed will follow next week.

Sentiment is slowly on the mend. At the same time, last night's Fed borrowing data is indicative of the efforts it took to achieve this feat. In the eurozone, we will be watching the amount

that banks want to repay from ECB TLTRO borrowings at the end of March. The general expectation is that banks will have chosen to hold on to the liquidity – in particular as their decision had to be communicated by Wednesday late afternoon to the ECB.

Also, as usual after an ECB meeting, we should see a pickup in ECB officials' public remarks again. The hawks may be encouraged if

sentiment further recovers, seeing how far front-end rates have dropped.