Evergrande default fears spread to HK banks

(MENAFN- Asia Times) China Evergrande Group, the mainland's largest and the world's most indebted property developer, is back in the news amid new market fears it may default on its debts.

The firm's shares bounced 7.9% on Thursday on news it had reached a settlement to unfreeze a 132 million yuan (US$20.4 million) project loan with a mainland bank. Evergrande's shares are down 48% this year. Evergrande's offshore notes due 2025 fell to as low as 47 cents on the dollar early Thursday.

Mainland media reported on Monday that China Guangfa Bank Yixing Sub-branch had filed a civil case to freeze a 132 million yuan loan in the account of Yixing Hengyu Real Estate Co Ltd, a subsidiary of Evergrande's Jiangsu branch.

Evergrande's shares slumped by 16.3% to HK$8.18 on the news that day. They fell to as low as HK$6.93 on Tuesday, the lowest level seen since March 2017.

Evergrande said in a filing to the Hong Kong stock exchange on Monday evening that the 132 million yuan deposit was a project loan extended by China Guangfa Bank to Yixing Hengyu Real Estate and would only become due on March 27, 2022.

The Shenzhen-based company said it would consider taking legal action against the bank for reputedly abusing a pre-litigation asset preservation process.

Some believe the company will come under new pressure unless it accelerates asset sales, finds new strategic investors or manages to secure a state bailout. Authorities have sought to discourage speculative investment in property in recent years, so it's not clear the state will lend a helping hand – though Evergrande is seen by some as“too big to fail.”

Panic has arguably spread to Hong Kong's commercial banks in the past two days. According to media reports, HSBC, Bank of China Ltd's Hong Kong unit, Hang Seng Bank and Bank of East Asia have all refused to offer mortgage loans to buyers of Evergrande's properties in the city.

Evergrande is currently selling apartments at The Vertex in Sheung Sha Wan and Emerald Bay Phase 2 in Tuen Mun. Since May, about 58 people have bought unfinished flats there. Evergrande said Thursday that they would allow buyers to delay their payments by 60 days and waive the interest for the period if they failed to raise mortgage loans.

The Vertex under construction in Hong Kong's Sheung Sha Wan district. Image: Twitter

Ivy Wong Mei-fung, managing director of Centaline Mortgage Broker, said banks had internal systems to assess the risks of whether a particular property developer could complete its projects. Wong said, from the perspective of commercial banks, it's riskier to offer mortgage loans for unfinished residences than completed ones.

She said Evergrande's case was particular to recent negative news and that Hong Kong's banks had remained active in the wider residential mortgage loan market.

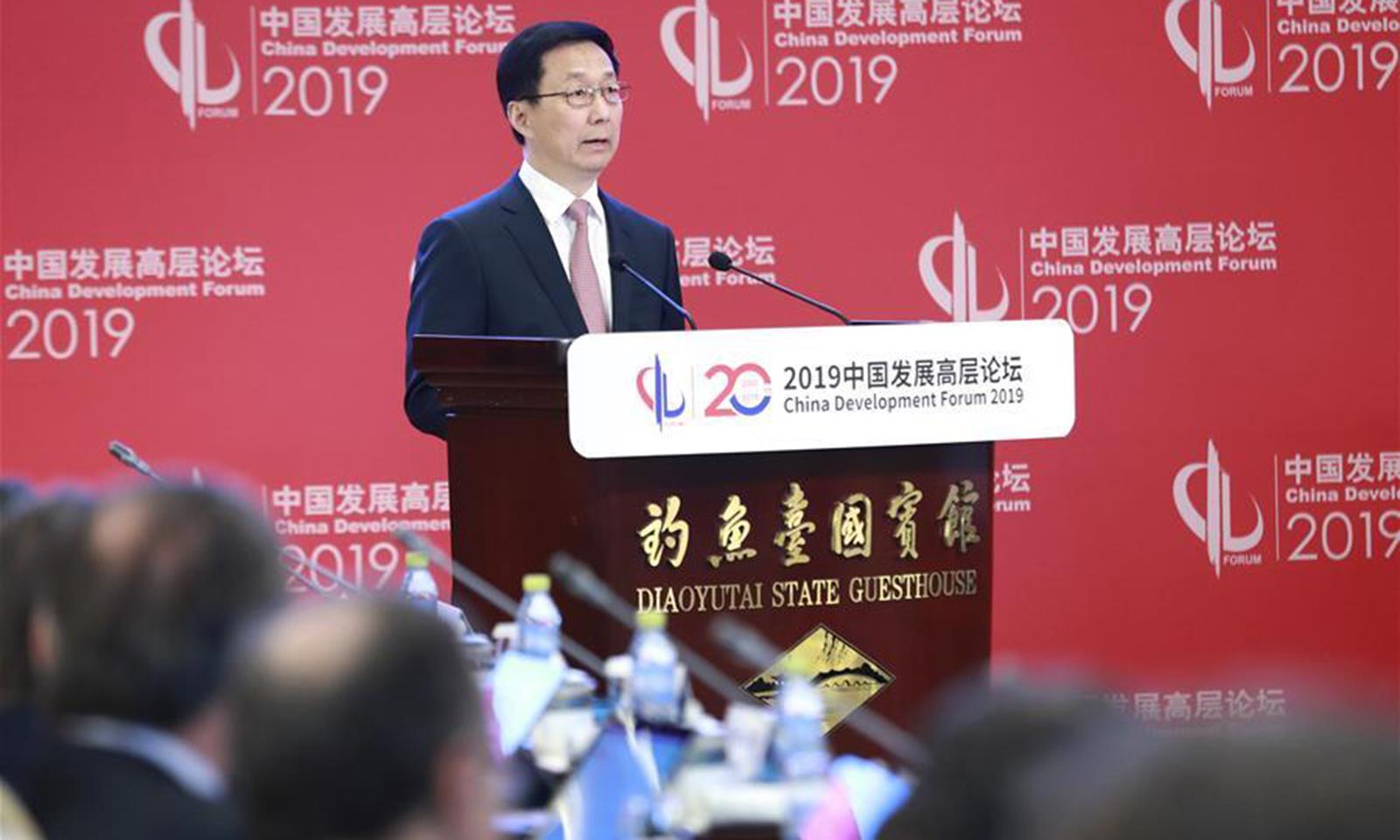

But warnings are coming from on high. On July 24, 2020, Chinese Vice Premier Han Zheng said in a work meeting that houses should be built for living, not speculation. Han said banking regulators should closely monitor all property loans and prevent them from flowing irregularly into the property market.

Nearly a month later, the People's Bank of China (PBOC), the central bank, and the Ministry of Housing and Urban-Rural Development launched new guidelines for property developers to fulfill certain requirements if they plan to take out loans.

As the country's largest property developer by sales, Evergrande faced a huge challenge to replenish its cash flow due to its high gearing ratio. Moreover, it was forced to repay 130 billion yuan of debt to its strategic investors after its plan to get listed in the A-share market through a back-door listing was scrapped last year.

Chinese Vice Premier Han Zheng says houses should be built for living, not speculation. Handout.

Last September, mainland media reported that Evergrande had sent a letter to the Guangdong government seeking help with its debt problems. It said a failure to resolve the problems could cause systemic risks to the banking system.

Finally, strategic investors agreed to give up the redemption of the loans they offered to Evergrande in exchange for ordinary shares. However, Evergrande denied that it had sent out such a letter.

To lower its debt ratio, Evergrande has accelerated its sales plan this year by offering discounts of up to 40% on some of its projects to homebuyers.

According to a July 18 research report by CCB International Securities, Evergrande's debt was reduced by 150 billion yuan to 570 billion yuan during the first half of this year. The company's net gearing was lowered to below 100% as of June, based on CCBI's estimate.

“Despite concern over its 206 billion yuan bills payable, we believe a large-scale delinquency is unlikely considering the responsiveness shown by Evergrande management,” Lung Siufung, an analyst at CCBI, said in the report.“The worst is likely over.”

An Evergrande project in Jiangsu province. Image: Twitter

The report said CCB International Securities is a wholly-owned subsidiary of CCBI Group, which has an investment banking relationship with Evergrande.

Simon Lee, a senior lecturer at the CUHK Business School, said Evergrande's 2020 annual report showed that its high turnover was not supported by its cash flow. Lee said there were signs that the company was borrowing new money to repay its matured debt.

Lee, who says he uses Evergrande as an example to teach students about debt analysis, said financially healthy companies should have their so-called Altman Z Scores at between 1.8 and 3.

He said Hong Kong-listed Sun Hung Kai Properties was 2.4 but Evergrande was only 0.58, which showed a high chance of going bankrupt.

Read: China moves to pinprick emerging property bubble

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment