(MENAFN- PR Newswire)

VANCOUVER, BC, Nov. 6, 2024 /PRNewswire/ - Vascular access is a dynamic market, brimming with innovative devices that make accessing veins and arteries easier, safer, and more effective than ever. From essential catheters used for daily blood draws and medication delivery to specialized tools for life-sustaining treatments like

hemodialysis, this market offers a wide array of solutions. Whether inserted peripherally in the arm or centrally in the jugular, these catheters are designed to meet the unique needs of every patient and procedure. Some are built for short stints, lasting just a few days, while others can go the distance for months-or even years. With a range of designs tailored to specific treatments, vascular access devices are shaping the future of healthcare, one innovation at a time.

Continue Reading

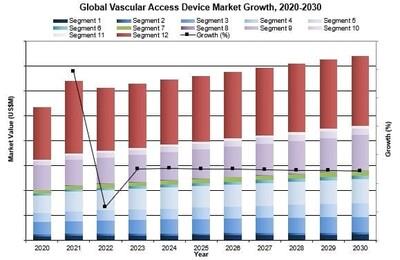

Figure 1. Global Vascular Access Market Growth (CNW Group/iData Research Inc.)

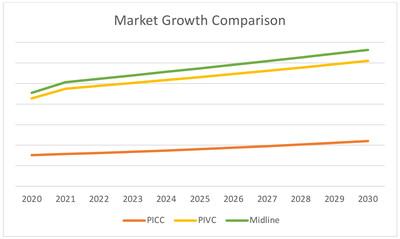

Figure 2. Market Growth Comparison Between PICCs, PIVCs, and Midlines (CNW Group/iData Research Inc.)

Figure 3. Market Share Leaders in the Global Vascular Access Market (CNW Group/iData Research Inc.)

At iData Research, we have just released our 2024 Vascular Access Report series that delivers comprehensive insights across U.S., Europe, and other global markets, spotlighting key trends, innovations, and growth drivers transforming the field. Within these reports, implantable ports, port needles, central venous catheters (CVC), peripherally inserted central catheters (PICC), peripheral intravenous catheters (PIVC), midlines, dialysis catheters, tip-placement systems, catheter securement devices, antibacterial catheter patches, catheter caps and syringe and needle markets are included.

Vascular Access Market Overview

Through a global lens, the vascular access devices and accessories market saw a steady increase in 2023, with growth expected to persist throughout the forecast period (2024-2030). In terms of the actual factors at play and contributing to this growth, there are several. Government policies are currently underway and are encouraging safer practices and products which in turn is driving innovation. Some examples are those introduced by the Centers of Disease Control and Prevention (CDC), the Occupational Safety and Health Administration (OSHA), and the Council of the European Union. Another key driver of this market surrounds the aging population. Globally, the population has been growing at just over 1% per year, with distribution shifting toward an older population due to declining mortality rates in the older demographic and reduced fertility rates in the younger demographic. Moreover, the prevalence of obesity has been increasing in certain parts of the world year over year. As the population ages and obesity rates rise, the number of individuals requiring medical care will also grow. In addition to safer practices and the aging population, technological advancements are also strongly contributing to the global vascular access market growth.

As per our most recent report, the global vascular access market grew at a low-single-digit rate from 2022 to 2023, and it is expected to continue along this trend to reach almost $15 billion by 2030.

Regional Insights

North America is the largest regional market, comprising approximately half of the total global market value. North America, more so than any other reason, is driven by advancements in technology for devices with increased safety features against needlestick injuries and infection. These types of devices tend to charge a premium over conventional devices, and increased penetration has buoyed the market in recent years. In terms of the European vascular access market, it is also expected to appreciate modestly over the forecast period. Within this market, growth is largely driven by increases in the midline, PICC, catheter securement device, extended dwell catheter, ultrasound vascular access device, vein visualization, tip-placement system and accessory, antibacterial catheter patch and catheter cap, and syringe and needle markets. However, growth will be limited by a slight decline in the market for implantable ports. Port needles, CVCs. PIVCs, and dialysis catheters are expected to be flat or slowly growing markets throughout the forecast period.

Collectively, the three largest regions – North America, Asia-Pacific and Western Europe – make up the vast majority of the total global market. The size of these markets is attributed to both high unit sales and generally more expensive devices. North America is expected to remain the largest global market throughout the forecast period.

Key Growth Trends

Technological advancements in vascular access devices, particularly those with enhanced safety features, are driving market growth. In developed regions like North America and Western Europe, there's been a strong shift toward safety-focused devices, such as peripheral intravenous catheters (PIVCs) and port needles, aimed at reducing needlestick injuries among healthcare workers and patients. These injuries can lead to complications that are both costly and time-consuming to treat, underscoring the importance of safer devices. However, in many regions, adoption of these premium-priced safety devices remains slow, largely due to limited legislation mandating their use and inconsistent enforcement in areas where laws do exist. This lower rate of conversion to safety devices is expected to pose a challenge to overall market growth in the coming years.

Additionally, long-term devices such as implantable ports, midlines, CVCs, and PICCs, are expected to be among the fastest-growing segments of the global vascular access device market. Long-term catheters are typically much more expensive than short-term devices, like PIVCs. Furthermore, there is a high degree of motivation for technological improvement in those spaces. Power-injection is a growing trend for implantable ports and PICCs, allowing for high-pressure injections, such as those required for computed tomography (CT) scans. CVCs and PICCs are more frequently being sold with coatings and technologies that make them antimicrobial or antithrombogenic, to decrease the instances of catheter-related infections. Notable growth in the markets for these high-priced devices is expected to help drive overall market growth throughout the forecast period.

Competitive Landscape

Becton Dickinson (BD) was the leading competitor in the total vascular access device and accessories market in 2023. The company derived its position in the total market from its leadership in the high-value PIVC and syringe and needle segments. PIVCs and syringe and needle products use similar components, which enables BD to establish multiple manufacturing plants all over the world. Furthermore, following BD's acquisition of C.R. Bard in 2017, the company has now obtained a leading position in many other vascular access markets, such as implantable ports, PICCs, midlines, vascular access ultrasound systems and tip-placement systems. BD is also now a notable player within the markets for port needles, CVCs, dialysis catheters and catheter securement.

3M was the second-leading competitor in the vascular access device market in 2023. The company derived its share of the market entirely from its leading position in the catheter securement market, mostly due to its catheter dressings. Its transparent dressings, specifically TegadermTM, are widely used in all global medical markets. The company's strength is a result of the fact that its products can be used with all kinds of catheters. Essentially every catheter inserted, particularly PIVCs, uses some sort of dressing, which means that unit sales of 3M's vascular access accessories are comparable to that of major players in the catheter-specific markets, such as BD or B. Braun.

B. Braun was the third-leading competitor in the vascular access device and accessories market in 2023. The company derived its leadership position from its strong presence in the implantable port, port needle, PIVC and syringe and needle segments. The company also held a notable share of the CVC market.

Future Outlook

The global vascular access devices market is expected to continue to see growth, with government policies, aging demographics, and technological advancements driving the market to reach almost $15 billion by 2030. North America was, and will continue to be, the largest regional market with Asia-Pacific and Europe following close behind. In terms of key market trends, there is a massive movement towards increased safety among devices and the technology that can do this along with long-term devices such as CVCs and PICCs. In terms of market share leaders, BD, 3M, and B. Braun are continually working to improve upon their current offerings and strong positions within their current market segments to maintain their dominance.

For more information on the vascular access market, please visit one of the following links depending on your geographic interest:

Global Vascular Access Market | 2024-2030

Europe Vascular Access Market | 2023-2029

U.S. Vascular Access Market | 2023-2029

SOURCE iData Research Inc.

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

MENAFN06112024003732001241ID1108857818