(MENAFN- ING) US corporate ESG issuance spans the full spectrum

Environmental, social, and corporate governance (ESG) issuance in the USD-denominated corporate space has been steady over the past number of months. Typically, US corporate names are more likely to issue ESG paper in USD-denominated products, whereas European names are more likely to issue EUR-denominated ones. We find that USD-denominated ESG bonds are just as likely to manage a greenium as EUR-denominated ones. Multinational or global names have been open to issuance in both currencies, and others.

The baseline expectation is for new issuance in USD-denominated ESG bonds to commence with a greenium. The greenium is typically in single digits, and often in low single digits. Some don't have a greenium to speak of at all, but there are not many examples of ESG bonds trading at a significant concession to surrounding grey issues, barring bond peculiarities to do with coupon size or unusual holding characteristics.

Example of ESG issuers in the energy space

Macrobond, ING estimates

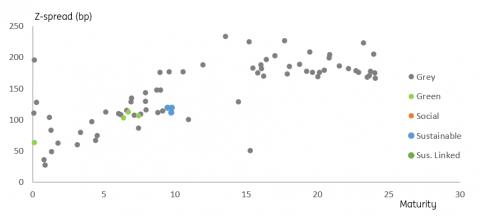

The spectrum of the type of ESG issuance has also been wide and ranging. Green bonds remain the most popular ESG vehicle, but there is an ongoing smattering of sustainability and sustainability-linked issuance happening on an ongoing basis too. And there has been some US corporate social bond issuance too – not much, but it helps complete the full array. The growth area of late has been in sustainability-linked issuance, although green issuance continues to dominate.

It has also been quite a wide-ranging market in terms of sector. ESG issuance in autos remains popular, and in energy, which is reflective of the quest to be seen as more ESG responsive than they might have been historically. ESG issuance has also been spanning other sectors ranging from food and beverage, real estate, transport, technology, pharmaceuticals and finance, and across a myriad of maturities all the way out to 30yrs, with the 10yr being the most popular.

ESG may be buy and hold, but there's no evidence they lack liquidity

We find that the ESG lines do tend to end up at accounts that are more minded to hold the paper on books rather than churn them through numerous buy/sell opportunities. At the same time, there is no clear evidence of a difference in bid/offer spreads in ESG lines relative to grey ones. While there may be individual and unique circumstances where there is a difference, in the vast majority of cases there is no discernible difference based on where traders price them on the secondary market.

In certain situations, there has been some evidence of greeniums in US corporate paper shrinking as credit spreads widened, especially during the recent spate of widening seen at the end of February and early March when the Russia/Ukraine war really hit the marketplace. While this would suggest that ESG lines suffered from a degree of illiquidity, in many cases it has been the opposite. In fact, the ESG lines were the easier ones to get liquidity from and were thus more prone to be used as a selling vehicle when liquidations were required, causing them to underperform. As the widening became less panicky, most of the greeniums that had shrunk tended to subsequently re-assert themselves.

Example of movement of credit spread alongside the greenium (energy sector)

Macrobond, ING estimates

The greenium is persistently there, and helps, but is not not dispositive

Issuers of ESG lines and claims of ESG compliance will receive increasing credibility among investors and other stakeholders as we face the US Securities and Exchange Commission disclosure requirements that are set to be implemented in the coming years (we expect they will). While these will require quite a considerable amount of time and effort to apply, they will at the same time help to assuage sporadic greenwashing accusations. And indeed can help switch on some ESG issuance for some corporates that have not done so yet.

The greenium attainable is an attractive aspect to help take some corporates over the line. However, it has not been the determining factor for most US issuers. There could well be questions on the logic of ESG issuance were they to persistently trade at a discount to grey bonds. But for now, that does not tend to be the case. Rather the ESG market tends to come with a virtual guarantee of tight launch versus adjacent grey lines, and typically through to exhibit a greenium.

Moreover, our analysis of the secondary market shows that the greenium persists, with ESG lines tending to remain through adjacent grey yields as they roll down the curve. The basis point differential is also not that responsive to maturity, although that clearly means that the value of the greenium is more pronounced for longer maturities when expressed in price terms. A happy medium remains in play where issuers are keen to issue and investors invest at yields that tend to be through grey lines.

MENAFN07042022000222011065ID1103974171

Author:

Padhraic Garvey, CFA

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.