Weak US Jobs Report Confirms Fed Has Increasing Room To Cut Rates

| 12,000 |

US jobs added in October

Nonfarm payrolls plunge |

| Lower than expected |

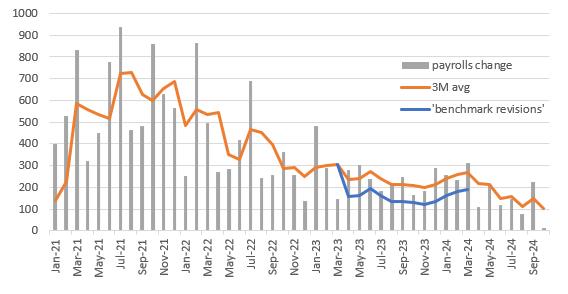

The October jobs report shows payrolls increasing by just 12k while there were net downward revisions of 112k to the previous 2 months. This was versus a consensus forecast of 100k that took into account the prospect of weakness from significant strike action during the month and a measurement hit due to hurricane-related disruption. Unemployment remains at 4.1%, as expected, while wages rose 0.4% month-on-month.

Monthly change in non-farm payrolls (000s)

Source: Macrobond

We knew strikes were going to subtract 44k from the total, but we were somewhat in the dark on the hurricane hit. The Bureau of Labour Statistics states, "The initial establishment survey collection rate for October was well below average. However, collection rates were similar in storm-affected areas and unaffected areas.... It is likely that payroll employment estimates in some industries were affected by the hurricanes; however, it is not possible to quantify the net effect". There will be a corresponding rebound in November.

As for the details, private payrolls fell 28k, led by a 46k drop in manufacturing, where the Boeing strike (-33k) played a major role. Temporary help fell 49k, with leisure and hospitality down 4k. Government hiring continued apace, rising 40k (maybe some new election workers here), while private education and healthcare services rose 57k.

Fed has increasing room to cut ratesRegarding the Federal Reserve, the downward revisions are significant, and today's number more closely matches survey evidence from the likes of ISM, the NFIB and Homebase. Remember, too, that the BLS admits to overstating employment by a third in the April 2023-March 2024 period, and there is concern that there continues to be a structural over-estimation. There are also some concerns about the quality of the jobs being added, which appear to be focused on more part-time, lower-paid roles. The chart below shows full-time employment continues to fall in YoY terms, with the gains coming from part-time jobs.

Changes in employmentYoY% change in full-time employment and part-time employment with recessions circled

Source: Macrobond

Given the inflation backdrop is less threatening and the Fed is putting more emphasis on jobs, today's report cements expectations for a 25bp Fed rate cut next week. We expect that to be followed up by another 25bp rate cut in December.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment