(MENAFN- PR Newswire)

BOSTON, Sept. 11, 2024 /PRNewswire/ -- AccountTECH , a leading accounting software and financial analysis firm for the Real estate industry, has released a benchmark report detailing labor costs for the first six months of 2024.

Labor cost benchmark in 2024

Continue Reading

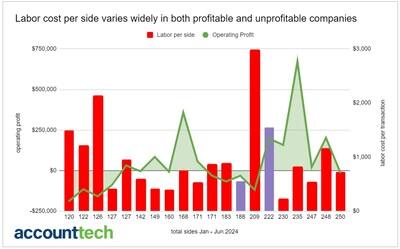

Labor cost per transaction varies widely between companies - even with similar numbers of closed transaction sides. The study found that labor cost per side has no direct correlation to net profitability.

The study analyzed labor costs for brokerages from January to June 2024 . The study included 100 randomly selected companies known for maintaining accurate GAAP protocols and excluding brokerages that inflate profitability through broker/owner personal sales. Collectively, these 100 companies closed 51,769 sides with 17,749 agents in the period.

Key Findings: Labor cost per Transaction

The analysis reveals that the

average labor cost per transaction surpassed $900.

In this study, the average labor cost per transaction was $919.50 for the first 6 months of 2024.

For profitable companies in the study, the average labor cost for the period was $821 per side.

For unprofitable companies in the study, the average labor cost was $1,046 per side.

Labor cost per Transaction does not predict profitability

Labor costs per transaction don't necessarily correlate with profitability, which came as a surprising discovery. In the companies studied, as the number of closed transaction sides increased, total labor costs did not increase. Conversely, as the number of closed transaction sides decreased, total labor costs did not decrease. Overall, labor cost appears to have no direct correlation to the number of transactions closed in any given period.

Other unexpected findings include the following:

high labor costs did not indicate that a company is closing more transactions than other test subjects with lower labor costs.

higher transaction counts do not necessarily mean that a brokerage will have increased profitability

Here is an example that highlights the inconsistencies:

One company in the study closed 248 sides in the study date range with a labor cost of $1,150 per transaction. This company was profitable with a 4.52% EBITDA margin

Another company in the study closed 250 sides in the same period with a labor cost of $723 per transaction. This company (37% lower costs per transaction) was unprofitable with a loss of negative -0.05% EBITDA margin

Labor costs are, by far, the largest expense category for all Real Estate brokerages. However high labor costs do not always predict unprofitability. A review of the profitable companies in our study shows that 24.14% had very high labor costs - ranging from $1,100 to $4,400 per side - and yet they were still profitable.

Analysis

Brokerages have long focused on increasing transaction count by increasing agent count. If transaction counts are increasing or agent counts are increasing, one would expect that costs per agent and costs per transaction should decrease proportionally - but in our analysis, that correlation does not seem to exist. Here is a graph of 20 companies in our study. If you look at the companies highlighted in purple.

One company in the study closed 188 sides with a labor cost per side of $550. This company lost $32,000 thru June 30th, 2024.

Another company in the study closed 222 sides with a labor cost per side of $1,547. This company had a profit of $197,500 thru the same period.

Comparing Real Estate brokerages to themselves over time, in our study, we did not find that labor costs per transaction decreased significantly in periods of rapid agent count growth. This appears to be due to brokerages growing through acquisitions - and experiencing labor cost increases because of the staff overhead that comes with all M&A activity.

Joe Peront, CFO of Century 21 Northeast has long understood the challenge of real estate brokerage labor costs. These costs have a rigidity that keeps them from adjusting to changing markets. Joe writes: "When analyzing a brokerage's ability to be profitable, I've found that adopting a cost accounting approach offers valuable insights. I start by viewing each transaction as a product being produced. The costs involved in delivering this "product" can be effectively broken down into two categories. The first category encompasses fixed costs, such as rent, utilities, insurance, software, and accounting. The second, more critical category includes variable costs like labor for compliance, training, marketing, and agent management.

AccountTech's recent analysis uncovers two key findings. First, it demonstrated that, despite variations in brokerage size and closed transaction count, there exists a constant and predictable range for the metric of labor costs. Second, it shows that we, as an industry, are failing to adjust labor cost up or down in response to the number of closed transactions. These insights are key to understanding and optimizing profitability across the industry."

Commentary

"Our industry is at a pivotal moment in terms of labor cost management," said Mark

Blagden, CEO at AccountTECH. "Our analysis indicates that the average labor cost, when evaluated on a per transaction OR a per agent basis, has reached unprecedented levels - but these KPI are not predictive of profitability. The study shows that companies maintain static labor cost expenditures even when transaction sides or agent count are trending lower. This in-elasticity of labor overhead is decreasing profitability. Since labor is the number one cost to brokerages, the industry needs a new way to benchmark for labor cost that isn't based on transaction count or agent count. Changing the way we budget for labor is crucial for companies aiming to optimize profitability"

Summary

Labor cost is a remarkably accurate predictor of profitability. The challenge is that trying to forecast profitably based on agent count or closed transaction sides isn't profitable.

This study revealed that the only reliable predictor of brokerage net profitability is labor cost as a percentage of total revenue. While the KPI is not intuitive, we found that this formula appears to be able to accurately predict a brokerage's net profitability percentage - just based on labor costs. It turns out that if you know a Real Estate brokerage's labor cost, you can know your net profit in advance.

AccountTECH subscribers should look for the complete study results and forecasting tools to appear in the Spotlight section of their darwin software.

Related Article

Brokerages are working toward decreasing costs. One critical issue facing the industry is the need to create an overhead structure that can become less expensive when sales are down - but staff up quickly when needed. One solution that many brokerages are turning to is outsourcing. Read this survey released by AccountTECH that shows outsourcing the Real Estate office accounting can decrease accounting labor costs by 90%.

About

AccountTECH

For over 25 years, AccountTECH's team of real estate accountants and software engineers have been building tools that increase the efficiency of brokerages. Their latest flagship product is darwin - a 4th generation evolution of their popular back office accounting software. The team is constantly adding automation and integrations towards the goal of single-point-of-entry. Their motto is: data entry can happen anywhere, but everything winds up in darwin. In their work with clients, partners and each other, they bring integrity to every interaction and every line of code.

AccountTECH (978) 947-3600

For sales inquiries, please contact:

Theresa Hurt [email protected]

(978) 710-0071

Media contact:

Rizza Batol

[email protected]

978.710.0071

SOURCE AccountTECH

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

MENAFN12092024003732001241ID1108666994

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.