(MENAFN- ING) Italy, Germany and the UK are behind in the fibre network race

One of the key priorities for

the EU is the digitalisation of our society. There are concrete objectives but also means available which should facilitate the transformation towards more digital service models in Europe by 2030. It's why

the coming years are dubbed:“the digital decade”. A target is for all households to have access to a gigabit network by 2030.

On the back of this, member states have embarked on an ambitious fibre roll-out programme. Some countries, such as Spain and Portugal, already have excellent fibre networks which reach almost 90% of households. This partly explains why these countries are particularly popular with 'digital nomads', notwithstanding the better weather. The nomadlist.com ranking can be found here .

This shows that digital connectivity can help economies to become more competitive over time. However, more still needs to be done elsewhere.

Many households in Europe have fibre connectivity

Homes passed/households

FTTH Council Europe

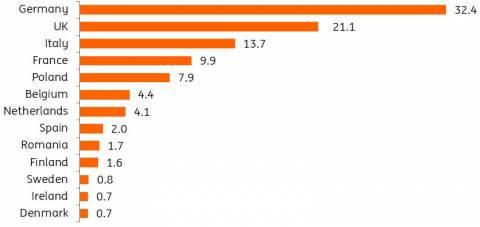

Some large countries in Europe need to spend heavily to establish fibre connectivity Although the span of fibre networks in Europe is progressing well, a lot still needs to be done,

especially in some bigger countries such as Germany, the UK and Italy. According to a report by the ftth council europe , operators still need to pass 32.5m houses with fibre in Germany, while the number is 21m for the UK and 10m for Italy (as of September 2021). This challenge is seen as an opportunity for new ventures and many have secured favourable financing conditions. Certainly, we're seeing progress in the UK, the Netherlands and Germany.

Of course, these companies need to make money and people need to be persuaded to upgrade to fibre connectivity.

A lot needs to be done to pass all households with fibre in many countries (m)

FTTH Council Europe

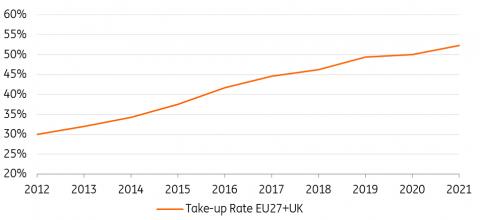

Consumers make better use of fibre networks

Back in 2012, only 30% of the households connected or

passed with fibre became fibre customers. This is particularly relevant for service providers since profitability increases with better usage. Once a network has been rolled out in a specific area, additional customers improve profitability. It is, therefore, a positive development that the pickup rate of fibre products has increased over time. In 2021, 55% of customers that had access to a fibre broadband product bought it. This provides for much better economics, but it also shows that there is a strong demand for fibre products.

Usage of fibre networks increases

FTTH Council Europe, ING

Percentage of people that subscribe to fibre when available

It may not be efficient to cover homes with multiple fibre connections

Initially, incumbent fixed network operators were reluctant to roll out full fibre to the home in many markets. They did not see the need to upgrade

since existing networks were relatively fast, and they could avoid additional expenses. It's worth noting that the cable operators in European markets were happy with an upgraded hybrid fibre coaxial (HFC) network technology. For most users, download speeds provided by these networks were good enough.

At the time, many greenfield fibre operators saw a market opportunity and started rolling out fibre in, for example,

the UK and the Netherlands. These efforts got a tailwind from abundant and cheap capital. CityFibre in the UK

rolled out a network that passes 2m homes, while DELTA Fiber in The Netherlands passes 1.2m homes. Today, incumbents are ramping up their roll-out plans quickly. In the UK, both Virgin Media and BT have announced substantial fibre

plans. This happens at a time when there are already alternative operators deploying fibre in London, where it can be completed in a relatively easy way. BT and Virgin Media O2 have the advantage that they can immediately transfer their existing customers to the new network,

generating a swifter profit. Smaller

operators, on the other hand, can bring fibre to areas that are of secondary interest to the market leaders.

For 2023, we expect the roll-out trends to continue, with all operators continuing their build-out plans. However, we think it is inefficient (from a cost perspective) to cover less dense regions with more than one fibre grid. It is more plausible that, at some point, operators will discuss reciprocal access and that the larger operators will scoop up the smaller ones –especially if there are difficulties with generating sustainable free cash flow. Similar structures have evolved in Spain, where operators rent lines from others, also supported by regulation.

There are also areas, of course, where it's

prohibitively expensive to install fibre connectivity. Rolling out fibre in rural areas where farms are at a large distance from the main network usually requires subsidies. Innovative solutions, such as fixed-wireless access and satellite connections, also offer suitable alternatives. It would therefore be helpful for

politicians to stick to speed and coverage targets rather than

fibre roll-out requirements which focus on a specific technology.