(MENAFN- ING) RBI likely on hold

We think it would be extremely unlikely that the Reserve Bank of India will make any change to their policy rates at this meeting, and like most other central banks in the region, will hold until the Federal Reserve starts easing. The policy rate will remain 6.5%, one of the highest in the region.

China PMI to edge closer to neutral

The upcoming week features a slew of PMI data across Greater China. China is up first on Sunday, where we expect a rebound in the manufacturing PMI on the month toward 49.5 to move closer to the neutral level. The encouraging start to industrial data at the start of the year also raises the possibility of an upside surprise.

We are also expecting China's non-manufacturing PMI to remain broadly unchanged at 51.4, staying in expansion. Taiwan's PMI is up next on Monday, where markets will watch to see if the manufacturing PMI can snap a 21-month streak of contraction. Hong Kong's PMI is the last of the three to be published, expected next Friday.

Additionally, Hong Kong will publish its retail sales data for February, where a strong base effect from last year's reopening could drag this year's growth numbers.

Korea's exports to advance while inflation to moderate

Korea's exports are expected to stay firm in March on the back of strong shipment of semiconductor and vessels. We're concerned that car exports may decline for a second month, which could signal that final demand from developed markets – especially from the US – is cooling down. We continue to expect strong semiconductor exports to dominate weak car exports, and an improved manufacturing PMI should support our view here. Meanwhile, consumer price growth should moderate as the Lunar New Year effect fades. However, headline inflation is expected to stay at 3% level, and the Bank of Korea is therefore likely to be on alert.

Inflation in the Philippines and Indonesia to tick higher

Price pressures are mounting in the region, with inflation in both Indonesia and the Philippines likely moving higher. Indonesia will likely see inflation settle at 3.0% year-on-year, creeping towards the top-end of their new inflation target.

Likewise, inflation for the Philippines will likely edge higher to 3.8% YoY from 3.4% in the previous month. Food inflation will likely be the driver for inflation in both economies as the drought induced by the El Nino weather phenomenon impacts crop production and overall supply of basic food.

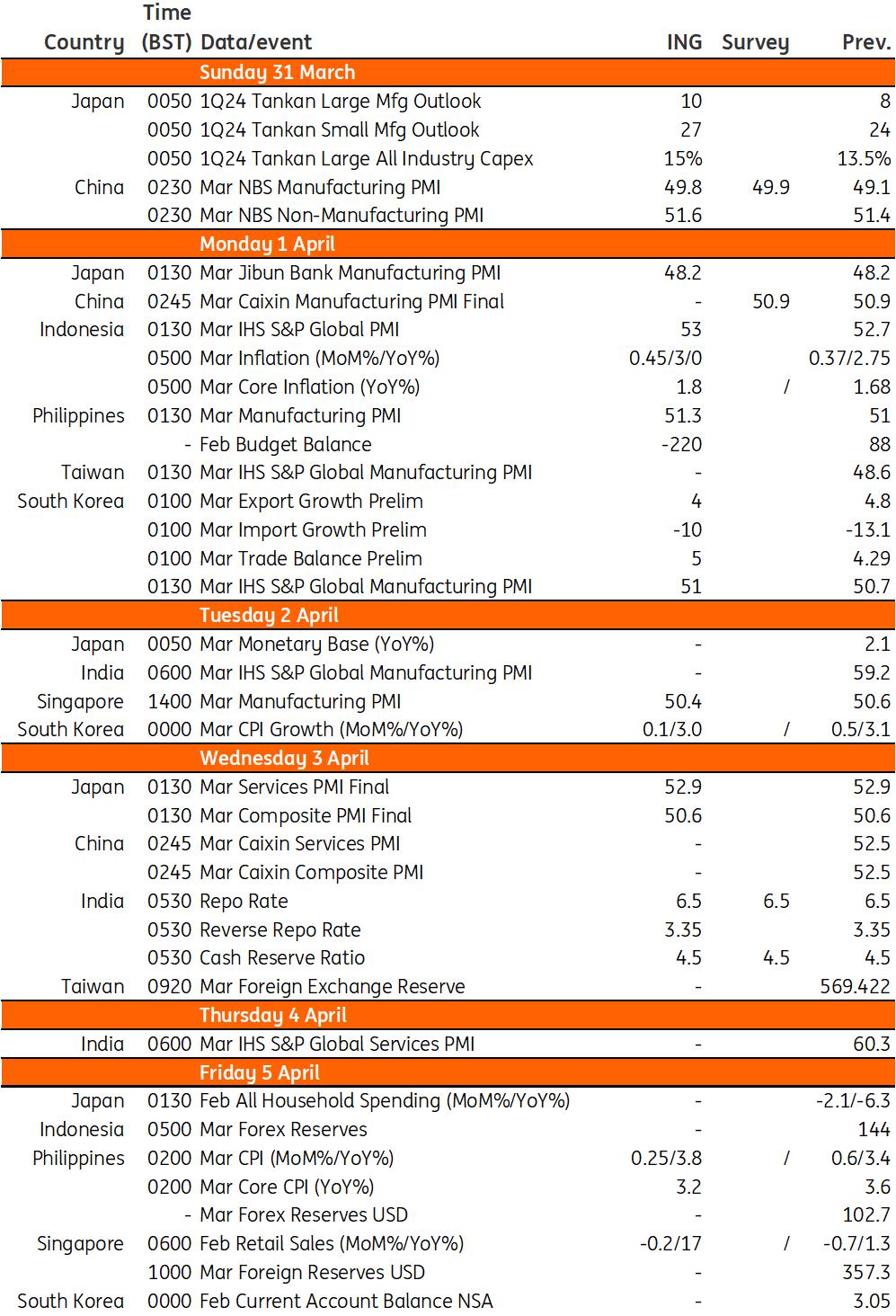

Key events in Asia next week

Refinitiv, ING

MENAFN28032024000222011065ID1108033956

Author:

Robert Carnell, Lynn Song , Min Joo Kang , Nicholas Mapa

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.