(MENAFN- Newsfile Corp)

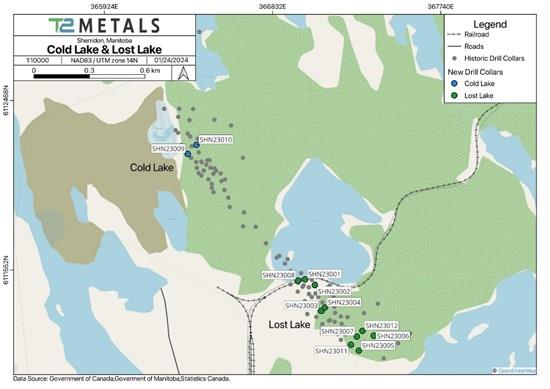

Vancouver, British Columbia--(Newsfile Corp. - March 1, 2024) - T2 Metals Corp. (TSXV: TWO) (OTCQB: AGLAF) (WKN: A2DR6E) ("T2" or the "Company") is pleased to announce a third set of results from the 2023 Q4 infill and delineation drill program at the Sherridon Project in Manitoba, that include the highest Gold grades reported from the project to date. Sherridon is a well-known Volcanic Hosted Massive Sulphide ("VHMS") camp in the Flin Flon - Snow Lake Greenstone Belt, with both a significant mining history and substantial copper-rich historical resources (see Table 4) calculated on behalf of Halo Resources Ltd in 2010. The Project has year-round road access, is 70 km from the mining centre of Flin Flon, and lies adjacent to an operating rail line.These data represent the third set of results and include 3 shallow holes from the southeast end of the Lost Lake prospect (see Figure 2), targeted on the basis of a shallow southeast plunging exploration model. Of particular note is hole SHN23005, drilled near the southeasternmost limits of the known Lost Lake resource, with very high grades of gold and copper over 23. The intersection lies only 20m below surface and includes some of the highest gold grades ever discovered at Sherridon.

The high gold and copper grades over a broad interval highlight the potential of VHMS style of mineralization in complexly folded host rocks. Gold grades have been higher than anticipated in numerous holes in the 2023 Q4 program, indicative of improved analytical methods vs prior explorers. Gold results in hole SHN23005 were re-checked with screen fire assay to overcome potential coarse gold analytical issues. Additional ground in the Sherridon area has been staked by T2 Metals in response to the results from this drilling program (see Company press release dated 22/02/24 ).

The most significant drill intersections of copper ("Cu"), zinc ("Zn"), gold ("Au"), and silver ("Ag") are provided below and in Table 2.

Drilling Highlights Include :

Lost Lake

SHN23005

23.50 m grading 1.18% Cu, 1.46% Zn, 6.8 g/t Au and 40.4 g/t Ag (7.4% CuEq) from 38.00 m;

including 4.50 m grading 0.38% Cu, 0.02% Zn, 29.2 g/t Au and 138.8 g/t Ag (25.0% CuEq) from 38.00 m;

including 8.67 m grading 2.48% Cu, 3.59% Zn, 2.5 g/t Au and 30.0 g/t Ag (5.8 % CuEq) from 50.05 m;

SHN23006

4.00 m grading 0.07% Cu, 0.42% Zn, 1.6 g/t Au and 17.6 g/t Ag (1.7% CuEq) from 154.00 m

SHN23007

6.70 m grading 0.82% Cu, 2.62% Zn, 0.3 g/t Au and 7.7 g/t Ag (2.0% CuEq) from 84.82 m

including 2.54 m grading 1.48% Cu, 5.19% Zn, 0.7 g/t Au and 14.4 g/t Ag (3.8% CuEq) from 88.98 m;

Notes:

Copper equivalents calculated using metal prices as at the first Sherrion drill press release (25 Jan 2024) (Cu $/t = 8,174; Pb $/t = 2,032; Zn = 2,487 $/t; Au = 2,020 $/oz; Ag = 22.7 $/oz) and assume 100% recovery of all elements. The formula used to calculate CuEq. = Cu(%) + ((Zn(%) * Zn(USD/t)) + (Pb(%) * Pb(USD/t)) + (Ag(g/t) * (Ag(USD/oz)/31.1) * 100) + (Au(g/t) * (Au(USD/oz)/31.1) * 100)) / Cu(USD/t) The formula used to calculate ZnEq. = Zn(%) + ((Cu(%) * Cu(USD/t)) + (Pb(%) * Pb(USD/t)) + (Ag(g/t) * (Ag(USD/oz)/31.1) * 100) + (Au(g/t) * (Au(USD/oz)/31.1) * 100)) / Zn(USD/t)

"Reported drill intercepts are downhole core lengths with true thickness estimated to be at least 90% of core downhole length."

The 2023 Q4 drill program saw 12 holes drilled with 10 intersecting intervals of semi-massive or massive sulphide from the Lost Lake and Cold Lake prospect areas. The exceptional thickness of mineralization in hole SHN23005 may be associated with a range of factors, including late remobilization of Au, Ag and Pb into the hanging wall of the VHMS system (analogous to the Chisel Lake Basin VHMS deposits found 70 km to the southeast) following intense regional deformation and metamorphism that effectively thickened the host horizon, and present a new targeting opportunity.

Mark Saxon, CEO of T2 Metals Corp., said, "This set of high gold drill results from the southeast end of the Lost Lake prospect represent a key moment for the Sherridon project. Gold-rich and gold-dominant VHMS deposits are well known from the Flin Flon - Snow Lake Greenstone Belt and form very attractive targets. The grade and thickness of SHN23005 demonstrates the quality of mineralization that can exist at Sherridon, presenting new targets throughout the project area.

The Sherridon project is a relatively underexplored part of the Flin Flon - Snow Lake Greenstone Belt, particularly with respect to deep drilling and targets similar to that drilled in SHN23005 lay completely untouched. We are very encouraged by the success of our exploration programs to date, along with the support of the Kiciwapa Cree and the Manitoba Mineral Development Fund (MMDF)."

Figure 1. Mineralization textures from drillhole SHN23005 (37 to 53 depth), Sherridon drill program, 2023.

To view an enhanced version of this graphic, please visit:

Twelve holes for a total of 1,500 metres were completed by T2 Metals during Q4 2023, testing a total strike length of 1,420 metres within, between and southeast of the Cold Lake and Lost Lake Deposits. These two deposits occur along a VHMS horizon that is both parallel to and normally less than 850 metres perpendicular to the VHMS horizon that hosts Sherritt Gordon's historic Sherridon East and Sherridon West Mines, where 7.74 million tonnes were mined at an average grade of 2.46% Cu, 2.84% Zn, 0.6 g/t Au and 33 g/t Ag (Goetz & Froese, 1981) between 1931 and 1951.

The Lost Lake and Cold Lake zones comprise a continuously mineralized horizon over a known strike length of approximately 1.8 km. The current T2 Metals drilling campaign further delineates shallow-dipping and plunging massive sulphide lenses and extends the historical drilling results by the previous explorers. It is also important to note that the while the Sherridon area is spatially and genetically associated with the prolific Paleoproterozoic Flin Flon - Snow Lake Greenstone Belt ("FFSLGB"), it has been under-explored despite the abundance of highly prospective felsic volcanic rocks, which host almost all of the historic VHMS resources in the FFSLGB, and despite the widespread precious and base metal endowment.

The company is incorporating 2023 results including assays, lithogeochemistry and core logging into its 3-D geological model to complete interpretation/analysis. Many geophysical follow-up opportunities and key VHMS-associated structural controls exist at Sherridon which provide additional high-value targets for planned 2024 drill programs. Cold Lake, Lost Lake and other historic resource areas are being considered for drill testing in 2024. Cross sections will be provided during Q1 2024 when all drill data is received and reported.

Figure 2: Cold and Lost Prospects, Sherridon, with Drill Hole Locations

To view an enhanced version of this graphic, please visit:

VHMS Type Deposits

VHMS deposits are attractive high-value exploration targets that sustain much of the world's supply of zinc, copper and silver and, in addition, are a major source of critical "high tech" metals germanium and indium. They typically occur in districts or "camps" comprised of numerous deposits of various sizes. They can be very high grade and are regularly gold enriched, with large very long-life deposits being "company-makers" (eg the founding of Rio Tinto). Longer-life mining operations tend to show total production exceeding the original pre-mining size by more than three times.

VHMS deposits can be discovered with conventional geophysical methods. Most deposits have simple sulphide mineralogy that is amenable to processing and high recovery.

| Project | Deposit Size* | Location | Owner | Market Cap

(CA$) |

| McIlvenna Bay | 39 Mt at 2.04% CuEq | Saskatchewan, Canada | Foran Mining Corp | $1,190 m |

| Green Bay (Ming) | 39.2 Mt at 2.07% CuEq | Newfoundland, Canada | FireFly Metals Ltd | $155.8 m |

| Palmer+ | 4.7 Mt at 3.92% CuEq | Alaska, USA | American Pacific Mining Corp | $53.1 m |

| B26 | 7.0 Mt at 2.94% CuEq | Quebec, Canada | Abitibi Metals Corp | $48.4 m |

| Great Burnt | 1.5 Mt at 2.73% CuEq | Newfoundland, Canada | Benton Resources Inc | $26.8 m |

| Pine Bay | 3.4 Mt at 3.59% CuEq | Manitoba, Canada | Callinex Mines Inc | $25.3 m |

| Pickett Mountain | 6.3 Mt at 5.17% CuEq | Maine, USA | Wolfden Resources Corp | $13.1 m |

| BMK | 9.7 Mt at 2.2% CuEq | Saskatchewan, Canada | Murchison Minerals Ltd | $9.1 m |

Table 1: Notable North American VHMS Deposits with Active Exploration. *Values are derived from deposit owner company material and have not been verified by T2 Metals.

Sampling Procedures and Quality Assurance (QA) / Quality Control (QC)

The Company's QA/QC drill core sample protocol consists of collection of samples over a minimum 0.3 m interval to a maximum 1.4 m interval (depending on the lithology and style of mineralization) over the mineralized portions of the drillhole. The drill core sample is cut in half with a diamond saw, with half of the core placed in individual sealed polyurethane bags and the remaining half securely retained in the original core box for permanent storage. Drill core samples are shipped by transport truck in sealed woven plastic bags to Bureau Veritas Minerals Analytical Lab preparation facility in Timmins, ON for sample preparation. Sample analysis was carried out at Bureau Veritas Minerals laboratory in Vancouver, BC.

Gold was determined by Bureau Veritas method FA430, a lead fire-assay fusion of a 30 g pulverized sample with an atomic absorption spectroscopy (AAS) finish. Select samples were re-assayed using method FS652 1kg. This method involves the metallic sieving (150 mesh), of 1 kg of pulverized sample where both the plus fraction and the minus fractions are retained. The >150 mesh size was assayed in its entirety, and the <150 mesh fraction was assayed in duplicate. Fire assay weight for all three analyses was 50 g. Analysis was conducted using FA430 and for values over 10 g/t, a gravimetric method (FA550) was used. Various metals including silver, gold, copper, lead and zinc were determined by inductively-coupled plasma atomic emission spectroscopy (ICP-AES) or inductively-coupled plasma mass spectroscopy (ICP-MS), following multi-acid digestion (Bureau Veritas method MA270). This method is considered an assay method with a precision of 5% for elements including copper, lead, zinc and silver. Select samples were analysed for gallium (Ga) and germanium (Ge) and concentrations were determined using a hydrofluoric and aqua regia digest, followed by an ICP-MS finish.

| HOLE_ID | FROM | TO | Interval | Cu | Zn | Pb | Au | Ag | CuEq | ZnEq |

| | (m) | (m) | (m) | % | % | % | g/t | g/t | % | % |

| SHN23001 | 75.97 | 85.98 | 10.01 | 0.92 | 4.70 | 0.02 | 0.37 | 10.82 | 2.74 | 9.01 |

| Including | 75.97 | 80.79 | 4.82 | 1.45 | 6.88 | 0.02 | 0.65 | 16.96 | 4.21 | 13.84 |

| Including | 75.97 | 77.76 | 1.79 | 2.15 | 12.29 | 0.01 | 0.81 | 24.37 | 6.75 | 22.20 |

| SHN23002 | 104.94 | 109.45 | 4.51 | 0.92 | 1.90 | 0.02 | 0.40 | 11.81 | 1.92 | 6.32 |

| SHN23003 | 44.95 | 48.66 | 3.71 | 1.77 | 5.16 | 0.01 | 0.68 | 20.56 | 4.06 | 13.36 |

| SHN23004 | 87.03 | 95.00 | 7.97 | 2.17 | 4.78 | 0.05 | 1.83 | 34.42 | 5.40 | 17.74 |

| Including | 87.03 | 90.83 | 3.80 | 4.23 | 9.77 | 0.03 | 2.30 | 54.00 | 9.52 | 31.30 |

| SHN23005 | 38.00 | 61.50 | 23.50 | 1.18 | 1.46 | 0.19 | 6.79 | 40.39 | 7.4 | 24.4 |

| Including | 38.00 | 42.50 | 4.5 | 0.38 | 0.02 | 0.88 | 29.17 | 138.83 | 25.0 | N.A. |

| Including | 50.05 | 58.72 | 8.67 | 2.48 | 3.59 | 0.02 | 2.50 | 30.03 | 5.8 | 19.2 |

| SHN23006 | 154.00 | 158.00 | 4.00 | 0.07 | 0.42 | 0.17 | 1.58 | 17.63 | 1.7 | 5.4 |

| SHN23007 | 84.82 | 91.52 | 6.7 | 0.82 | 2.62 | 0.02 | 0.34 | 7.70 | 2.0 | 6.4 |

| Including | 88.98 | 91.52 | 2.54 | 1.48 | 5.19 | 0.03 | 0.72 | 14.39 | 3.8 | 12.4 |

| SHN23008 | 49.38 | 63.78 | 14.40 | 0.88 | 2.58 | 0.02 | 0.51 | 9.85 | 2.16 | 7.11 |

| Including | 49.38 | 52.13 | 2.75 | 3.34 | 6.00 | 0.01 | 1.92 | 33.23 | 6.99 | 22.95 |

| SHN23009 | 34.91 | 40.65 | 5.74 | 1.42 | 1.18 | 0.03 | 0.85 | 18.85 | 2.63 | 8.65 |

| SHN23010 | 105.00 | 110.52 | 5.52 | 1.77 | 1.47 | 0.09 | 2.30 | 37.22 | 4.41 | 14.50 |

| SHN23011 | 39.00 | 53.50 | 14.50 | 0.92 | 2.82 | 0.04 | 0.78 | 13.76 | 2.52 | 11.50 |

| Including | 44.22 | 53.50 | 9.28 | 0.85 | 4.01 | 0.07 | 1.08 | 17.57 | 3.09 | 10.20 |

| SHN23012 | Hole terminated before target. |

Table 2: Assay Results 2023 Q4 Drilling, Cold and Lost Prospects, Sherridon

| HOLE_ID | EAST | NORTH | RL | DEPTH | INCLINATION | AZIMUTH |

| SHN23001 | 367008 | 6111502 | 328 | 134.0 | -45 | 220 |

| SHN23002 | 367060 | 6111471 | 312 | 125.0 | -55 | 220 |

| SHN23003 | 367093 | 6111332 | 328 | 86.0 | -52 | 220 |

| SHN23004 | 367114 | 6111350 | 328 | 125.0 | -50 | 220 |

| SHN23005 | 367298 | 6111117 | 320 | 164.0 | -45 | 220 |

| SHN23006 | 367378 | 6111198 | 321 | 179.0 | -45 | 220 |

| SHN23007 | 367287 | 6111193 | 320 | 125.0 | -45 | 220 |

| SHN23008 | 366969 | 6111496 | 320 | 134.0 | -60 | 220 |

| SHN23009 | 366374 | 6112179 | 325 | 104.0 | -45 | 220 |

| SHN23010 | 366421 | 6112228 | 325 | 131.0 | -55 | 220 |

| SHN23011 | 367255 | 6111149 | 333 | 77.0 | -45 | 220 |

| SHN23012 | 367317 | 6111224 | 330 | 116.0 | -52 | 220 |

Table 3: T2 Metals Drill Coordinates, 2023 Q4 (Coordinates given in UTM Zone 14N, NAD83).

| SHERRIDON PROJECT - INDICATED RESOURCES (2010) |

| Mining Method | Million

Tonnes | Cu (%) | Zn (%) | Au (g/t) | Ag (g/t) | Copper

(M lbs) | Zinc

(M lbs) | Gold

(oz) | Silver

(oz) |

| Open Pit | 5.32 | 0.8 | 1.23 | 0.34 | 7.2 | | | | |

| Underground | 1.24 | 1.04 | 1.18 | 0.48 | 8.2 | | | | |

| Total Indicated | 6.55 | 0.85 | 1.22 | 0.37 | 7.4 | 122.1 M lb | 176.3 M lb | 77,192 oz | 1.56 M oz |

| SHERRIDON PROJECT - INFERRED RESOURCES (2010) |

| Open Pit | 12.24 | 0.62 | 0.77 | 0.26 | 5.3 | | | | |

| Underground | 3.62 | 0.91 | 1.08 | 0.32 | 7.4 | | | | |

| Total Inferred | 15.86 | 0.69 | 0.84 | 0.28 | 5.8 | 239.9 M lb | 294.0 M lb | 141,245 oz | 2.94 M oz |

Indicated and Inferred resources for Bob, Lost, Cold, and Jungle deposits. Mineral Resource estimates are based upon Bloom, L., Healy, T., Giroux, G., Halo Resources Ltd. 2010, Sherridon VMS Property, Technical Report NI43-101 - November 22, 2010, which is available at .

Mineral Resources were estimated at a net smelter return (NSR) cut-off of US$20 per tonne and US$45 per tonne for open pit and underground respectively. Metal prices used were US$3.00/lb copper, US$1.05/lb zinc, US$1,000/oz gold and US$15.00/oz silver. Metallurgical recovery factors assumed were 92% for copper, 83% for zinc, 65% for gold and 57% for silver.

The Mineral Resource estimates were prepared under the direction of, and dated and signed by, a Qualified Person as defined in accordance with NI 43-101 and CIM Definition Standards. The data, information, estimates, conclusions and recommendations were consistent with the information available at the time of preparation. The terms "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are defined in NI 43-101 and recognized by Canadian securities laws. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be upgraded to mineral reserves. T2 Metals has received the exploration and drilling data, but has not independently confirmed the Mineral Resource estimates. Halo has indicated that no Mineral Resource estimates were completed subsequent to those provided in Table 1.

Table 4: Sherridon Historical Resource Estimate, 2010

The qualified person for the Company's projects, Mr. Mark Saxon, the Company's Chief Executive Officer, a Fellow of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists, has reviewed and approved the contents of this release.

About T2 Metals Corp (TSXV: TWO) (OTCQB: AGLAF) (WKN: A2DR6E)

T2 Metals Corp is an emerging copper and precious metal company enhancing shareholder value through exploration and discovery. The Company continues to target under-explored areas, including the Sherridon, Lida, Cora and Copper Eagle projects where post-mineralization cover masks areas of high geological prospectivity in the vicinity of major mines.

ON BEHALF OF THE BOARD,

"Mark Saxon"

Mark Saxon

President & CEO

For further information, please contact:

t2metals

1305 - 1090 West Georgia St., Vancouver, BC, V6E 3V7

...

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain information set out in this news release constitutes forward-looking information. Forward looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "intend", "could", "might", "should", "believe" and similar expressions. Forward-looking statements are based upon the opinions and expectations of management of the Company as at the effective date of such statements and, in certain cases, information provided or disseminated by third parties. Although the Company believes that the expectations reflected in forward-looking statements are based upon reasonable assumptions, and that information obtained from third party sources is reliable, they can give no assurance that those expectations will prove to have been correct. Readers are cautioned not to place undue reliance on forward-looking statements.

These forward-looking statements are subject to a number of risks and uncertainties. Actual results may differ materially from results contemplated by the forward-looking statements. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. Such risks include uncertainties relating to exploration activities. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements, except as may be required by applicable securities laws.

To view the source version of this press release, please visit

SOURCE: T2 Metals Corp.

MENAFN01032024004218003983ID1107922216