The US economy is broken and the Fed can''t fix it

Click to read it. Buy it for just $1.00

sign-in • add your credit card once • pay as you read • no obligation

Or to Asia Times for

$100 per year or $10 per month.

Special discount rates apply for .

Already a subscriber to Asia Times? . TO READ THE FULL STORY {{ sharing.sharer }} paid $1.00 to share this story with you.Click to read it. Buy it for just $1.00

sign-in • add your credit card once • pay as you read • no obligation

Or to Asia Times for

$100 per year or $10 per month.

Special discount rates apply for .

Already a subscriber to Asia Times? . Oops, we have a problem. {{{message}}}{{#message}}{{{message}}}{{/message}}{{^message}}It appears your submission was successful. Even though the server responded OK, it is possible the submission was not processed. Please contact the developer of this form processor to improve this message. {{/message}}

Submitting…

Thanks for supporting quality journalism!

Your story will be shown in a few seconds.

(if it doesn''t, .)

Enjoy the read.

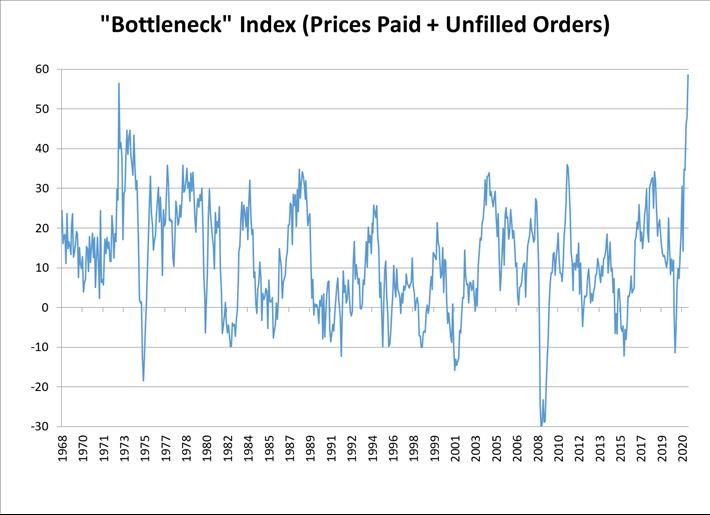

During the stagflation of the 1970s, economists devised a ''discomfort index,'' which simply added the unemployment rate to the inflation rate. In the Chart of the Day we average two of the Philadelphia Federal Reserve's diffusion indices for economic bottlenecks: prices paid for inputs, and unfilled orders.

The proportion of respondents in the Philly Fed's survey reporting more unfilled orders is the highest since 1973, and the proportion reporting higher input costs is the highest since May 1974, just after the price of oil quadrupled.

That's what happens when you throw $5 trillion of demand into an economy that hasn''t invested in capital stock and infrastructure for more than a decade. The supply chains are creaking and breaking, and there's no quick fix.

Some parts of the problem might be mitigated by sensible policy. Twenty of America's fifty states, for example, have on their own initiative canceled a federal government supplement to unemployment insurance of $300 a week.

Many unemployed workers now receive more from unemployment insurance than they previously made at work, and even more workers are receiving almost as much. That's why there are over 8 million job openings in the US, while more employers than ever before report that jobs are hard to fill.

Removing the extra unemployment benefit might help to reduce the bottlenecks. But the basic problem remains lack of capacity. The semiconductor shortage that has crippled auto production will last well in to 2023, according to industry experts.

An enormous surge in global demand for semiconductors is underway due to 5G phones (which consume about 40 % more chips than the previous generation), the internet of things, and other applications.

The investments now underway in new fabrication capacity won''t make a difference until 2023 (when the industry may face another glut as a great deal of new capacity comes on line simultaneously).

Don''t look to the Federal Reserve to fix the mess. Monetary policy isn''t the problem.

The Fed is financing the Treasury's massive deficit, partly by purchasing $120 billion a month in bonds and partly by giving the banks extremely cheap funds at the short end to buy Treasury securities with a slightly higher maturity and yield.

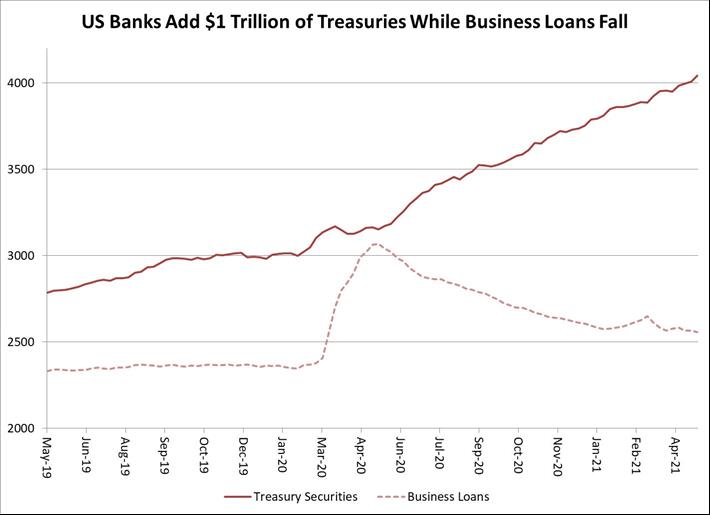

The banks have added a trillion dollars of Treasuries to their portfolios since the Covid crisis began. Except for a bump due to government-backed lending in the Spring of 2020, business loans haven''t grown.

That's very different from the last big bout of US inflation in the late 1970s, when commercial bank business loans were growing at 20 percent a year.

This isn''t a conventional business cycle driven by easy monetary policy and bank lending. It's a fiscal shock to the system – $5 trillion worth of shock. The Fed can''t do much about this as long as the Biden administration insists on running a deficit of 15% of GDP.

If the Fed tightens, the US yield curve will flatten like a pancake and Treasury bond buyers will step back to wait until the dust settles. The banks will stop buying Treasuries. Rates will shoot up, the buoyant housing market will deflate and the economy will probably plunge into recession.

So expect the Fed to wait to see how long the bottlenecks in the US economy contribute to inflation pressures. It will be a long and nervous wait.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment