Octa Broker Forecast: What Factors Will Affect The Gold Rate In India

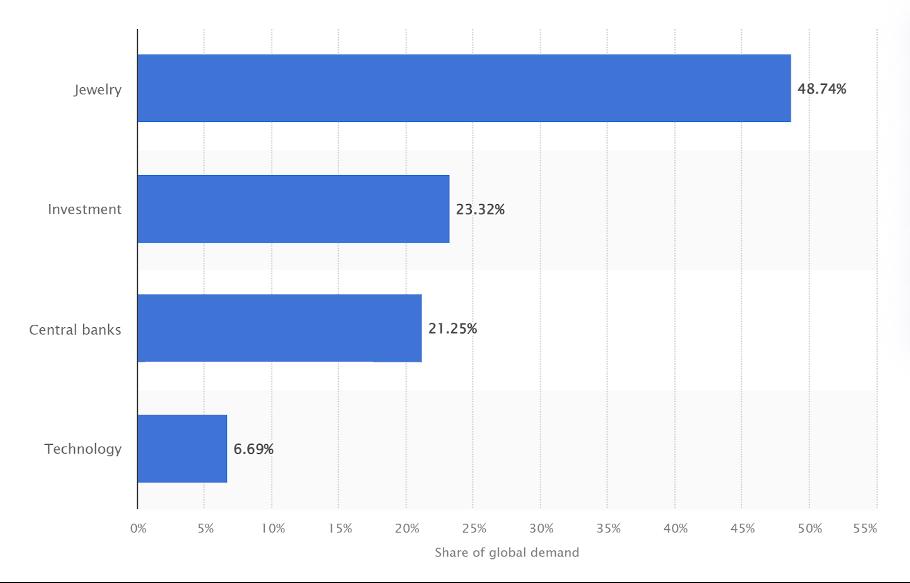

Just over 48% of mined gold is used to make jewellery. The metal is regarded as one of the most popular precious metals and jewellery production accounts for the largest share of global gold consumption. Major jewellery markets include India and China, where gold jewellery is used as a store of value. However, rising prices tend to result in reduced demand for gold used in jewellery production in these countries. About a quarter of mined gold is used for investments: bullion bars, investment coins, indirect ownership through exchange-traded funds (ETFs), and other products. Gold also plays an important role in asset diversification in the foreign exchange reserves of various countries' central banks, accounting for 21% of mined gold.

Only 6% of mined gold is used in industry. It is little used in electronic equipment, so industrial demand does not significantly affect the price.

It is worth considering that gold is a rare metal with limited reserves. Fewer and fewer deposits can be mined cheaply using open-pit methods, likely reducing production and creating a shortage on the market, which could increase its price in the long term.

Gold is not just an exchange-traded commodity, but also an important economic indicator. In addition to supply and demand, there are several macroeconomic factors that strongly influence its price. Since gold is traded in U.S. dollars, these influential factors are often linked to the U.S. economy. This includes:

- inflation government bond yields the dollar exchange rate confidence in the U.S. economy.

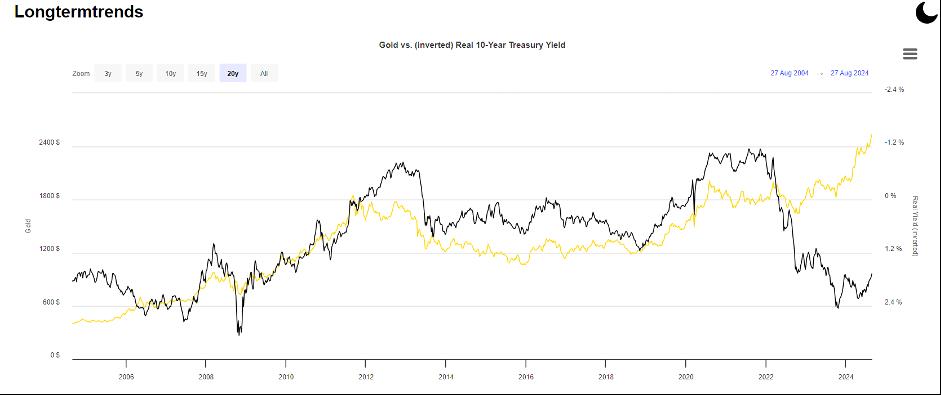

As a close example, let's look at gold's relationship to the real interest rate. The scale of expected 10-year U.S. real interest rates is inverted for convenience. The graph shows that the expectation of real interest rate growth negatively affects the price of gold.

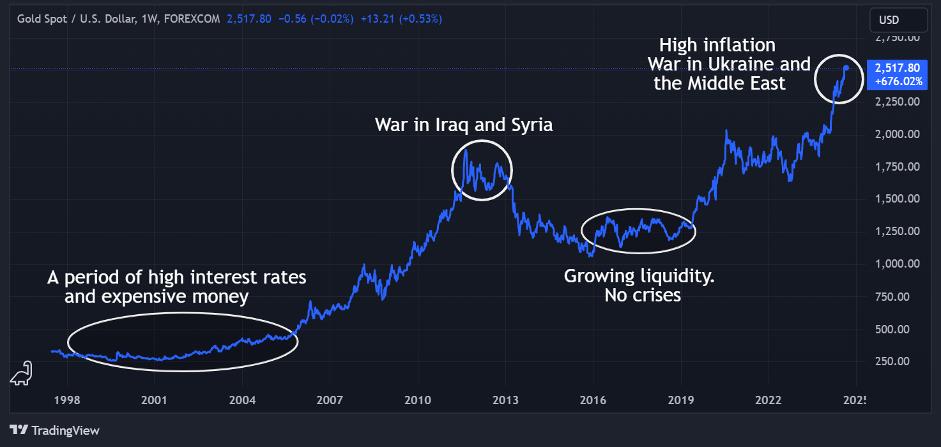

The chart below shows the price fluctuation of gold across the past several years and the events which have influenced the market.

The many peaks and dips in the chart represent times when the price of gold was influenced by decisive factors. For example, gold ended the first half of 2022 at $1,817 per troy ounce. Initially, the price rose as the conflict in Ukraine unfolded, and fears related to the conflict and the restriction of currency circulation created a frenzy of demand. Investors started to use gold to reduce their risks. However, investors' attention eventually shifted to higher bond yields and the price of the metal returned to its previous position.

Emerging growth drivers

Strong market sentiment suggests that the Fed will soon start cutting rates because of the risks of a global recession. When interest rates are low, government bond yields are also low. Then the demand for gold rises, and with it the price.

Non-Western central banks, which are buying the metal for their reserves to diversify and reduce credit risks, are bolstering the price of gold. These purchases have accelerated to record levels in recent years, with China and Russia purchasing the most, followed by India, Turkey, and Brazil. It is also worth noting that demand for gold jewellery remains at high levels.

Gold tends to rise during periods of economic and financial instability. Many events have contributed to this, including the ongoing conflicts in Ukraine and the Middle East. For example, from January 2024 to the beginning of August, the price of gold rose by 15.2%, reaching its maximum value of $2,530 per troy ounce in August. Once the conflicts in Ukraine and the Middle East subside and the markets calm down, gold prices may decline.

Key reasons for gold price growth in India

According to Octa broker financial market analyst Kar Yong Ang, the situation in South Asia and India will play a key role in gold price growth in 2025.

1. Weakening of the rupee. Due to the measures taken by the Reserve Bank of India, the rupee may appreciate to 81-82 INR by the end of 2024, leading to an increase in the demand for gold by the end of the year.

2. India's status as the world's largest consumer of gold. Demand is traditionally driven by cultural and religious traditions, and the high global gold price reflects how gold is seen as a symbol of prosperity and wealth for South Asians.

3. Largest ever reduction in customs duty. The reduction on gold came into effect on 24 July, as well as tax incentives for long-term investors in gold assets.

Overall, the gold market may see a rising trend for the next few months. Indeed, according to a forecast by Citi, gold prices could soar to $3,000 an ounce in 2024-2025.

About Octa

Octa is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services already utilised by clients from 180 countries with more than 42 million trading accounts. Free educational webinars, articles, and analytical tools they provide help clients reach their investment goals.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

Octa has also won more than 70 awards since its foundation, including the 'Best Educational Broker 2023' award from Global Forex Awards and the 'Best Global Broker Asia 2022' award from International Business Magazine.

Contact:

Iana Maes

PR manager

...

Disclaimer: This content is provided by the Octa. The statements, views and opinions expressed in this column are solely those of the content provider.The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

Photos accompanying this announcement are available at:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment