Happy Birthday AUD: How Our Australian Dollar Was Floated, 40 Years Ago This Week

But for most of Australia's history, the value of the Australian dollar – and the earlier Australian pound – was“pegged” to either gold, pound sterling, the US dollar or to a value of a basket of currencies.

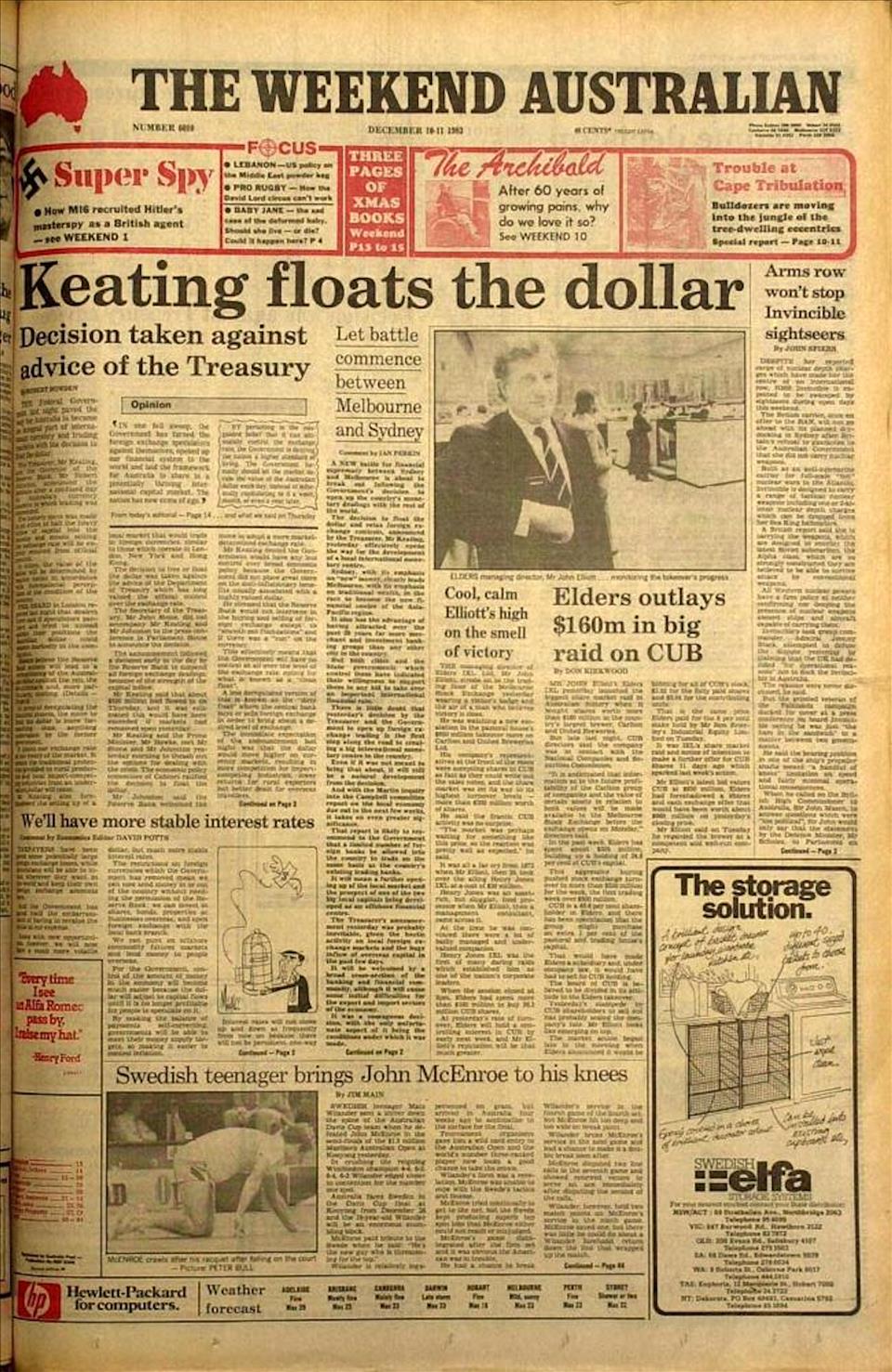

The momentous decision to float the dollar was taken on Friday December 9 1983 by the Hawke Labor Government, which was elected nine months earlier.

As they approached the cabinet room at what is now Old Parliament House, Treasurer Paul Keating asked Reserve Bank Governor Bob Johnston to write him a letter to say the bank recommended floating.

The letter, dated December 9, referred to the bank's concern about the

By“less Reserve Bank participation”, Johnston meant a managed float; direct controls were to be considered“as a last resort”.

The bank had long maintained a“war book”, bearing the intriguing label“Secret Matter”, outlining the procedures to be followed in the event of a decision to float.

An updated version was handed to the treasurer the day before the decision.

The US and the UK floated their currencies in the early 1970s. Since the early 1980s the value of the dollar had been set via a“crawling peg” – meaning its value was pegged to other currencies each week, and later each day, by a committee of officials who announced the values at 9.30 each morning .

Foreign exchange traders used to bet against authorities over where they would move the dollar. Lee Jin-man/AAP

If too much or too little money came into the country as a result of the rate the authorities had set, they adjusted it the next day, sometimes losing money to speculators who had bet they wouldn't be able to hold the rate they had set.

Keating had Johnston accompany him to the December 9 press conference instead of Treasury Secretary John Stone, who had argued against the float in the cabinet room, putting the case for direct controls on capital inflows instead.

Johnston's presence was meant to make clear that at least the central bank supported floating the dollar.

Speculators now speculate against themselvesKeating told the press conference the float meant the speculators would be“speculating against themselves”, rather than against the authorities.

One banker quoted that night confessed to being“absolutely staggered”.“I'm not sure they know what they have done,” the banker said.

The following Monday on ABC's AM program, presenter Red Harrison heralded“a brave new world for the Australian dollar”. He said

At the time, the Australian dollar was worth 90 US cents. At first it rose , before settling back.

Since then, the Australian dollar has fluctuated from a low of 47.75 US cents in April 2001 to a high of US$1.10 in July 2011.

The long road to the floatThe idea first took hold in Australia when Commonwealth Bank Governor “Nugget” Coombs visited Canada in 1953, at a time when it was one of the few countries with a floating exchange rate.

On his return, Coombs wrote the bank should consider Canada's experience.

A strong advocate from the mid-1960s was the bank's economist Austin Holmes . Among those he mentored at what by then was called the Reserve Bank were Bob Johnston, Don Sanders and John Phillips.

All three were in the cabinet room when the decision was taken.

Backed by Cairns, opposed by AbbottAn unlikely advocate in the 1970s was the left-wing Labor treasurer Jim Cairns .

But asked in 1979 whether he was in favour of a float, the then Reserve Bank governor Harry Knight responded by quoting Saint Augustine, saying“God make me pure, but not yet”. An oil shock was making markets turbulent at the time.

In 1981, the Campbell inquiry into the Australian financial system delivered a landmark report to Treasurer John Howard, recommending a float. The idea was backed by neither the Treasury nor Prime Minister Malcolm Fraser.

Two years later, Howard watched from opposition as Labor did what he could not.

The Liberal Party generally backed Labor's move, with one notable exception – the later prime minister, Tony Abbott , who in 1994 wrote that

A success by any measureThe floating exchange rate has served Australia well.

When the Australian economy has slowed or contracted – in the early 1990s, the Asian financial crisis, the global financial crisis and in the COVID recession – the Australian dollar has fallen, making Australian exports cheaper in foreign markets.

When mining booms have sucked money into the country, the Australian dollar has climbed, spreading the benefit and fighting inflation by increasing the buying power of Australian dollars.

It's why these days, hardly anyone wants to return to a pegged rate.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment