Crude Oil Forecast Today - 27/02: Optimistic (Video & Chart)

Date

2/28/2024 1:15:09 AM

(MENAFN- Daily Forex)

The early hours of Monday saw a little decline in the price of crude oil, but it later recovered and began to show signs of life. Given that spring is usually a time when crude oil prices rise, all other things being equal, it appears that the markets for the commodity will remain optimistic about the long run.

WTI crude oil

The US oil

market has somewhat rebounded from the 50-day moving average (50-day EMA) early on Monday. The 50-day EMA and the $76 level provide ample support for the market. Having said that, the market is attempting to gather sufficient strength to go higher. And I do believe that we will eventually make a significant dent in the $80 level above, which has been like a brick wall. In the short term , I believe there will be a lot of noisy activity. Having said that, the market is probably going to continue to see more people buying on dips, especially as attention turns to spring, which is usually a season with higher demand.

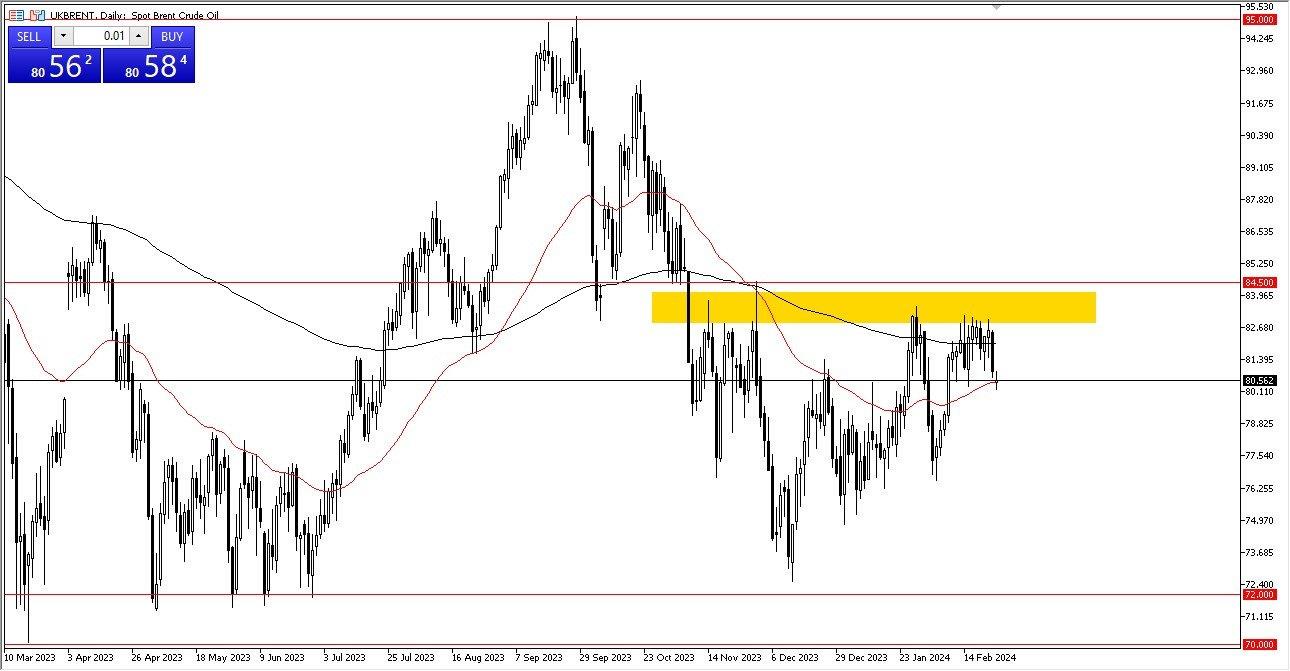

Brent

Forex Brokers We Recommend in Your Region See full brokers list 1 Read full review Get Started

Even though Brent opened the trading session with a reduced gap, it is still bouncing off the 50-day exponential moving average and appears to be exhibiting signs of life. We could go much higher, possibly hitting the $92 level, if we can rally from here and break through the $84.50 level, which is, to be honest, rather far away. In my opinion, there is still a lot of support below the $80 mark, thus there is no longer any justification for shorting oil in this scenario. It does appear that both classes are producing a circular bottom, so it doesn't necessarily mean that it needs to go straight up in the air. Additionally, there will undoubtedly be an increase in demand.

The Middle East is naturally tense, and supply has been decreasing as well; these factors point to an upside oil price spike. It's also important to remember that central banks will probably soften monetary policy, which will frequently spur development and, naturally, increase demand for energy. If that's the case, we may be at the beginning of something rather big. Nonetheless, I think this is a scenario that is going to remain choppy, but at this point in time I don't have the interest in shorting crude oil at all.

Ready to trade WTI Crude Oil FX ? We've shortlisted the best Forex Oil trading brokers in the industry for you.

MENAFN28022024000131011023ID1107909510

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.