South Korea Inflation Stabilises Faster Than Expected

Date

12/5/2023 4:14:50 AM

(MENAFN- ING) Last month's downside

surprises in South Korea

mainly came from food and gasoline prices.

Inflation will likely return to the 2% range by early next year when the bank of Korea's

concerns about inflation will likely drift away

and the market

begins to price in

rate cuts

Bukchon Hanok Village in Seoul, South Korea

| 3.3% YoY | Consumer inflation

(vs 3.8% in October, 3.5% market consensus) |

| Lower than expected |

Fresh food and energy prices fell more than expected in November

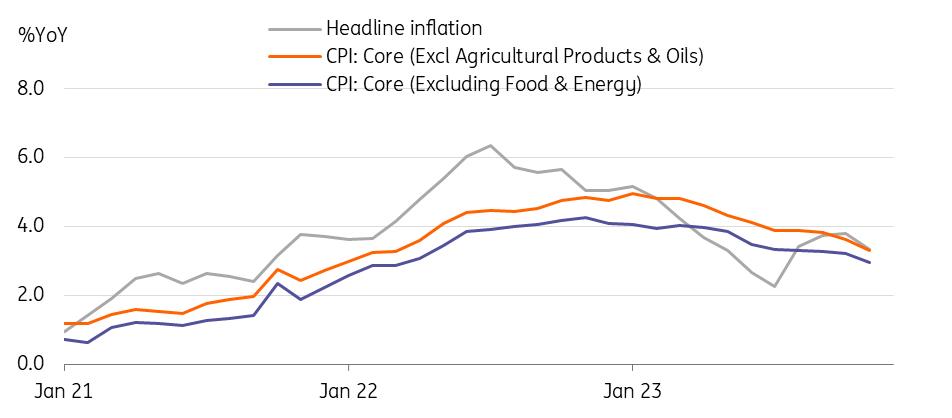

Consumer prices decelerated to 3.3% year-on-year in November (vs 3.8% in October, 3.5% market consensus) mainly due to price declines in fresh food and energy. Excluding food and energy, core inflation also moved down to 3.0% YoY (vs 3.2% in October, 3.1% market consensus).

In a monthly comparison, consumer prices dropped -0.6% month-on-month nsa in November. Utilities and services prices remained unchanged compared to October, while fresh food (-4.9%) and industrial goods (-0.3%) prices declined sharply.

We believe that the government's price stabilisation policy contributed significantly to November's price drop. Fresh vegetable prices (-10.3%) fell thanks to the supply of the government's stockpile and shopping vouchers. Petroleum prices (-3.5%) also dropped significantly due to falling global oil prices and the government's extended fuel tax cut programme. We expect headline inflation to come down to the 2% range early next year.

That said, we still see some upside risks for inflation next year, especially once various government programs come to an end in the coming months. If global oil prices stabilise further, the fuel tax cut will likely end next year. Accumulated price pressures on utilities will also become a reality. This dynamic could delay the Bank of Korea's rate cuts next year.

Inflation stabilised in November due to sharp drop in fresh food and energy prices

CEIC Bank of Korea

We think that the market is soon likely to begin pricing in rate cuts next year despite the BoK's hawkish stance. We pencilled in a rate cut in the second quarter of 2024, as tight monetary policy curbs the demand side of inflation as well as growth.

Another key risk factor for our BoK call is housing debt. We believe that the pace of household debt growth should slow in the coming months as the government's facility loan programme ended last month and market sentiment on property prices turned weak. In terms of growth, exports will likely be the key driver, but poor consumption and construction investment will weigh on the overall picture. As a result, BoK will likely ease its policy tightness. However, if household debt growth accelerates faster than expected, the central bank's easing process will likely be delayed until the third quarter.

MENAFN05122023000222011065ID1107537045

Author:

Min Joo Kang

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.