(MENAFN- ING) The Bank of Japan kept currency easing policy measures unchanged, as expected

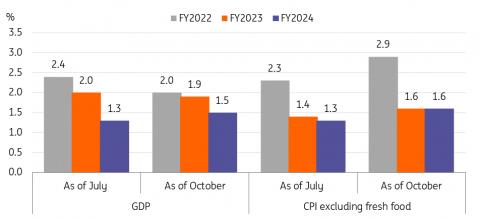

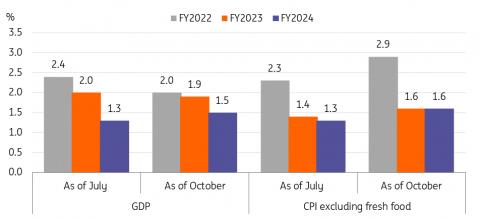

The Bank of Japan (BoJ) unanimously decided to keep its short-term and 10Y targets at -0.1% and 0.0%, respectively. The dovish forward guidance on the statement reiterated that the central bank will take additional easing measures if necessary. Meanwhile, the BoJ upgraded its inflation outlook for the next two years. Now, it expects core inflation to rise quite sharply to 2.9% in FY22, then drop to 1.6% in FY23 and FY24. This suggests that this year's higher inflation is only transitory, and inflation will eventually return to below its 2% target.

The BoJ has upgraded its inflation outlook

Bank of Japan

Meanwhile, fiscal policy will play an important role in reducing the inflation burden

The government unveiled an extra budget plan of 29.1 trillion JPY (5.3% of GDP) to curb inflation pressures. The government will extend fuel tax cuts until next year and subsidise electricity fees by about 20% to households. In addition, the government will provide incentive programmes to encourage companies to be proactive in raising wages. The subsidy programme could help the BoJ earn more time until it sees the long-awaited signs of wage growth.

However, doing this will require the government to issue more debt, but at least domestic funding costs will be cheap, as long as the BoJ keeps its yield curve control (YCC) policy. Otherwise, when the time comes to raise rates, the government will see expensive paychecks, which can be even more painful.

FX: Dovish BoJ undermines intervention efforts

Unchanged and dovish BoJ policy will continue to undermine the Finance Ministry's FX intervention efforts to stabilise USD/JPY. One could argue that the government's fiscal stimulus package is also an acknowledgement that it cannot protect its consumers from a weaker yen and higher energy costs.

On Monday, the Ministry of Finance should release statistics for the size of FX intervention for the month of October. This could be close to $40bn, following the $20bn of intervention in September. Japan has around $1.1trn of FX reserves, so there will be no question of Japan running out of FX reserves. For reference, the Czech National Bank

has spent 20% of its FX reserves this year on defending the koruna. But Japan's FX reserves are not limitless and we would expect this FX intervention campaign to continue in a strategic and judicious manner.

In practice

and given our strong dollar view, we doubt Japanese authorities can prevent USD/JPY from retesting 150 later this year –

and it could go even higher were the recent benign conditions in energy markets to take a turn for the worse.

Comments

No comment