Latest stories

Evil Does Not Exist: a powerful Japanese eco-drama

Iran-US secret backchannel talks are a good sign

Xi tells Biden not to curb China's tech sector On March 29, Beijing announced a number of state-owned enterprises and conglomerates it hopes will drive China's next big foray into future-oriented sectors to make the economy less susceptible to US-led attempts to curb China's rise. They include AI, neuroscience, quantum computing, nuclear fusion and other tech-driven industries.

This“pioneer” scheme is being overseen by the State-owned Assets Supervision and Administration Commission. The aim is to deputize several conglomerates to catalyze a startup boom that creates a thriving ecosystem for a new generation of tech“unicorns.”

The commission“has given a clear mandate that developing emerging and future industries is a pivotal task,” says Lin Xipeng, an analyst with China Merchants Securities.“While cultivating start-ups and units within their ecosystems, SOEs will also tap external investment and merger opportunities.”

The key is to end the West's“chokehold” on China's tech development, says Hu Yongjun, an analyst at the State Information Center under the National Development and Reform Commission.

This, of course, raises any number of risks as the US tightens the screws. Whereas Trump imposed massive tariffs, current President Joe Biden has sharply limited China's access to semiconductors and other vital technology. Biden has also brought allies Japan and South Korea together to close ranks vis-à-vis China. And he has vowed to invest hundreds of billions of dollars to rebuild tech muscle at home.

For China, having to produce new high-tech items with less-than-cutting-edge machinery is an obvious inefficiency that has put a spanner in Beijing's up-tech plans. Even so, the quicker China puts innovation and entrepreneurship in the economy's driver's seat the better.

China's semiconductor market faces US sanctions. Image: Asia Times Files / iStockXi's inner circle is betting a segue of this magnitude will elevate Chinese competitiveness toward the level of peers in the US and Europe. Beijing also reckons it will supersize a high-income workforce to raise living standards and consumption. Then, over time, China's growth will be self-reinforcing without the need for bursts of traditional fiscal and monetary stimulus.

Not everyone is convinced it'll work, though.“The theory is that all of these investments in high-tech industries will ultimately produce very successful companies, which will be able to employ people at high wages, and that will create a lot of employment growth and consumption growth down the road,” says Arthur Kroeber, an analyst at Gavekal Dragonomics.

Yet, Kroeber cautions,“I think the problem with that is, number one, there's just no way that these new high-tech industries, no matter how successful they get, will be able to completely replace the loss of demand that you are having from a property sector that's contracting probably by somewhere in the neighborhood of 30 to 40%.”

The“second thing,” Kroeber says,“is that even if these investments in high tech pay off, and frankly I think a lot of them will, that doesn't necessarily mean that productivity across the entire economy is going to rise.”

These high-tech companies may end up accounting for a fairly small share of overall employment in the economy, Kroeber cautions. Most employment in the last decade has come from service sectors, largely from consumer-facing industries, and there's no particular reason for that to change.

“So,” Kroeber argues,“the idea that you are going to create an economy-wide productivity boom that will raise overall wages and consuming power from these high-tech investments, I think is a little bit fantastical, frankly. So when I add all of this up, I think looking forward over the next several years, what we can expect is that China will continue to struggle to maintain growth.”

Yet, all the more reason for China to forge a new, different path forward. One reason is to deal with its increasingly complicated demographic challenges. As its 1.4 billion-person population grows older and local government debt levels swell, China must act urgently to increase productivity.

David Mann, chief economist for Asia-Pacific at the Mastercard Economics Institute, argues that 10 to 20 years ago the mainland“had so much growth coming purely from just more people showing up each year” that it was able to paper over economic inefficiencies.

As such, private sector growth and economic disruption have never been more vital. The key question, as Mann sees it, is how rapidly and reliably Xi's team is“able to bring in those innovations and introduce them in a way that does keep growth a bit stronger, without needing to resort to, for example, residential real estate investment, which is not as productive.”

Speaking in Beijing last month, International Monetary Fund head Kristalina Georgieva made the typical“Washington consensus” calls for China to increase domestic demand-driven growth. But she also made a timely pitch for greater innovation and labor efficiency.

“Domestic consumption depends on income growth, which in turn relies on the productivity of capital and labor,” Georgieva explains.“Reforms such as strengthening the business environment and ensuring a level playing field between private and state-owned enterprises will improve the allocation of capital. Investments in human capital - in education, life-long training and reskilling – and quality health care will deliver higher labor productivity and higher incomes.”

Georgieva stressed such reforms are“particularly important as China seeks to seize the opportunities of the AI 'big bang.' Countries' preparedness for the world of artificial intelligence is no longer a goal for the future - it is already an issue for today.”

But, Georgieva said,“the transformation ahead is not easy. China's remarkable development success has delivered tremendous benefits to hundreds of millions of people. The younger generations, who have lived their whole lives in an environment of exceptionally high growth rates, are experiencing what many countries have experienced before as economies mature and growth

moderates.”

In recent years, Xi's efforts to champion high-tech industries, particularly cutting-edge manufacturing and service sectors , flowed from his“Made in China 2025” project. That plan is to lead the global charge on semiconductors, biotechnology, aerospace, renewable energy, self-driving vehicles, artificial intelligence, green infrastructure, logistics and other areas.

This 2025 vision dovetailed with efforts to create a kind of“Silicon Valley East” in southern China. Xi's so-called Greater Bay Area enterprise has sought to group Hong Kong and Macau with Shenzhen and eight other municipalities all angling to become economic powers of their own, namely Guangzhou, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing.

The 55-kilometer Hong Kong-Zhuhai-Macau Bridge cost more than US$15 billion to build. Photo: XinhuaThe innovation-first zeitgeist has municipal leaders around the nation getting on board in a hurry.

In January, for example, the eastern city of Hefei christened the first tranche of a series of big projects in areas including new energy vehicles (NEVs), new-generation information technology and photovoltaics. The wave of investment totals 36.7 billion yuan (US$5.1 billion).

Sign up for one of our free newsletters The Daily ReportStart your day right with Asia Times' top stories AT Weekly ReportA weekly roundup of Asia Times' most-read stories

Hefei is on the vanguard of locales for China's scheme to build 10 national research labs, each charged with a different area of specialization. In the case of Hefei, it's a quantum computing lab; in Shanghai, its a lab focused on AI pursuits.

ln the eastern Xiamen city, part of Fujian Province, more than 53 billion yuan ($7.3 billion) worth of productivity-enhancing projects in new energy, new materials and biomedicine have been greenlit.

Nearly 600 billion yuan ($83 billion) worth of contracts have been signed in central Henan Province for cutting-edge manufacturing facilities and a number of future-oriented emerging industries .

One reason such efforts matter is that they offer a path for local governments keen to get out of the land sales business. Over the years, the almost linear focus on selling and leveraging land to generate tax revenue distracted municipal leaders from developing local economies.

To be sure, none of this will be easy in the short run. Chinese provinces are at the center of Xi's efforts to deleverage the economy. Regulators are prodding banks to curb their use of mechanisms involved with offshore bonds issued by local government financing vehicles (LGFVs).

The $9 trillion

mountain of LGFVs ' debt

is a major challenge to Xi's efforts to pivot toward more productive and sustainable tech-driven growth.

In the interim, Jeremy Zook, an analyst at Fitch Ratings, says that“economically weaker regions may face further deterioration in fiscal revenue and tighten expenditures.” It's quite a balancing act, he adds, at the moment when Xi both wants to support national growth and curb runaway borrowing around the nation.

Indeed, massive state-led economic transitions of the type China is endeavoring to pull off take time and carry supersized risks. The key, though, is that Xi and Li ensure that“new quality productive forces” is more than just an empty slogan.

Shifting engines in such fundamental ways without crashing the economy will require, at least for a time, increased foreign direct investment (FDI), which just fell to a 23-year low of $42.7 billion of inflows in 2023.

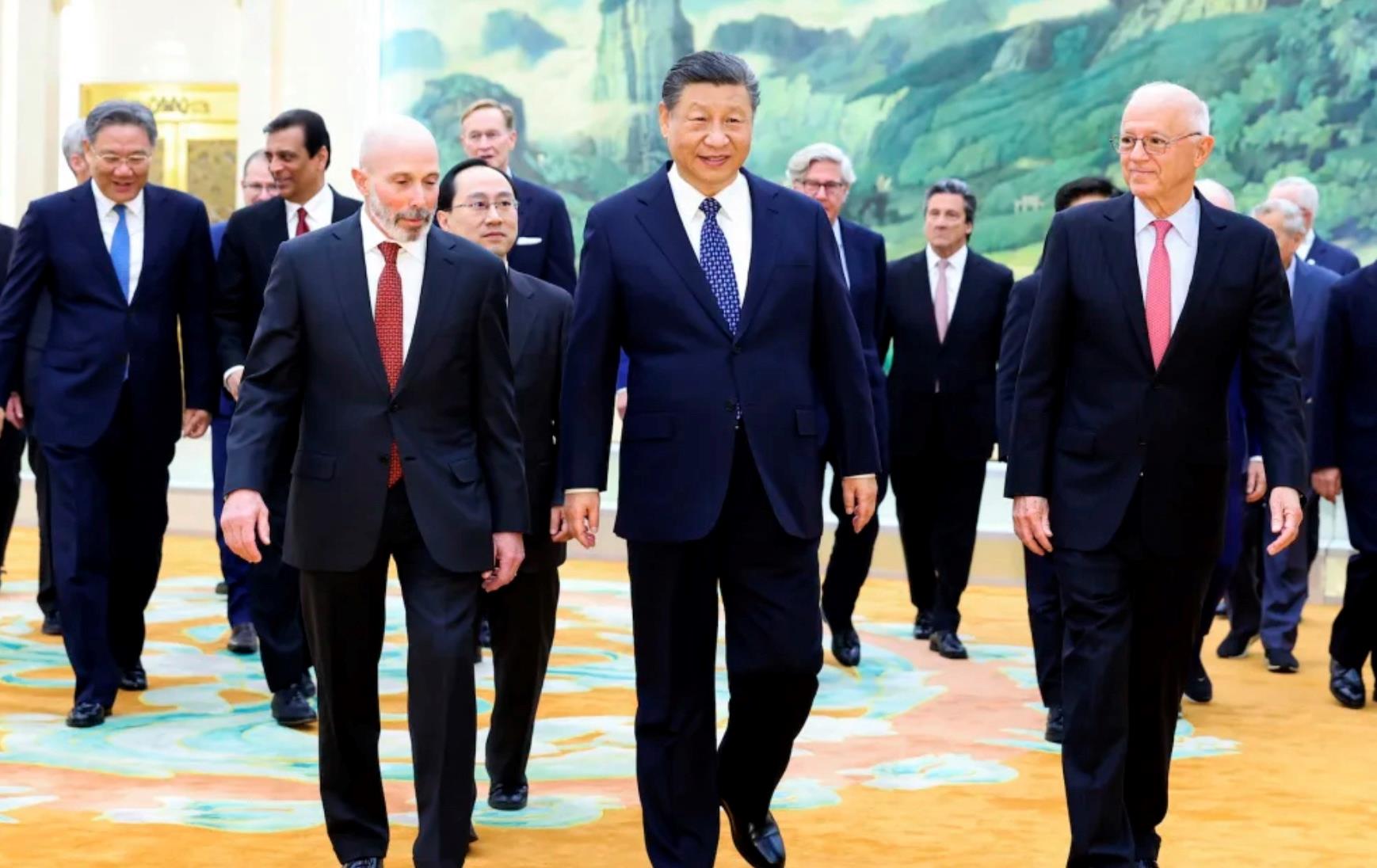

Chinese leader Xi Jinping meets with US CEOs and academics at the Great Hall of the People in Beijing on March 27, 2024. Photo: Xinhua /

Huang JingwenAnother concern being flagged by many foreign investors is that Xi's blueprint for a more innovative economy is replete with soaring rhetoric and promises but scarce on specific reform steps to build greater trust among foreign investors.

True, the $7 trillion stock market rout from a 2021 peak to January has seemingly stabilized. It's worth noting, too, that Xi recently hosted a who's-who of global CEOs from Apple's Tim Cook to Blackstone's Stephen Schwarzman to Tesla's Elon Musk to Boeing's Stan Deal to Pfizer's Albert Bourla to reassure the international business establishment.

But action in Beijing will speak louder than words. Trump hardly deserves credit for all this. But the trade war risks another Trump presidency represents buttresses the argument that China must change its economic stripes, and fast.

Follow William Pesek on X at @WilliamPesek

Already have an account?Sign in Sign up here to comment on Asia Times stories OR Thank you for registering!

An account was already registered with this email. Please check your inbox for an authentication link.