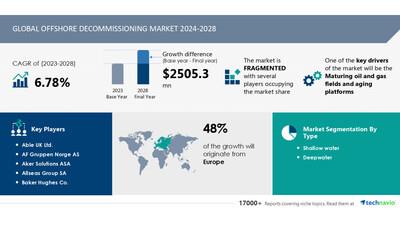

Offshore Decommissioning Market Size Is Set To Grow By USD 2.50 Billion From 2024-2028, Maturing Oil And Gas Fields And Aging Platforms Boost The Market, Technavio

| Offshore Decommissioning Market Scope |

|

| Report Coverage |

Details |

| Base year |

2023 |

| Historic period |

2018 - 2022 |

| Forecast period |

2024-2028 |

| Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

| Market growth 2024-2028 |

USD 2505.3 million |

| Market structure |

Fragmented |

| YoY growth 2022-2023 (%) |

6.23 |

| Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

| Performing market contribution |

Europe at 48% |

| Key countries |

US, UK, Germany, Denmark, and China |

| Key companies profiled |

Able UK Ltd., AF Gruppen Norge AS, Aker Solutions ASA, Allseas Group SA, Baker Hughes Co., Boskalis, DeepOcean Group Holding BV, DNV Group AS, Halliburton Co., Heerema International Group, John Wood Group PLC, Oceaneering International Inc., Perenco, Petrofac Ltd., Ramboll Group AS, Saipem S.p.A., Schlumberger Ltd., Subsea 7 SA, TechnipFMC plc, and Weatherford International Plc |

Market Driver

The global shift towards renewable energy sources, such as wind, solar, and geothermal, is driving economic, social, and environmental development. According to the US Energy Information Administration, renewable energy consumption is projected to grow at an annual rate of 3.1% between 2018 and 2050, compared to 0.6% for petroleum and other liquids, 0.4% for coal, and 1.1% for natural gas. This trend is hindering the growth of the oil and gas industry, creating opportunities for the offshore decommissioning market. Countries like the Philippines are leading the way, with Mindanao's power mix expected to increase its renewable energy share from 40% to further increase during the forecast period. Fluctuating crude oil prices, depleting resources, and environmental concerns are also fueling the demand for clean energy sources. The European Union aims to reach a 27% renewable energy share by 2030, reducing dependence on fossil fuels for power generation. This shift will decrease the number of new oil and gas drilling projects and minimize the adoption of Enhanced Oil Recovery methods. Investments in renewable energy will positively impact the offshore decommissioning market, as the need for decommissioning oil and gas wells increases.

Offshore decommissioning refers to the process of safely removing and disposing of obsolete oil and gas infrastructure in the sea. This market is currently experiencing trends in liability management for abandoned oil wells and pipelines, conductors, and sub-infrastructure. The primary and secondary phases involve platform preparation, permitting and regulatory approval, conductor and platform removal, materials disposal, and site clearance. Technologies like enhanced oil recovery through gas injection and polymer insertion are used. Project management, engineering, and permitting are crucial. Derrick barges, pipeline decommissioning, power cables, and manufacturing facilities are key components. Operational costs increase with shallow, deepwater, and ultradeepwater depths. Natural gas and crude oil prices impact the market. International footprints face challenges from lockdown measures and quarantine restrictions. Skilled operators are essential for cement plugs, wellbore, reservoir, and fluid-bearing formations. The supply chain includes billions in costs for abandoned oil wells.

Discover 360° analysis of this market. For complete information, schedule your consultation -

Book Here!

Market

Challenges

-

Offshore oil and gas wells with maturing or aging assets can become costly non-performers, as operating expenses surpass revenue generated. The

OSPAR Convention assigns decommissioning responsibility to the well owner, adding to the challenge. Decommissioning costs depend on the weight of materials to be removed, which is a significant expense. Transparency and communication between industry and government, as well as stakeholder consultation, are essential. However, the precise calculation of decommissioning costs is complex due to factors like material condition changes, risks, market volatility, personnel loss, industry experience, supply chain inflation, information management systems, and technical data. These variables contribute to the high cost of offshore decommissioning projects, potentially hindering market growth during the forecast period. Offshore decommissioning involves retiring obsolete offshore structures and sub-infrastructure, including pipelines, conductors, and platforms. The primary and secondary phases include platform preparation, conductor removal, and platform removal. Challenges include liability, permitting and regulatory hurdles, and project management. Depth is a factor, with challenges in shallow,

deepwater, and ultradeepwater depths. Offshore regions face unique issues like operational costs, natural gas, and abandoned oil wells. Engineering and permitting are crucial, as are derrick barges for pipeline decommissioning and power cable removal. International footprints bring logistical challenges due to lockdown measures and quarantine restrictions. Crude oil prices and supply chain disruptions also impact the market. Skilled operators are needed for cement plugs, wellbore abandonment, and reservoir management in fluid-bearing formations.

For more insights on driver and challenges

-

Request a

sample report!

Segment Overview

This offshore decommissioning market report extensively covers market segmentation by

Type-

1.1 Shallow water

1.2 Deepwater

-

2.1 Well plugging and abandonment

2.2 Platform removal

2.3 Permitting and regulatory compliance

2.4 Platform preparation

2.5 Others

-

3.1 Europe

3.2 North America

3.3 APAC

3.4 South America

3.5 Middle East and Africa

1.1 Shallow water- The shallow water segment of the global offshore decommissioning market is expected to experience significant growth due to several factors. Traditionally, shallow water was defined as water up to 400-500 feet (122-152 meters) deep. Jackup rigs, submersibles, and drill barges are commonly used for decommissioning in this segment. Jackups, which can rest on the seabed, are the most practical option for water up to 400-500 feet deep. Their age, specifications, location, and weather conditions determine their suitability. As jackups with deeper capabilities compete with semi-submersibles, cost becomes a critical factor. Submersibles, which can operate in very shallow water, are lifted out of the water before transportation. Extremely shallow water, such as inland lakes, is suitable for drill barges, which are towed by tugboats and lack the clearance above the water surface to withstand severe storms. These factors are driving the growth of the shallow water offshore decommissioning market.

For more information on market segmentation with geographical analysis including forecast (2024-2028) and historic data (2017-2021) - Download a Sample Report

Learn and explore more about Technavio's in-depth research reports

The Global Well Abandonment Services Market is witnessing significant growth due to increasing regulations on environmental safety and the rising number of aging oil and gas wells. These services are essential for safely decommissioning wells, preventing environmental hazards. Market drivers include stringent regulatory frameworks, advancements in well abandonment technologies, and a surge in offshore drilling activities. Key players in this market are focused on developing innovative solutions to enhance efficiency and reduce costs, driving further market expansion. The market is poised for robust growth in the coming years.

Research Analysis

Offshore decommissioning refers to the process of safely and efficiently dismantling and removing abandoned oil wells, platforms, pipelines, conductors, and other offshore structures. This complex and costly process involves multiple phases, including primary and secondary decommissioning. The primary phase focuses on wellbore abandonment using cement plugs and other methods, while the secondary phase involves platform removal and materials disposal.

Market Research Overview

Offshore decommissioning refers to the process of safely and efficiently removing obsolete offshore structures and infrastructure, such as platforms, pipelines, and

subsea equipment, from shallow water to ultradeepwater depths. This market is currently experiencing significant growth due to the increasing number of abandoned oil wells and aging infrastructure. The primary and secondary phases of decommissioning include platform preparation, permitting and regulatory approval, engineering, and project management. Manufacturing facilities for offshore decommissioning equipment have been impacted by lockdown measures and quarantine restrictions, causing delays in supply chain and crewmembers' availability.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

-

Type

-

Shallow Water

Deepwater

-

Well Plugging And Abandonment

Platform Removal

Permitting And Regulatory Compliance

Platform Preparation

Others

-

Europe

North America

APAC

South America

Middle East And Africa

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email:

[email protected]

Website:

SOURCE Technavio

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment