Key Events In EMEA Next Week

(MENAFN- ING) Hungary: industry and construction to lead weakness across fourth quarter GDP data

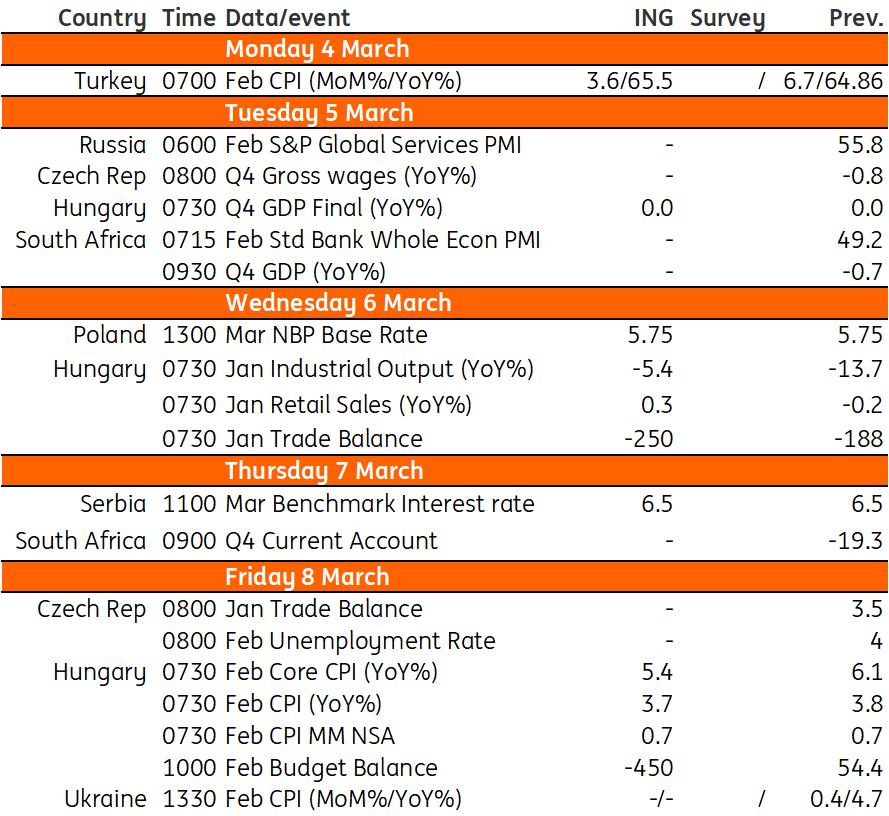

Next week will be very busy in Hungary in terms of data releases. We will see the details behind the very weak GDP data in the fourth quarter. We expect weakness across the board, led by industry and construction. After that, the focus will turn to 2024, when the Statistical Office will release the first data on economic activity for this year.

Industrial production may fall again on a monthly basis as supply chain disruptions from the Red Sea conflict hit some manufacturers in January. Retail sales may improve on food and non-food sales, while fuel consumption is expected to fall sharply as consumers brought forward consumption due to the excise duty hike in January. Given the weakness in the manufacturing sector, we are likely to see another monthly deficit in the trade balance after the downside surprise in December.

Finally, we close the week with fresh inflation and fiscal data. The excise duty hike will be reflected in February's price data and will have a significant upward impact on the month-on-month inflation rate, which we see at 0.7%. As a result, the year-on-year figure will only be marginally lower compared to January due to the high base. In the budget, we see a monthly deficit due to seasonality.

Turkey: We expect February annual inflation to come in at 65.5%

We expect Turkey's annual figure to come in at 65.5% in February (with 3.6% MoM reading) vs 64.9% a month ago. A limited slowdown in domestic demand which allows producers to pass their cost increases, implications of the minimum wage and public salary adjustments, and the rigidity in services inflation will likely be factors that weigh on the inflation outlook. February and March inflation turnouts will be key for the rate outlook as the Central Bank of Turkey has left the door open for further rate hikes in the case of a significant deterioration in the inflation outlook.

Key events in EMEA next week

MENAFN01032024000222011065ID1107923569

Author:

Peter Virovacz, Muhammet Mercan

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.